Xerox (XRX) to Transition Peru and Ecuador Operations to PBS

Xerox Holdings Corporation XRX shares have had an impressive run over the past year, gaining 21%.

Xerox yesterday revealed its plan to shift operations in Peru and Ecuador to Productive Business Solutions (PBS), a longstanding partner of the company. The financial terms of the deal have been kept under wraps.

As part of the deal, Xerox's staff in Peru and Ecuador will transition to PBS, which will then serve as the exclusive distribution partner for Xerox in these regions. The transaction is anticipated to close in the second quarter of 2024 upon authorization from the Ecuadorian competition authority.

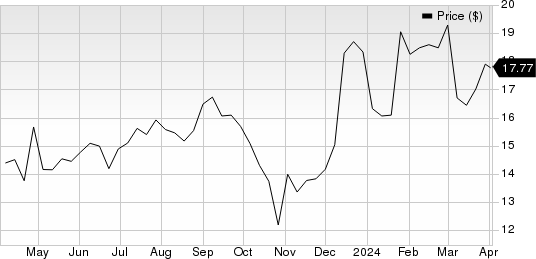

Xerox Holdings Corporation Price

Xerox Holdings Corporation price | Xerox Holdings Corporation Quote

Strategic Operating Model Transformation

This appears to be a strategic move by Xerox to refine its business model and focus on core strengths, particularly its Digital Services capabilities. By doing so, it is choosing to delegate certain operational aspects, a strategy that is especially important in complex markets like Latin America, where local expertise and connections are crucial for success.

Shifting to a partner-driven business model should enable Xerox to leverage PBS's established local networks and market insights. This could lead to more efficient distribution, customized marketing approaches and potentially higher sales.

From a financial perspective, by delegating its operational responsibilities, Xerox will likely be able to lower operational expenses and enhance profit margins. The move may be a part of Xerox’s bid to sustain profitability in a competitive technology sector, where firms are increasingly focused on refining their cost structures.

Zacks Rank and Other Stocks to Consider

Xerox currently sports a Zacks Rank #1 (Strong Buy).

A couple of other top-ranked stocks are APi Group APG and Charles River Associates CRAI.

APi Group flaunts a Zacks Rank of 1 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

APG has a long-term earnings growth expectation of 17.9%. It delivered a trailing four-quarter earnings surprise of 5.1%, on average.

Charles River Associates carries a Zacks Rank of 2 (Buy) at present. It has a long-term earnings growth expectation of 16%.

CRAI delivered a trailing four-quarter earnings surprise of 8.1%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

Xerox Holdings Corporation (XRX) : Free Stock Analysis Report

APi Group Corporation (APG) : Free Stock Analysis Report