Air transportation services provider United Airlines (NASDAQ:UAL) reported first-quarter results yesterday, with both sales and earnings surpassing analysts’ expectations. Interestingly, the company’s performance would not have surprised users who closely monitored the company’s website traffic using TipRanks’ Website Traffic Tool.

The tool gathers data on website visits and can offer valuable insights into user demand for a company’s products or services. This information can be used to predict the upcoming earnings report, as growth in online usage may point to higher sales.

Learn how Website Traffic can help you research your favorite stocks.

Website Traffic Indicated Growth

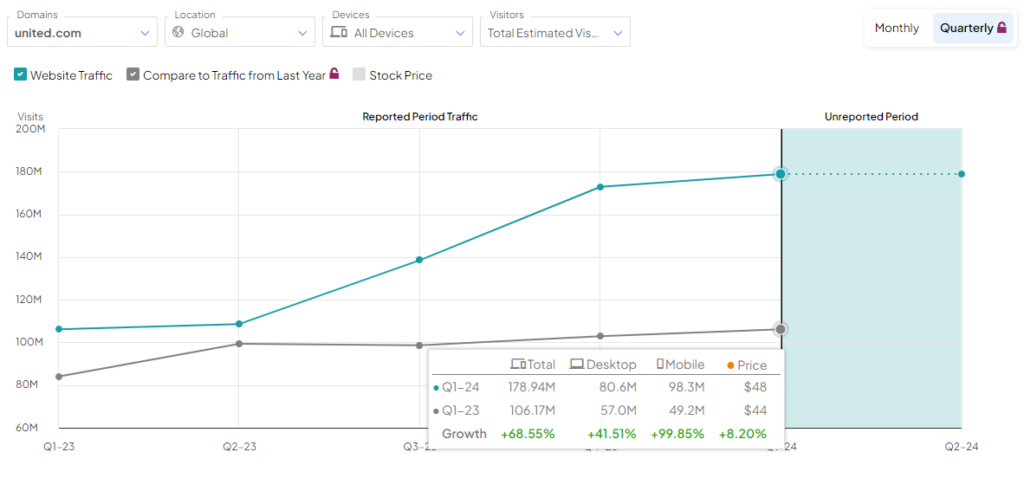

Before the release of Q1 earnings, the tool showed that website traffic for united.com witnessed a 68.55% year-over-year increase in total estimated visits. The robust growth in website visits indicated that UAL would deliver an upbeat topline performance in the first quarter.

The company posted revenues of $12.5 billion, up about 10% year-over-year and above the consensus of $12.4 billion. The company’s top-line growth was primarily attributable to a rebound in business travel demand. Other factors that contributed to higher revenues included higher passenger revenue per available seat mile and a 9.1% year-over-year capacity growth.

A Top-rated Analyst Expects Upside in UAL Stock

Following the release of Q1 earnings, five-star analyst Stephen Trent from Citi reiterated a Buy rating on the stock with a price target of $73, implying about 76% upside potential from the current level.

It should be noted that TipRanks ranks the Top analysts which reflects their ability to deliver higher returns through recommendations.

What Is the Price Target for UAL Stock?

Overall, Wall Street is cautiously optimistic about the company. It has a Moderate Buy consensus rating based on 10 Buy and five Hold ratings. The analysts’ average price target on UAL stock of $58.27 implies a solid upside potential of 40.4%. Shares of the company have gained 9.6% in the past three months.

If you’re wondering which analyst you should follow if you want to trade United Airlines stock, the most accurate analyst covering the stock (on a one-year timeframe) is Bank of America Securities analyst Andrew Didora. He boasts an average return of 1.11% per rating and a 63% success rate. Click on the image below to learn more.