Australia is blessed with a range of quality dividend shares that pay out dividend yields that are the envy of other nations.

This is no accident, though.

The situation arose because of the tax laws in this country allowing investors to not be double-taxed.

Companies that have already paid corporate tax on their profits, which then pay some of that out as dividends, are eligible to give out franking credits to shareholders.

Those credits then allow the investors to avoid paying income tax on that income.

This means that for all concerned, dividends are the most attractive way to return capital from a business to an investor.

$2,400 annual income from just an $18,000 outlay

It's all excellent news for punters who have some cash to invest.

If you play your cards right, just a small batch of shares in the right dividend stock could instantly pay you thousands in annual passive income.

Check this out as an example.

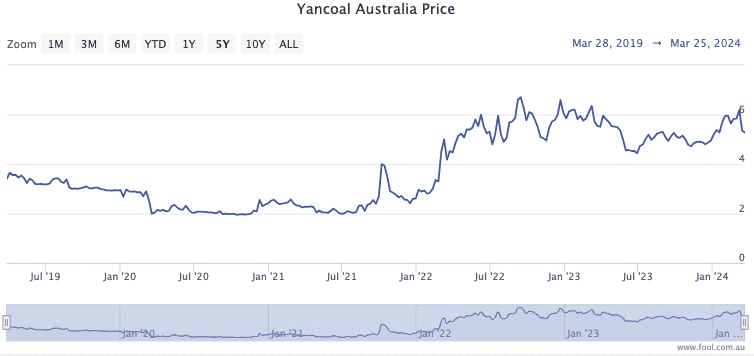

Yancoal Australia Ltd (ASX: YAL), which at $7 billion in market capitalisation is no cowboy microcap, currently pays out a sensational yield of 13.2%. This is fully franked, as well.

And with the energy market expected to be buoyant, all four analysts covering Yancoal surveyed on CMC Invest rate the miner as a buy.

Buy just 3,500 Yancoal shares and see what happens.

That's roughly an $18,000 investment at the current stock price, which is not a massive outlay.

If the company can maintain the yield, that's $2,376 in your pocket each year immediately.

No waiting for the pot to grow for years. That's thousands of dollars of income from the get-go.

Of course, in a real portfolio you want to diversify your holdings so that if Yancoal or any of the other stocks go pear-shaped, you are not left devastated.

But this example shows you how fortunate we are Down Under to have reliable high-yield dividend stocks immediately ready to generate cash for you.

Sure beats a term deposit in a bank.