Baxter Is Deeply Undervalued

Baxter International Inc. (NYSE:BAX) provides a broad portfolio of health care products, including acute and chronic dialysis therapies, sterile IV solutions, infusion systems and devices, parenteral nutrition therapies, inhaled anesthetics, generic injectable pharmaceuticals, surgical hemostat and sealant products, smart bed systems, patient monitoring and diagnostic technologies and respiratory health devices.

In September 2021, Baxter reached an agreement to acquire Hillrom for approximately $12.50 billion (including the assumption of debt). The acquisition closed in December of that year. Hillrom was a medical device and technology company focused on patient monitoring solutions, medical beds and surfaces, respiratory care equipment, surgical and operating room solutions and connected care systems such as telehealth platforms, remote monitoring systems and data analytics tools that improve patient management and clinical decision-making.

Baxter anticipated this strategic transaction would bring low double-digit increases to its adjusted earnings per share in the first year after the close, with the accretion rising to 20% by the third year. However, this has not yet happened. The combination aimed to unlock revenue synergies through global expansion of Hillrom's portfolio and also anticipated cost synergies, such as accelerating the combined organization's digital transformation to achieve approximately $250 million of annual pre-tax cost savings by the end of year three. This alignment was aimed to position Baxter to drive innovation, enhance patient care and create value across diverse health care settings, from hospitals to homes.

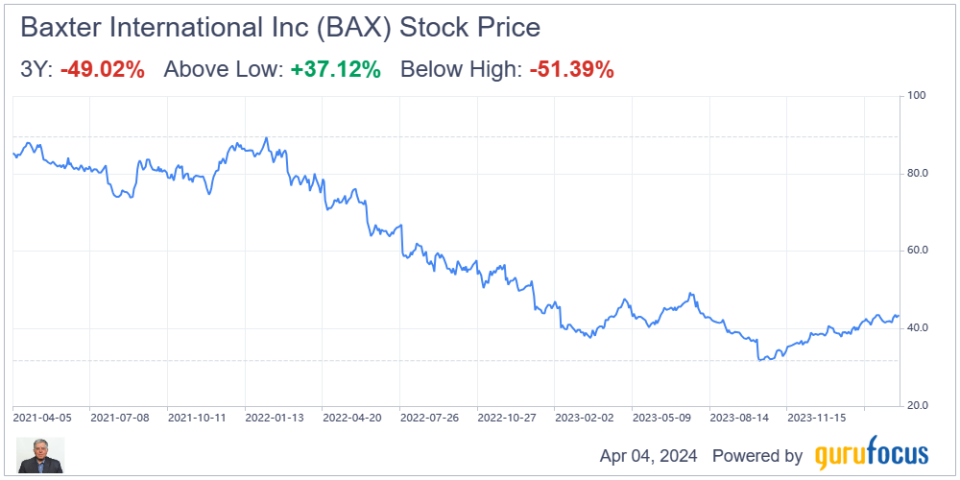

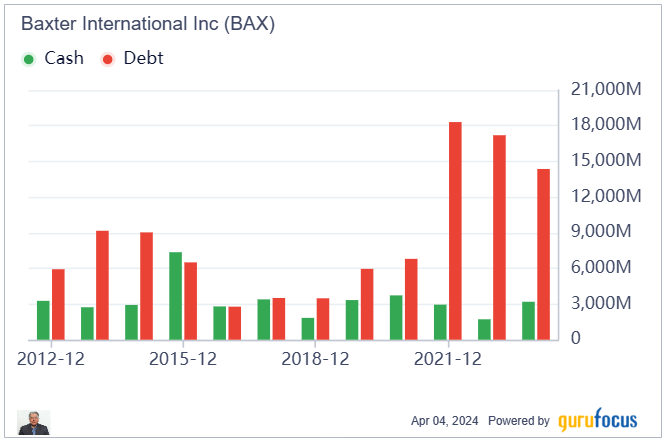

However, after closing the deal, Baxter's stock fell steeply from the high $80s to the low $30s as investors grew very nervous about the large amount of debt the company took on to fund the acquisition and the integration risk. This risk was bought to an head by Baxter not meeting earnings estimates because of a steep rise in inflation as well as a cost constrained hospital sector after the Covid-19 pandemic. The company's debt had more than tripled from about $6 billion prior to the acquisition to around $18 billion after.

Likely motivated by the steep fall in stock price, Baxter quickly sold off its BioPharma Solutions business in May 2023. The transaction involved the sale of BPS to Advent International and Warburg Pincus, two prominent global private equity investors. Under this agreement, Baxter received $4.25 billion in cash, with net after-tax proceeds estimated to be approximately $3.40 billion. The proceeds were earmarked for deleveraging the company.

Baxter is now preparing to spin off its kidney care business into an independent publicly traded company slated to take place this year. After the spinoff is completed, the company will be primarily focused on medical products and therapies, which will include the Medication Delivery, Advanced Surgery, and Clinical Nutrition product categories, health care systems and technologies, which will include the Patient Support Systems, Front Line Care and Global Surgical Solutions product categories obtained in the Hillrom acquisition and pharmaceuticals, which includes injectables and anesthesia products and an international drug compounding business. All these business's are oriented toward hospitals and institutional buyers.

As can be seen in the quarterly chart below, while Baxter has started to deleverage its bloated balance sheet, it is still substantially indebted and has some ways to go to get its debt under control. It remains to be seen how much of the debt will be hived off to the planned kidney care spinoff.

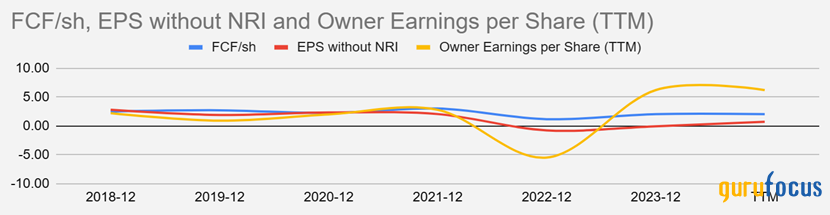

However, it appears that Baxter's owner earning per share (yellow line below) has rebounded sharply from depressed levels following the Hillrom acqusition and I expect earnings per share should follow as the company proceeds along its transformation from a conglomerate structure to a focused hospital-oriented solutions and services provider with a higher growth profile once it completes the spinoff. Thus the accretion in earnings promised by management following the acqusition appears to be be delayed and not altogether cancelled.

Kidney care operating margins of 6% to 7% are substantially lower than the 15% to 19% operating margins of the remaining Baxter businesses once the separation is completed. This should enable the company to obtain better price multiples from the stock market, which is expected after the company achieves its deleveraging target of net debt-to-Ebitda of below 3.

Conclusion

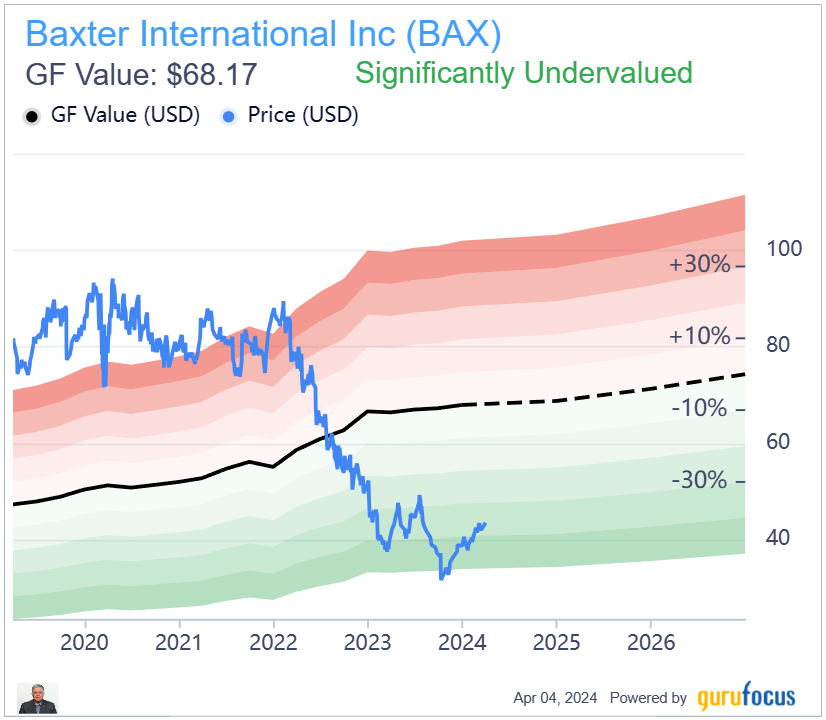

Baxter is currently trading at a depressed valuation with the GF Value Line showing a 36% discount. In my opinion, the undervaluation may be even greater in the 50% range, subject to the company achieving deleveraging targets and a successful separation of the kidney care business.

I expect the company to achieve its normalized earnings power of about $5 per share by 2027 and a normalized price-earnings multiple of around 13. This will bring the stock price to around $65. I think the probability of this happening is good given the stock was at about $85 in 2021.

Thus, the current entry point looks attractive and investors can implement a buy-and-hold strategy from here for the next three to five years. I expect them to be well rewarded with mid-teens returns per year including dividends.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance