We're Not Worried About Third Harmonic Bio's (NASDAQ:THRD) Cash Burn

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. Indeed, Third Harmonic Bio (NASDAQ:THRD) stock is up 137% in the last year, providing strong gains for shareholders. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

In light of its strong share price run, we think now is a good time to investigate how risky Third Harmonic Bio's cash burn is. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for Third Harmonic Bio

How Long Is Third Harmonic Bio's Cash Runway?

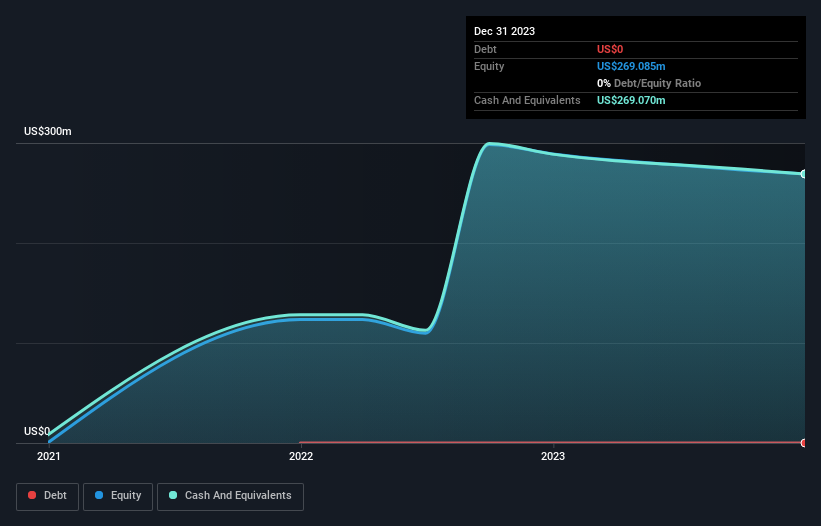

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at December 2023, Third Harmonic Bio had cash of US$269m and no debt. Looking at the last year, the company burnt through US$21m. That means it had a cash runway of very many years as of December 2023. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. You can see how its cash balance has changed over time in the image below.

How Is Third Harmonic Bio's Cash Burn Changing Over Time?

Because Third Harmonic Bio isn't currently generating revenue, we consider it an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. While it hardly paints a picture of imminent growth, the fact that it has reduced its cash burn by 41% over the last year suggests some degree of prudence. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Third Harmonic Bio Raise Cash?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Third Harmonic Bio to raise more cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Third Harmonic Bio has a market capitalisation of US$436m and burnt through US$21m last year, which is 4.7% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

Is Third Harmonic Bio's Cash Burn A Worry?

It may already be apparent to you that we're relatively comfortable with the way Third Harmonic Bio is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. And even though its cash burn reduction wasn't quite as impressive, it was still a positive. Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. On another note, we conducted an in-depth investigation of the company, and identified 3 warning signs for Third Harmonic Bio (2 can't be ignored!) that you should be aware of before investing here.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.