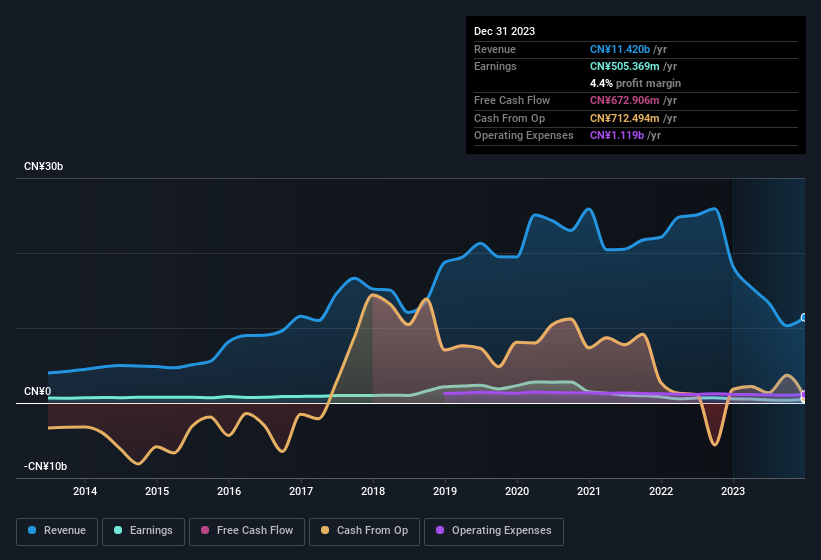

Investors weren't pleased with the recent soft earnings report from Cinda Real Estate Co., Ltd. (SHSE:600657). Our analysis suggests that while the headline numbers were soft, there are some positive factors which shareholders may have missed.

The Power Of Non-Operating Revenue

Most companies divide classify their revenue as either 'operating revenue', which comes from normal operations, and other revenue, which could include government grants, for example. Where possible, we prefer rely on operating revenue to get a better understanding of how the business is functioning. However, we note that when non-operating revenue increases suddenly, it will sometimes generate an unsustainable boost to profit. Notably, Cinda Real Estate had a significant increase in non-operating revenue over the last year. Indeed, its non-operating revenue rose from CN¥1.74b last year to CN¥1.79b this year. The high levels of non-operating revenue are problematic because if (and when) they do not repeat, then overall revenue (and profitability) of the firm will fall. In order to better understand a company's profit result, it can sometimes help to consider whether the result would be very different without a sudden increase in non-operating revenue.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Cinda Real Estate.

How Do Unusual Items Influence Profit?

Alongside that spike in non-operating revenue, it's also important to note that Cinda Real Estate'sprofit suffered from unusual items, which reduced profit by CN¥160m in the last twelve months. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual expenses don't come up again, we'd therefore expect Cinda Real Estate to produce a higher profit next year, all else being equal.

Our Take On Cinda Real Estate's Profit Performance

In the last year Cinda Real Estate's non-operating revenue really gave it a boost, but not in a way that is necessarily going to be sustained. Having said that, it also took a hit from unusual items, which could bode well for next year, assuming the expense was one-off in nature. Based on these factors, we think it's very unlikely that Cinda Real Estate's statutory profits make it seem much weaker than it is. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Case in point: We've spotted 2 warning signs for Cinda Real Estate you should be aware of.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.