Project Management Software Stocks Q4 Recap: Benchmarking Monday.com (NASDAQ:MNDY)

With Q4 earnings behind us, let's assess the key takeaways from the quarter for project management software stocks, including Monday.com (NASDAQ:MNDY) and its peers.

The future of work requires teams to collaborate across departments and remote offices. Project management software is both driving this change and benefiting from it. While the trend of collaborative work management has been strong for a while, the Covid pandemic has definitively accelerated the demand for tools that allow work to be done remotely.

The 4 project management software stocks we track reported a decent Q4; on average, revenues beat analyst consensus estimates by 2.1%. while next quarter's revenue guidance was in line with consensus. Valuation multiples for growth stocks have reverted to their historical means after reaching highs in early 2021, and project management software stocks have not been spared, with share prices down 14.3% on average since the previous earnings results.

Monday.com (NASDAQ:MNDY)

Founded in Israel in 2014, and named after the dreaded first day of the work week, Monday.com (NASDAQ:MNDY) makes software as a service platforms that helps teams plan and track work efficiently.

Monday.com reported revenues of $202.6 million, up 35.1% year on year, topping analyst expectations by 2.4%. It was a mixed quarter for the company, with a decent beat of analysts' ARR (annual recurring revenue) estimates but underwhelming revenue guidance for the next year.

“We concluded 2023 with strong Q4 results, demonstrating our ability to drive sustainable growth and profitability while continuing to scale,” said Eliran Glazer, monday.com CFO.

Monday.com pulled off the fastest revenue growth of the whole group. The company added 218 enterprise customers paying more than $50,000 annually to reach a total of 2,295. The stock is down 7.4% since the results and currently trades at $218.88.

Is now the time to buy Monday.com? Access our full analysis of the earnings results here, it's free.

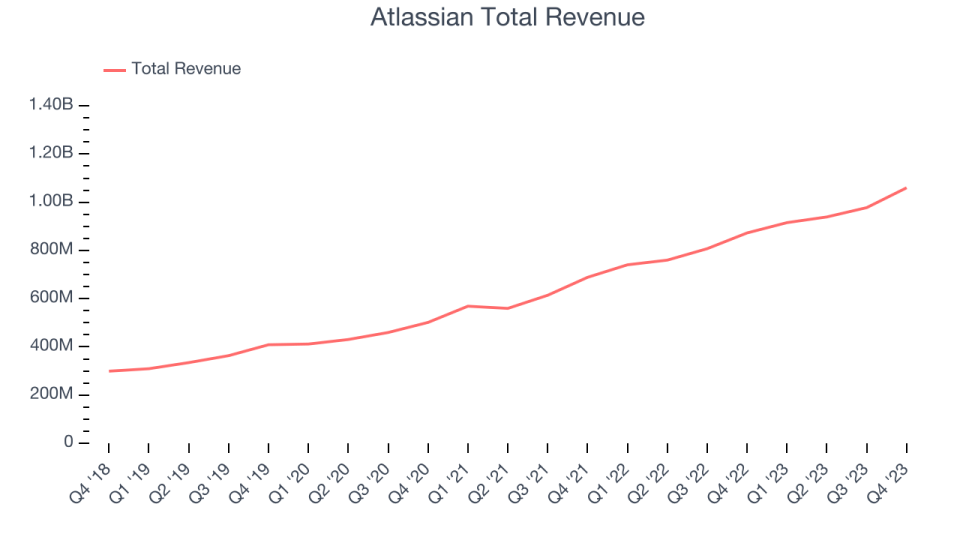

Best Q4: Atlassian (NASDAQ:TEAM)

Founded by Australian co-CEOs Mike Cannon-Brookes and Scott Farquhar in 2002, Atlassian (NASDAQ:TEAM) provides software as a service that makes it easier for large teams of software developers to manage projects, especially in software development.

Atlassian reported revenues of $1.06 billion, up 21.5% year on year, outperforming analyst expectations by 3.6%. It was a very strong quarter for the company, with an impressive beat of analysts' billings estimates and optimistic revenue guidance for the next quarter.

Atlassian scored the biggest analyst estimates beat among its peers. The stock is down 23.1% since the results and currently trades at $196.

Is now the time to buy Atlassian? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Smartsheet (NYSE:SMAR)

Founded in 2005, Smartsheet (NYSE:SMAR) is a software as a service platform that helps companies plan, manage and report on work.

Smartsheet reported revenues of $256.9 million, up 21% year on year, in line with analyst expectations. It was a weaker quarter for the company, with full-year revenue guidance missing analysts' expectations.

Smartsheet had the weakest performance against analyst estimates and weakest full-year guidance update in the group. The company added 429 enterprise customers paying more than $5,000 annually to reach a total of 19,818. The stock is down 5.9% since the results and currently trades at $37.91.

Read our full analysis of Smartsheet's results here.

Asana (NYSE:ASAN)

Founded in 2008 by Facebook’s co-founder Dustin Moskovitz, Asana (NYSE:ASAN) is a cloud-based project management software, where you can plan and assign tasks to employees and monitor and discuss progress of work.

Asana reported revenues of $171.1 million, up 13.9% year on year, surpassing analyst expectations by 1.9%. It was a mixed quarter for the company, with an impressive beat of analysts' billings estimates. On the other hand, while revenue guidance for next quarter and the full year came in line with expectations, Asana's guidance for operating loss for those periods was worse than expectations.

Asana delivered the highest full-year guidance raise but had the slowest revenue growth among its peers. The company added 300 enterprise customers paying more than $5,000 annually to reach a total of 21,646. The stock is down 20.7% since the results and currently trades at $14.9.

Read our full, actionable report on Asana here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance