Here's Why Hold Strategy is Apt for Illinois Tool (ITW) Stock

Illinois Tool Works Inc. ITW has been benefiting from strength in the Automotive OEM (Original Equipment Manufacturer) segment and enterprise initiatives despite continued softness in the semiconductor end market and foreign currency woes.

What’s Aiding ITW?

Business Strength: Illinois Tool has been benefiting from stable underlying demand and improving supply chains. Strong market share and penetration gains in the rapidly growing EV market are boosting revenues in the Automotive OEM segment. The Food Equipment unit is aided by growth in the institutional, retail and service end markets.

Driven by the strength across its businesses, the company has issued a bullish guidance for 2024. Illinois Tools expects organic revenues to increase 1-3% and total revenues to increase 2-4% from the year-ago reported figure in the year. Illinois Tool expects adjusted earnings of $10.00-$10.40 per share for 2024, representing a year-over-year increase of 5.1% at the midpoint.

Enterprise Initiatives: The company’s focus on cost management and enterprise initiatives are supporting its margin performance. For instance, the company’s cost of sales decreased 1.2% year over year in 2023. Also, in the same period, the operating margin of 25.1% increased 130 basis points as enterprise initiatives contributed 130 basis points. The company expects the operating margin to be in the range of 25.5–26.5% for 2024 compared with 25.1% reported in 2023. Enterprise initiatives are expected to contribute 100 basis points to the operating margin in 2024.

Rewards to Shareholders: ITW is committed to rewarding its shareholders handsomely. In 2023, the company paid dividends worth $1.6 billion and bought back 6.4 million shares of its common stock for approximately $1.5 billion. In August 2023, the company hiked its dividend by 7% to $1.40 per share. Simultaneously, the company’s board approved a new $5 billion buyback program.

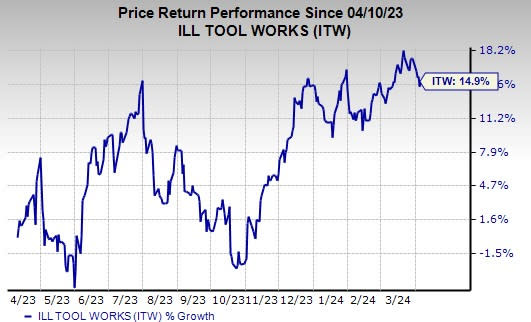

In light of the above-mentioned positives, we believe, investors should retain ITW stock for now, as suggested by its current Zacks Rank #3 (Hold). In the past year, shares of the company have gained 14.9%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked companies from the Industrial Products sector are discussed below:

Applied Industrial Technologies, Inc. AIT presently sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter average earnings surprise of 10.4%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for AIT’s fiscal 2024 earnings has increased 2.5% in the past 60 days. The stock has gained 48.3% in the past year.

Belden Inc. BDC presently carries a Zacks Rank #2 (Buy) and a trailing four-quarter earnings surprise of 12.3%, on average.

BDC’s earnings estimates have remained steady for 2024 in the past 60 days. Shares of Belden have risen 10.5% in the past year.

A. O. Smith Corporation AOS presently carries a Zacks Rank of 2. It has a trailing four-quarter average earnings surprise of 12%.

The Zacks Consensus Estimate for AOS’ 2023 earnings increased 0.5% in the past 60 days. Shares of A. O. Smith have soared 33.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Illinois Tool Works Inc. (ITW) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Belden Inc (BDC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance