What's in the Cards for Alaska Air (ALK) in Q1 Earnings?

Alaska Air ALK is scheduled to release first-quarter 2024 results on Apr 18 before market open.

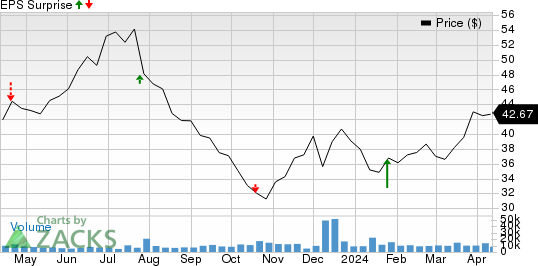

The company has an unimpressive earnings surprise history, having surpassed the Zacks Consensus Estimate in two of the preceding four quarters and missing twice, the average beat being 11.49%. The Zacks Consensus Estimate for first-quarter earnings has been revised 9.91% upward over the past 60 days.

Alaska Air Group, Inc. Price and EPS Surprise

Alaska Air Group, Inc. price-eps-surprise | Alaska Air Group, Inc. Quote

Given this backdrop, let’s examine the factors that are likely to have influenced Alaska Air’s performance in the to-be-reported quarter.

High fuel costs are likely to have dented ALK’s bottom-line performance in the first quarter of 2024. With oil prices moving north, the fuel cost per gallon is likely to have been high. For the first quarter of 2024, Alaska Air anticipates the economic fuel cost per gallon to be $3.10.

Moreover, results are expected to be hurt by the grounding of the company's Boeing 737-9 MAX fleet following the mid-air scare on Jan 5. Due to the headwinds, ALK anticipates adjusted loss in the range of 55-45 cents per share for the first quarter of 2024.

However, passenger volumes are expected to be impressive in the to-be-reported quarter. We expect passenger revenues to increase 0.1% from the year-ago actuals. The company expects available seat miles (a measure of capacity) to decrease by 2.5% in the first quarter of 2024 from the first-quarter 2023 actuals.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for Alaska Air this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that is not the case here.

Alaska Air currently has an Earnings ESP of -1.14% (the Most Accurate Estimate is currently pegged at -$1.01 per share, whereas the Zacks Consensus Estimate is currently pegged at a loss of $1.00) and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Q4 Highlights

Alaska Air reported fourth-quarter 2023 earnings of 30 cents per share, which beat the Zacks Consensus Estimate of 18 cents and declined 67.4% year over year. Operating revenues of $2.6 billion beat the Zacks Consensus Estimate of $2.5 billion. Moreover, the top line increased 3% year over year. Passenger revenues, accounting for 91.1% of the top line, improved 3%.

Stocks to Consider

Here are a few stocks from the broader Zacks Transportation sector that investors may consider as our model shows that these have the right combination of elements to beat on their first-quarter 2024 earnings.

CSX CSX has an Earnings ESP of +0.41% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

CSX is scheduled to report first-quarter 2024 earnings on Apr 17. The Zacks Consensus Estimate for earnings has been revised 0.51% upward over the trailing 12 months. CSX has an impressive earnings surprise history, having surpassed the Zacks Consensus Estimate in each of the preceding four quarters, the average beat being 4.14%.

Expeditors International of Washington EXPD has an Earnings ESP of +0.92% and a Zacks Rank #3. EXPD is scheduled to report first-quarter 2024 earnings on May 7.

EXPD has an unimpressive earnings surprise history, having surpassed the Zacks Consensus Estimate only once in the preceding four quarters and missing thrice, the average miss being -3.37%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CSX Corporation (CSX) : Free Stock Analysis Report

Expeditors International of Washington, Inc. (EXPD) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance