United States Less than Truckload (LTL) Road Freight Transport Market 2024-2029 - Oil & Gas, Mining, and Quarrying Identified as the Fastest Growing Segment by End-user, Signaling a Surging Demand Curve

United States Less Than Truck Load Market United States Less Than Truckload Road Freight Transport Market C A G R By End User 2022 2028

Dublin, March 26, 2024 (GLOBE NEWSWIRE) -- The "United States Less than Truckload Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2016-2029" report has been added to ResearchAndMarkets.com's offering.

This report shows a robust trajectory for the United States Less than Truckload (LTL) Road Freight Transport industry, with significant insights into market shares, trends, and growth forecasts for the period 2016-2029. Focus areas include segments based on destination and end-user dynamics, highlighting the domestic segment's dominance and the surge within the wholesale and retail trade sector.

The study outlines the domestic LTL freight segment as the largest contributor relative to international trucking. This segment's upswing is attributed to a consistent increase in freight tonnage movements across the United States in recent years. This surge is particularly impactful for the industry, indicating a focused growth within the domestic sphere.

Similarly, the end-user segment analysis signals that the wholesale and retail trade has a pivotal role in the industry, accounting for 11.9% of the market share and standing as a substantial contributor to the nation's Gross Domestic Product (GDP). This section of the LTL market is also marked for expansion, aligning with projections for retail sales in the U.S., which are expected to reach USD 7.9 trillion by 2026.

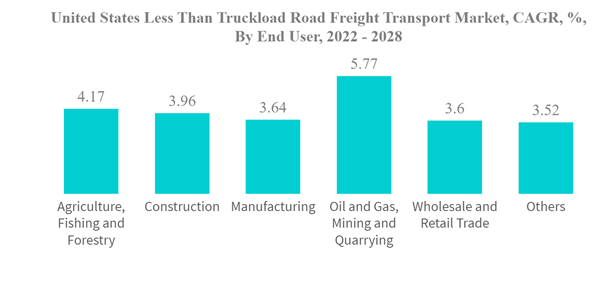

In terms of growth rate, the oil and gas, mining, and quarrying sectors are highlighted as the fastest expanding segments in end-user categories. Predictions for peak crude production alongside rising demand for exports underpin the forecasted acceleration in these industries.

Despite pandemic-induced challenges, the industry illustrates resilience, with the wholesale and retail trade segment within LTL reporting YoY growth in volumes and a continued upward trend in market share. A specific highlight is the remarkable recovery of this sector from the recession, showing a significant rebound in 2020 and 2021.

Industry Overview

The United States LTL Road Freight Transport Market is characterized by a fragmented competitive landscape, with leading players such as C.H. Robinson, FedEx, United Parcel Service (UPS), XPO Logistics Inc., and Yellow Corporation at the forefront. Collectively, these top entities constitute a notable portion of the market presence, demonstrating a balanced mix of established incumbent firms and emerging challengers shaping the industry's future.

Key Market Segments

Wholesale and Retail Trade: Maintains the highest market share with continued growth prospects.

Domestic Transportation: Emerges as the largest and fastest-growing segment by destination.

Oil & Gas, Mining, and Quarrying: Identified as the fastest growing segment by end-user, signaling a surging demand curve.

A selection of companies mentioned in this report includes:

C.H. Robinson

Deutsche Post DHL Group

FedEx

Knight-Swift Transportation

Landstar System Inc.

Schneider

United Parcel Service (UPS)

Werner Enterprises Inc.

XPO Logistics Inc.

Yellow Corporation

For more information about this report visit https://www.researchandmarkets.com/r/dilr6w

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance