Don't Overlook These High-Growth Business Services Stocks it's time to Buy

Markets rebounded resiliently on Thursday after another month of hotter-than-expected CPI data caused a wide selloff among the broader indexes yesterday.

Still, the S&P 500 and Nasdaq sprung back and rose roughly 1% and 2% in today’s trading session respectively. This was indicative of investors buying the dip and in the process, they may want to consider several high-growth stocks out of the Zacks Business Services sector.

Core & Main CNM: One business services stock that certainly looks attractive is Core & Main, a waste removal services company. Core & Main is a specialized distributor of water, wastewater, storm drainage, and fire protection products.

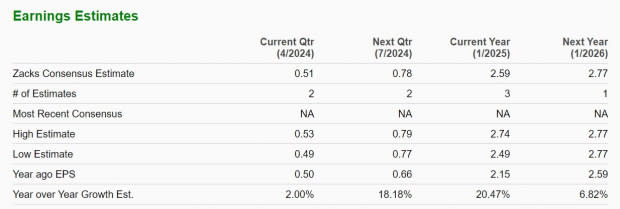

Most compelling is that Core & Main’s annual earnings are expected to jump 24% in its current fiscal 2025 to $2.59 per share compared to $2.15 a share in FY24. Plus, FY26 EPS is projected to rise another 7%. Core & Main’s total sales are expected to rise 12% in FY25 with its top line projected to rise another 4% in FY26 to $7.87 billion. It’s also noteworthy that over the last 60 days, FY25 and FY26 earnings estimates are up 5% and 2% respectively.

Image Source: Zacks Investment Research

GigaCloud Technology GCT: The trend of upward earnings estimate revisions is very compelling for GigaCloud Technology which is a pioneer of global end-to-end B2B e-commerce solutions for large parcel merchandise.

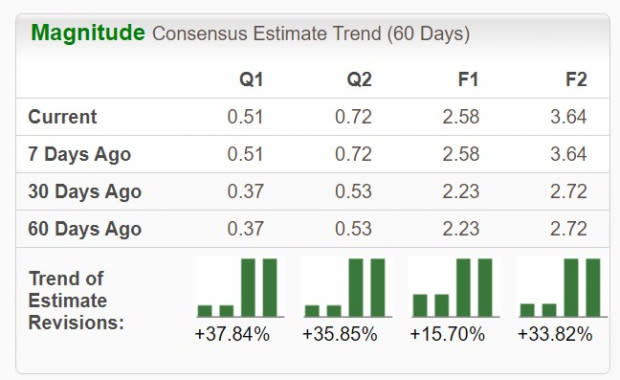

GigaCloud's FY24 earnings estimates have spiked 16% in the last two months with FY25 EPS estimates soaring 34%. Furthermore, GigaCloud’s annual earnings are now anticipated to rise 12% in FY24 and are forecasted to soar another 41% in FY25 to $3.64 per share. More intriguing is that GigaCloud’s stock trades at a very reasonable 12X forward earnings multiple and is expecting high double-digit percentage growth on its top line as well with sales projections now over $1 billion.

Image Source: Zacks Investment Research

HNI HNI: Last but not least is HNI, a provider of products and solutions for the home and workplace environments. As a leading global manufacturer of office furniture, HNI is expecting 10% EPS growth this year with FY25 earnings projected to rise another 11% to $3.27 per share. Notably, FY24 an FY25 EPS estimates have risen 6% in the last two months.

More reassuring is that HNI’s annual sales are forecasted to rise 10% in FY24 with its top line expected to expand another 4% next year to $2.8 billion. The cherry on top is that HNI offers a 3% annual dividend to accompany its steady growth.

Image Source: Zacks Investment Research

Bottom Line

Rising earnings estimates are starting to magnify the attractive growth trajectories of these highly ranked business services stocks. To that point, they sport a Zacks Rank #1 (Strong Buy) and have an “A” Zacks Style Scores grade for Growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

HNI Corporation (HNI) : Free Stock Analysis Report

Core & Main, Inc. (CNM) : Free Stock Analysis Report

GigaCloud Technology Inc. (GCT) : Free Stock Analysis Report