Koppers (KOP) Wraps Up Acquisition of Brown Wood Preserving

Koppers Holdings Inc. KOP successfully wrapped up the acquisition of a significant portion of Brown Wood Preserving Company, Inc.'s assets, alongside certain affiliates, for approximately $100 million in cash. Completed through its subsidiary, Koppers Utility and Industrial Products Inc. (UIP), this acquisition sees Brown Wood, well-known for its production of pressure-treated wood utility poles, integrating into Koppers UIP. KOP is a prominent player in treated wood products, wood treatment chemicals and carbon compounds globally.

Expressing keen enthusiasm for the acquisition, Koppers highlights its strategic significance in reinforcing existing markets and forging pathways into new geographic regions. The inclusion of Brown Wood's assets into Koppers' portfolio amplifies sales and production capabilities within current markets and presents a promising avenue for expansion.

With the acquisition completed, Koppers extends a warm welcome to the Brown Wood team, embracing them into the Koppers family. Recognizing the utility pole market as a burgeoning growth sector, Koppers is poised to capitalize on synergies between the two entities. Anticipating favorable industry trends, Koppers foresees a robust and enduring market for utility poles in the foreseeable future.

Anticipated to contribute $15 million to $25 million in EBITDA in 2025, the transaction's impact on 2024 will be further detailed during Koppers' first-quarter earnings call in early May.

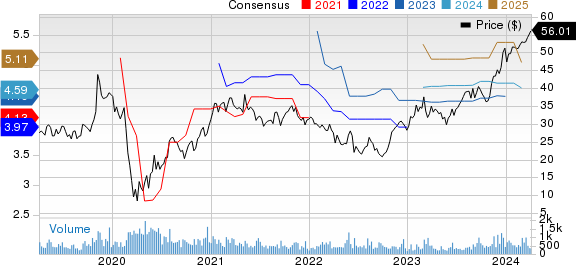

Shares of Koppers are up 67.5% in the past year compared with the industry’s fall of 4.9% in the same period.

Image Source: Zacks Investment Research

In the fourth quarter, Koppers reported adjusted earnings of 67 cents per share, excluding one-time items compared with $1.09 per share a year ago, falling short of the Zacks Consensus Estimate of 72 cents. However, the company saw a 6% year-over-year increase in revenues, totaling $513.2 million, surpassing the Zacks Consensus Estimate of $496 million. The upside was primarily driven by record sales in the Railroad and Utility Products and Services segment, which can be attributed to higher pricing and volumes.

Looking ahead to 2024, Koppers anticipates sales to reach approximately $2.25 billion, with adjusted EBITDA expected to be around $275 million for the year. The company forecasts adjusted earnings per share in the range of $4.60-$4.80 for 2024, along with capital expenditures of approximately $100 million for the year.

Koppers Holdings Inc. Price and Consensus

Koppers Holdings Inc. price-consensus-chart | Koppers Holdings Inc. Quote

Zacks Rank & Key Picks

Koppers currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Carpenter Technology Corporation CRS and Ecolab Inc. ECL, each sporting a Zacks Rank #1 (Strong Buy), and Innospec Inc. IOSP,carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for CRS’ current fiscal year earnings is pegged at $4 per share, indicating a year-over-year surge of 250.9%. CRS beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 12.2%. The company’s shares have increased 76.9% in the past year.

Ecolab has a projected earnings growth rate of 22.65% for the current year. The Zacks Consensus Estimate for ECL’s current-year earnings has been revised upward by 5.4% in the past 60 days. ECL topped the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.7%. The company’s shares have rallied 37.4% in the past year.

The consensus estimate for IOSP’s current fiscal year earnings is pegged at $6.72 per share, indicating a 10.3% year-over-year rise. IOSP beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 10.5%. The company’s shares have increased 22.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

Innospec Inc. (IOSP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance