J&J's (JNJ) $13.1B Shockwave Deal to Boost MedTech Cardio

Johnson & Johnson JNJ announced that it has entered into a definitive agreement to acquire medical device company Shockwave Medical SWAV for approximately $13.1 billion. The acquisition will strengthen JNJ’s MedTech cardiovascular portfolio.

The acquisition will add Shockwave’s leading IVL intravascular lithotripsy (IVL) technology to JNJ’s MedTech business, thus strengthening its position in high-growth cardiovascular intervention segments – coronary artery disease (CAD) and peripheral artery disease (PAD).

ShockWave Medical’s IVL system is a catheter-based product, which works through local delivery of sonic pressure waves for the treatment of calcified plaque in arteries. These calcified plaques reduce blood flow and cause pain or heart attack. ShockWave Medical’s IVL catheters are used in both CAD and PAD.

J&J will acquire all outstanding shares of Shockwave for $335.00 per share in cash. The consideration represents a premium of 5% on SWAV’s closing price on Apr 4. SWAV’s stock had been rising since the past week after rumors of a buyout by J&J surfaced. J&J will pay for the acquisition through cash on hand and debt.

J&J already holds a strong position in some of the highest-growing MedTech markets within cardiovascular intervention, like heart recovery and electrophysiology. ShockWave Medical’s IVL technology complements these businesses. Shockwave is also evaluating the use of IVL in new indications, including carotid artery disease and structural heart disease.

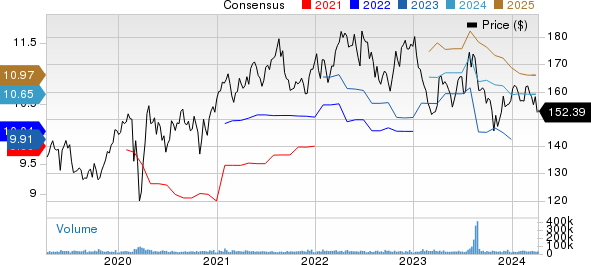

In the past year, J&J’s shares have declined 7.3% against the industry’s 20.2% increase.

Image Source: Zacks Investment Research

J&J’s most recent high-growth acquisitions in the MedTech cardiovascular space include Abiomed, which added the Impella heart pump platform, and Laminar, a private medical device company focused on eliminating the left atrial appendage in patients with non-valvular atrial fibrillation. Shockwave will operate as a subsidiary of the MedTech unit.

The transaction is expected to dilute J&J’s adjusted earnings per share by approximately 10 cents in 2024 and by approximately 17 cents in 2025.

Shockwave Medical recorded total revenues of $730.2 million in 2023, up 49% year over year. Its revenue guidance for 2024 is $910 million to $930 million, which represents an increase of around 26% at the midpoint from 2023 levels. The transaction is expected to close by mid-2024. The M&A deal is approved by the boards of both companies

Zacks Rank and Stocks to Consider

J&J currently has a Zacks Rank #3 (Hold).

Johnson & Johnson Price and Consensus

Johnson & Johnson price-consensus-chart | Johnson & Johnson Quote

Some better-ranked biotech stocks are ADMA Biologics ADMA and MorphoSys MOR, sporting a Zacks Rank #1 (Strong Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share have improved from 22 cents to 30 cents. Estimates for 2025 have increased from 32 cents to 50 cents. In the past year, shares of ADMA Biologics have risen 93.6%.

Earnings of ADMA Biologics beat estimates in three of the last four quarters while meeting the same once. ADMA delivered a four-quarter average earnings surprise of 85.0%.

In the past 60 days, estimates for MorphoSys’ 2024 loss per share have narrowed from 96 cents per share to a loss of 73 cents per share. In the past year, shares of MOR have risen 288.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

MorphoSys AG Unsponsored ADR (MOR) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance