Time to Buy Goldman Sachs (GS) Stock After Strong Q1 Results?

On Monday, strong first quarter results from Goldman Sachs GS served as a nod to the notion that investment banking is strengthening. Notably, JPMorgan JPM and Morgan Stanley MS have been able to impressively exceed their quarterly expectations as well.

However, Goldman Sachs’ superb Q1 report has caused the most excitement in this regard, and investors may be wondering if it’s time to buy stock in the finance titan.

Q1 Review

At the moment the Zacks Finacial-Investment Bank Industry is in the top 16% of over 250 Zacks industries and Goldman Sachs has been a prime beneficiary. Correlating with such, it’s noteworthy that Goldman Sachs’ assets under supervision increased $36 billion during Q1 to a record $2.85 trillion.

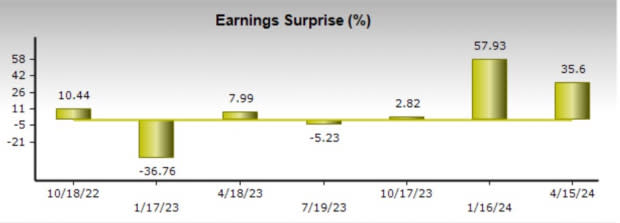

Even better, Q1 earnings of $11.58 per share crushed the Zacks Consensus of $8.54 a share by 35%. Plus, Goldman Sachs’ bottom line stretched 32% from $8.79 a share in the comparative quarter. On the top line, Q1 sales of $14.21 billion came in 10% better than expected and leaped 16% from $12.22 billion a year ago. Other compelling highlights included Goldman Sachs being the worldwide leader in annouced and completed mergers so far this year.

Image Source: Zacks Investment Research

David Solomon’s Comments on Artificial Intelligence

Goldman Sachs Asset Management sees AI shifting from the excitement phase into the deployment phase in 2024. Furthermore, CEO David Solomon followed up on this in yesterday's earnings call and expressed optimism about AI boosting the investment bank’s bottom line.

Essentially, Solomon believes AI will drive more business and make operations more efficient by carving out a significant opportunity for growth in deal volume fueled by AI-driven corporate investment.

Growth & Outlook

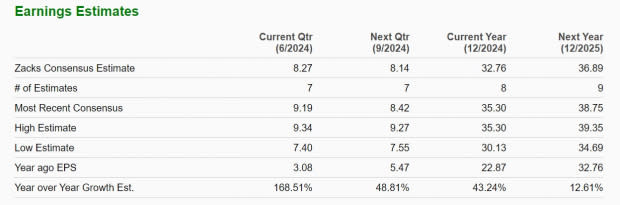

According to Zacks estimates, Goldman Sachs’ bottom line is currently projected to expand 43% in fiscal 2024 to $32.76 per share versus $22.87 a share last year. Fiscal 2025 EPS projections call for another 12% growth. Total sales are expected to be up 9% in FY24 and are forecasted to rise another 4% in FY25 to $52.37 billion.

Image Source: Zacks Investment Research

Recent Performance & Valuaiton

Year to date, Goldman Sachs stock is up +3% which has trailed JPMorgan and the S&P 500’s +6% but topped Morgan Stanley’s -4%. Over the last year, GS has risen +16% which has also lagged the benchmark’s +22% and JPM at +29% while topping Morgan Stanley’s virtually flat performance.

Image Source: Zacks Investment Research

That said, Goldman Sachs’ valuation has remained attractive with GS trading at 12.2X forward earnings and a slight discount to its industry average of 15.2X with Morgan Stanley at 13.6X and being a direct competitor in the space.

Image Source: Zacks Investment Research

Takeaway

Fow now, Goldman Sachs stock lands a Zacks Rank #3 (Hold). Offering a generous 2.74% annual dividend, holding GS could certainly be rewarding for long-term investors from current levels. Goldman Sachs stock is very reasonably valued as the global leader in investment banking and it wouldn’t be surprising if a buy rating is on the way given earnings estimate revisions are likely to trend higher.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Morgan Stanley (MS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance