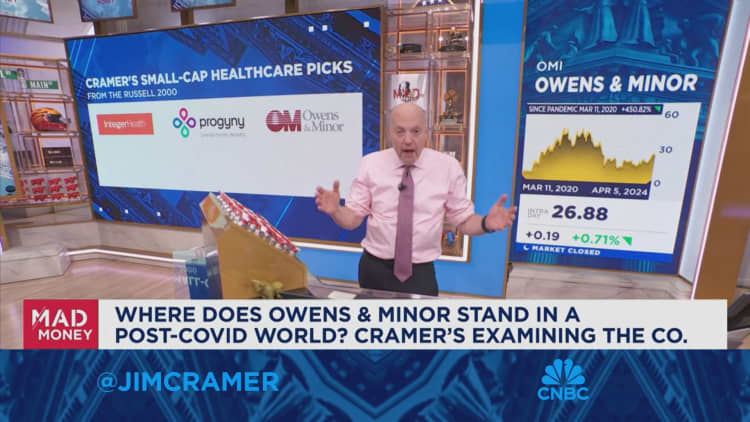

CNBC's Jim Cramer said he thinks it could be a good year for small-cap stocks, and shared his top five lesser-known companies in the health-care sector.

"I think 2024 could ultimately be the year that small-cap stocks get their mojo back," he said. "This is a group that went out of style when interest rates soared and they'll work a lot better as rates come down."

- Integer Holdings: Integer Holdings is a major medical-device manufacturer, producing products for companies that design them. Cramer said he thinks this company benefits from high health-care utilization rates, as it could take years for patients to receive non-urgent procedures they postponed during the pandemic.

- Progyny: Cramer said this fertility-benefits management company's stock does not reflect its rapid growth. Progyny helps businesses offer family planning and fertility services to their employees. To Cramer, the company's business remains solid, even though its latest earnings report was mixed. He added that because of the labor shortage, employers may be more willing to offer these benefits.

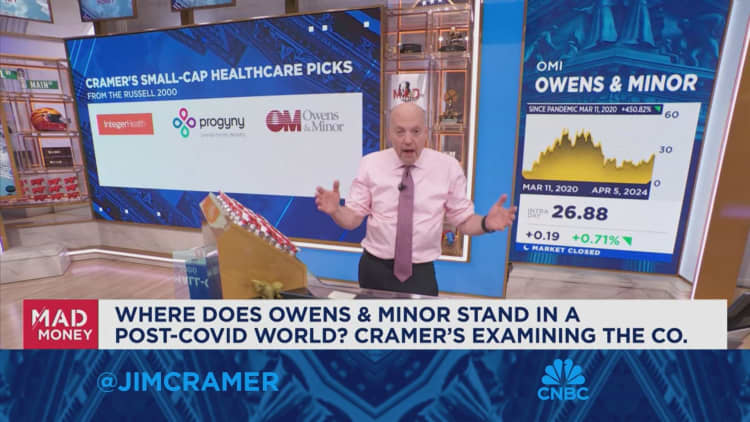

- Owens & Minor: Owens & Minor did well during the pandemic because it is a major producer of personal protective equipment. Although the stock pulled back after Covid, Cramer said the company was able to use its gains to make acquisitions in the health-care space, and suggested it could succeed in the healt-care utilization realm.

- Catalyst Pharmaceuticals: Cramer said he doesn't want to recommend most biotechs, but he likes Catalyst Pharmaceuticals. The company buys early stage drugs for rare diseases and brings them to market, and he said he's optimistic in part because it launched a new drug in February.

- Addus HomeCare: To Cramer, an investable theme across the health-care industry is moving care out of hospitals and into lower-cost settings. Addus HomeCare provides in-home medical care, like day-to-day assistance and hospice, to patients in their homes. He was also impressed with the company's most recent earnings report, which beat Wall Street's expectations.

Sign up now for the CNBC Investing Club to follow Jim Cramer's every move in the market.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com