Here's Why Amgen (AMGN) Stock is Outperforming the Industry

Amgen AMGN is one of the biggest biotech companies in the world, with a strong presence in the oncology/hematology, cardiovascular disease, neuroscience, inflammation, bone health, nephrology and neuroscience markets.

Thousand Oaks, CA-based Amgen also has a promising pipeline of cancer drugs. It has one of the strongest cash positions in the biotech sector, which could be used to acquire more pipeline assets that could fuel long-term growth. Biosimilar drugs are also a key part of Amgen’s growth strategy.

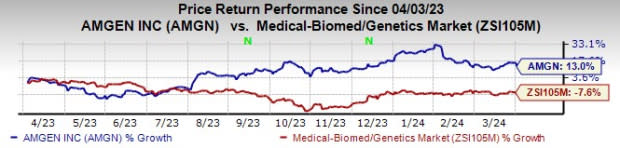

Amgen has outperformed the industry in the past year.

The company’s shares have gained 13.0% in the past year against the decline of 7.6% for the industry.

Image Source: Zacks Investment Research

Here, we discuss some reasons for this outperformance.

Key Products to Drive Sales: Amgen expects strong sales growth of products like Tezspire, Evenity, Repatha, Prolia and Tavneos to offset declining revenues from oncology biosimilars and legacy established products such as Enbrel in 2024.

Interesting Branded and Biosimilar Pipeline: Amgen also has some key pipeline assets in obesity and inflammation, which are indications that it can have a large market opportunity. Several key pipeline data readouts are expected in 2024, including from the obesity programs.

A key candidate in its obesity pipeline is maridebart cafraglutide, a GLP-1 receptor. Enrollment is completed in a phase II study on the candidate for obesity. Top-line data from the study is expected in late 2024. The company recently added another part to this study to explore the candidate’s ability to achieve durable weight loss beyond 52 weeks. Amgen is planning to conduct a comprehensive phase III program on the candidate across multiple indications.

Initial top-line data from the phase I study on AMG 786, Amgen’s small molecule obesity candidate, is expected in the first half of 2024. AMG 786 is not an incretin-based therapy and has a different target than maridebart cafraglutide.

Amgen has also developed biosimilars of J&J’s Stelara (Wezlana/ABP 654), Alexion’s Soliris (Bekemv/ABP 959) and Regeneron’s Eylea (ABP 938). The company has successfully completed phase III studies for all these biosimilar candidates, positioning it to be in the first wave of launches of these biosimilars, which are critical to the success of biosimilar products.

Wezlana was approved in the United States in October 2023 and is expected to be launched in 2025. Bekemv was approved in the EU in April 2023, while a BLA is under review in the United States. A BLA for ABP 938 is also under review with the FDA. A phase III study is ongoing on ABP 206, which is a biosimilar of Bristol-Myers’ Opdivo.

Horizon Therapeutics Buyout Should Boost Growth Prospects: Amgen closed the acquisition of Horizon Therapeutics for $27.8 billion on Oct 6, 2023. The addition of Horizon Therapeutics has given the company a significant rare disease business by adding several rare disease drugs like Tepezza, Krystexxa and Uplizna to Amgen’s portfolio.

The addition of Horizon’s rare disease drugs should further boost revenue growth, which is likely to be accretive to earnings.

Overall, Amgen has invested several billion dollars in M&A deals over the last decade, including platform and technology-related deals as well as acquisitions of marketed products.

Zacks Rank & Stocks to Consider

Amgen currently has a Zacks Rank #3 (Hold).

Amgen Inc. Price and Consensus

Amgen Inc. price-consensus-chart | Amgen Inc. Quote

Some better-ranked biotech stocks are Vanda Pharmaceuticals VNDA, ADMA Biologics ADMA and MorphoSys MOR, sporting a Zacks Rank #1 (Strong Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, 2024 estimates for Vanda Pharmaceuticals have improved from a loss of 46 cents to earnings of 1 cent. For 2025, loss estimates have narrowed from 94 cents to 48 cents per share in the past 60 days. In the past year, shares of VNDA have declined 42.9%.

Vanda Pharmaceuticals delivered a three-quarter average earnings surprise of 92.88%.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share have improved from 22 cents to 30 cents. Estimates for 2025 have increased from 32 cents to 50 cents. In the past year, shares of ADMA Biologics have risen 94.0%.

Earnings of ADMA Biologics beat estimates in three of the last four quarters while meeting the same once. ADMA delivered a four-quarter average earnings surprise of 85.0%.

In the past 60 days, estimates for MorphoSys’ 2024 loss per share have narrowed from $2.24 to $2.08. Estimates for 2025 have narrowed from a loss of $1.02 per share to a loss of 89 cents per share. In the past year, shares of MOR have risen 357.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amgen Inc. (AMGN) : Free Stock Analysis Report

Vanda Pharmaceuticals Inc. (VNDA) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

MorphoSys AG Unsponsored ADR (MOR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance