InspireMD's (NASDAQ:NSPR) investors will be pleased with their solid 110% return over the last year

It hasn't been the best quarter for InspireMD, Inc. (NASDAQ:NSPR) shareholders, since the share price has fallen 16% in that time. On the other hand, over the last twelve months the stock has delivered rather impressive returns. We're very pleased to report the share price shot up 110% in that time. So some might not be surprised to see the price retrace some. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for InspireMD

InspireMD isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over the last twelve months, InspireMD's revenue grew by 20%. We respect that sort of growth, no doubt. While that revenue growth is pretty good the share price performance outshone it, with a lift of 110% as mentioned above. Given that the business has made good progress on the top line, it would be worth taking a look at its path to profitability. But investors need to be wary of how the 'fear of missing out' could influence them to buy without doing thorough research.

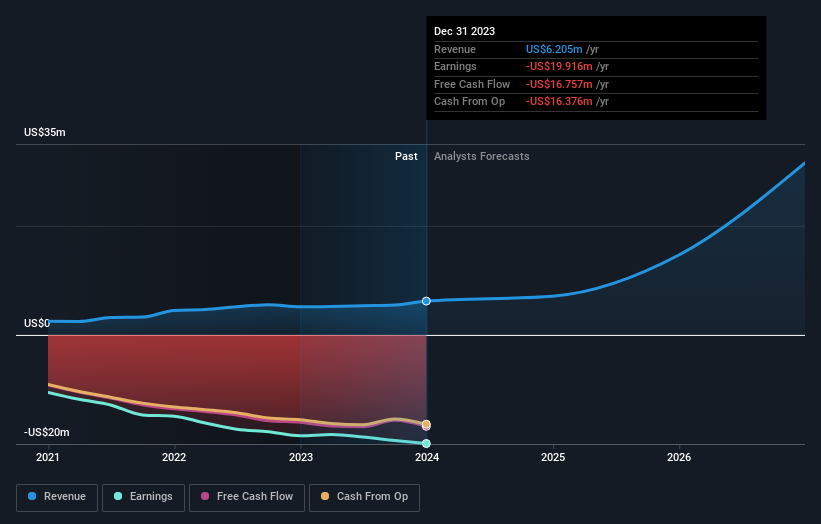

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling InspireMD stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's good to see that InspireMD has rewarded shareholders with a total shareholder return of 110% in the last twelve months. Notably the five-year annualised TSR loss of 14% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for InspireMD (2 don't sit too well with us) that you should be aware of.

InspireMD is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance