Investors with significant funds have taken a bullish position in Danaher (NYSE:DHR), a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in DHR usually indicates foreknowledge of upcoming events.

Today, Benzinga's options scanner identified 8 options transactions for Danaher. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 75% being bullish and 25% bearish. Of all the options we discovered, 7 are puts, valued at $335,424, and there was a single call, worth $30,000.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $240.0 to $250.0 for Danaher over the last 3 months.

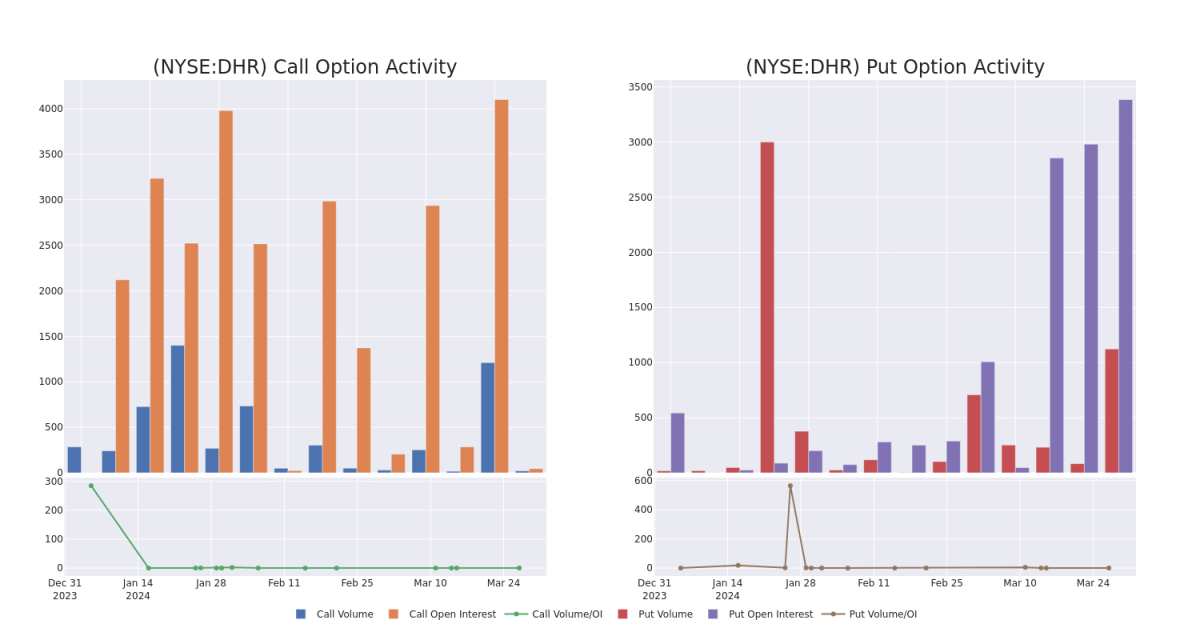

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Danaher's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Danaher's substantial trades, within a strike price spectrum from $240.0 to $250.0 over the preceding 30 days.

Danaher Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| DHR | PUT | SWEEP | BULLISH | 04/19/24 | $250.00 | $128.5K | 2.8K | 253 |

| DHR | PUT | SWEEP | BULLISH | 04/19/24 | $250.00 | $56.5K | 2.8K | 321 |

| DHR | PUT | SWEEP | BULLISH | 04/19/24 | $250.00 | $37.4K | 2.8K | 321 |

| DHR | PUT | SWEEP | BEARISH | 03/28/24 | $247.50 | $32.5K | 266 | 0 |

| DHR | CALL | SWEEP | BEARISH | 05/17/24 | $240.00 | $30.0K | 45 | 21 |

About Danaher

In 1984, Danaher's founders transformed a real estate organization into an industrial-focused manufacturing company. Through a series of mergers, acquisitions, and divestitures, Danaher now focuses primarily on manufacturing scientific instruments and consumables in two segments--life sciences and diagnostics--after the late 2023 divesititure of its environmental and applied solutions group, Veralto.

Where Is Danaher Standing Right Now?

- With a volume of 479,583, the price of DHR is up 0.11% at $248.46.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 27 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.