Infosys (INFY) Q4 Earnings and Revenues Surpass Estimates

Infosys Limited INFY ended fiscal 2024 on a strong note with better-than-expected financial results for the fourth quarter. The company reported fourth-quarter fiscal 2024 earnings of 23 cents per share, beating the Zacks Consensus Estimate of 17 cents per share. The bottom line also improved 28.9% from the year-ago quarter’s earnings of 18 cents per share.

The company’s fiscal fourth-quarter revenues marginally improved to $4.56 billion from the year-ago quarter’s revenues of $4.54 billion. The top line also surpassed the Zacks Consensus Estimate of $4.49 billion. In terms of constant currency (cc), the metric remained flat.

The company’s top-line performance was mainly driven by stronger growth in the balanced portfolio and better realizations from one-timers. However, macroeconomic challenges, including high inflation and increased interest rates in BFSI, have affected the company's financial segment and overall revenues. The financial segment was also affected by the rescoping and renegotiation of one of the large contracts causing a one-time impact of approximately 100 basis points (bps) in the quarter. The clients in the communications segment are also spending with caution resulting in slow decision making.

Shares of Infosys have underperformed the Zacks Computer and Technology sector in the year-to-date period. Shares of INFY have lost 10.2% year to date against the Computer and Technology sector’s growth of 7.8%.

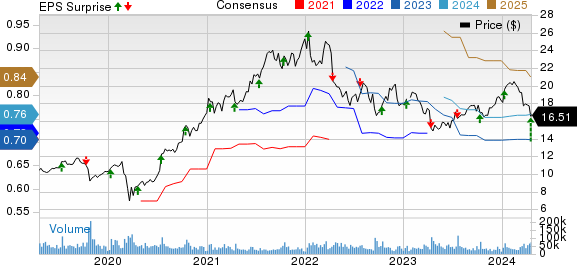

Infosys Limited. Price, Consensus and EPS Surprise

Infosys Limited. price-consensus-eps-surprise-chart | American Noble Gas Inc. Quote

Top-Line Details

Revenues across North America and India recorded a year-over-year decline of 2.1% and 16.1%, respectively, on a reported basis. Revenues across Europe and Rest of the World increased 6.5% and 1.6%, respectively, on a reported basis. On a cc basis, North America and India registered a decline of 2.2% and 15.4%, respectively. On a cc basis, Europe and the Rest of the World registered growth of 4.9% and 4.5%, respectively.

Segment-wise, revenues from Manufacturing increased 9% to $673 million, Life Sciences revenues grew 1.9% to $332 million, and Energy, Utilities, Resources & Services sales climbed 3.9% to $610 million. Communication rose 4.7% to $562 million and Hi-Tech division sales increased 9.8% to $399 million.

In the fourth quarter of fiscal 2024, the company’s Retail segment revenues declined 3% to $653 million, Financial Services fell 8.4% to $1.21 billion, while the Others business unit’s revenues declined 2.7% to $130 million.

Infosys added 98 clients in the fiscal fourth quarter. It signed multiple large deals of contract values worth $4.5 billion. The company reported that its clients, worth more than $100 million, now add up to 40 and were in line with both the year-ago quarter and third-quarter fiscal 2024.

Other Financial Details

Gross profits decreased 3.2% year over year to $1.35 billion. The gross margin contracted 100 bps on a year-over-year basis to 29.5%.

The company’s operating income decreased 4.2% year over year to $917 million. Meanwhile, the operating margin contracted 90 bps to 20.1% year over year.

Infosys ended the fiscal fourth quarter with consolidated cash and investments of $4.68 billion, up from the $3.9 billion recorded at the end of the third quarter of fiscal 2024. During the fiscal fourth quarter and fiscal 2024, the company generated free cash flow of $848 million and $2.9 billion, respectively.

FY25 Outlook

The company released its fiscal 2025 guidance and expects its full-year revenues to grow 1-3% on a constant currency basis. Moreover, it expects fiscal 2025 operating margin in the range of 20-22%.

Zacks Rank and Stocks to Consider

Currently, Infosys carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader technology sector are NVIDIA NVDA, Dell Technologies DELL and Bentley Systems BSY. While NVDA and DELL sport a Zacks Rank #1 (Strong Buy) each, BSY carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for NVIDIA’s 2025 earnings per share has been revised upward by 62 cents to $23.84 in the past 30 days. Shares of NVDA have skyrocketed 203.7% in the past year.

The Zacks Consensus Estimate for DELL’s 2024 earnings per share has been revised upward by 60 cents to $7.64 in the past 60 days. Shares of DELL have surged 162.9% in the past year.

The Zacks Consensus Estimate for Bentley Systems' 2024 earnings per share has been revised downward by a penny to $1.01 in the past 30 days. Shares of BSY have gained 15.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Noble Gas Inc. (INFY) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Bentley Systems, Incorporated (BSY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance