Vicor Corp (VICR) Q1 Earnings: Misses Revenue Estimates and Faces Declining Net Income

Revenue: Reported at $83.9 million, a 14.3% decrease year-over-year and fell short of estimates of $84.83 million.

Net Income: Achieved $2.6 million, significantly below the estimated $4.9 million and down from $11.2 million year-over-year.

Earnings Per Share (EPS): Recorded at $0.06, surpassing the estimated $0.11 per share.

Gross Margin: Increased to 53.8% of revenue, improving from 47.6% in the same period last year.

Operating Expenses: Rose to $44.0 million due to higher legal expenses, up from $36.1 million year-over-year.

Cash Flow from Operations: Totaled $2.7 million, a sharp decline from $10.1 million in the corresponding period last year.

Backlog: Decreased to $150.3 million, down 44.6% from $271.3 million year-over-year.

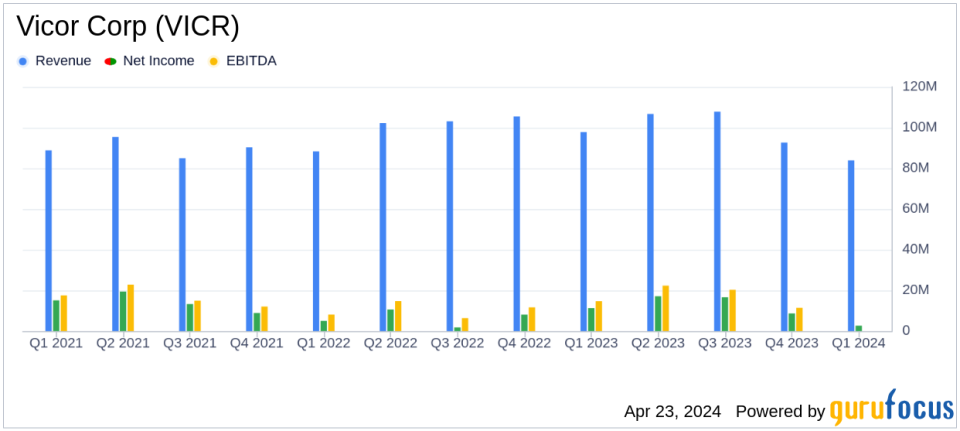

Vicor Corp (NASDAQ:VICR), a prominent player in the modular power components and complete power systems market, released its 8-K filing on April 23, 2024, detailing its financial results for the first quarter ended March 31, 2024. The company, known for its innovative power solutions, reported a significant decrease in revenue and net income compared to the same period last year, alongside a drop in cash flow from operations.

Vicor Corp, headquartered in Andover, Massachusetts, specializes in manufacturing and marketing modular power components and complete power systems crucial for converting electrical power. The company's product lineup includes Converters, Power Systems, Filters, and Custom Power Systems, primarily serving markets in the Asia Pacific which contribute significantly to its revenue.

Financial Performance Overview

For Q1 2024, Vicor reported revenues of $83.9 million, a 14.3% decrease from $97.8 million in Q1 2023, and below the analyst estimate of $84.83 million. The gross margin as a percentage of revenue saw an improvement, rising to 53.8% from 47.6% in the previous year, indicating better profitability per unit of sales. However, net income significantly declined to $2.6 million, or $0.06 per diluted share, from $11.2 million, or $0.25 per diluted share in Q1 2023, falling short of the estimated $0.11 earnings per share.

Operating expenses surged to $44.0 million, up from $36.1 million in the prior year, driven primarily by increased legal expenses. This rise in expenses, coupled with the revenue shortfall, squeezed the income from operations to just $1.085 million, a stark decrease from $10.442 million in Q1 2023.

Balance Sheet and Cash Flow Insights

The balance sheet remains robust with cash and cash equivalents totaling approximately $239.2 million as of March 31, 2024, though slightly down from $242.2 million at the end of 2023. Total assets increased to $605.1 million from $594.9 million at the end of the previous quarter. However, cash flow from operations saw a significant reduction, totaling just $2.7 million, compared to $10.1 million in the corresponding period last year.

Strategic Initiatives and Market Positioning

Despite the financial setbacks, CEO Dr. Patrizio Vinciarelli highlighted strategic initiatives aimed at securing Vicor's future growth. The company is focusing on asserting its intellectual property and licensing patented power system technology, which is expected to complement future revenues, particularly from its 5G product line and ChiP foundry. These efforts are poised to position Vicor advantageously in markets demanding higher current and power density.

As we confront challenges and pursue opportunities, 2024 will be seen as the year in which our product strategy, selective licensing of Intellectual Property and clarity of purpose secured Vicors future growth and profitability. We are pleased with our execution of this comprehensive vision, said Dr. Vinciarelli.

Overall, while Vicor faces immediate financial challenges, its strategic focus on intellectual property and market-leading technologies may pave the way for recovery and growth in the evolving power systems landscape.

For more detailed information and to participate in the upcoming investor conference call, please visit Vicor's Investor Relations page.

Explore the complete 8-K earnings release (here) from Vicor Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance