Despite currently being unprofitable, Sigma Lithium (NASDAQ:SGML) has delivered a 838% return to shareholders over 5 years

Some Sigma Lithium Corporation (NASDAQ:SGML) shareholders are probably rather concerned to see the share price fall 64% over the last three months. But over five years returns have been remarkably great. In fact, during that period, the share price climbed 838%. Impressive! Arguably, the recent fall is to be expected after such a strong rise. But the real question is whether the business fundamentals can improve over the long term. Anyone who held for that rewarding ride would probably be keen to talk about it.

Although Sigma Lithium has shed US$94m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

View our latest analysis for Sigma Lithium

Sigma Lithium isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Sigma Lithium saw its revenue grow at 109% per year. That's well above most pre-profit companies. Arguably, this is well and truly reflected in the strong share price gain of 56%(per year) over the same period. It's never too late to start following a top notch stock like Sigma Lithium, since some long term winners go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

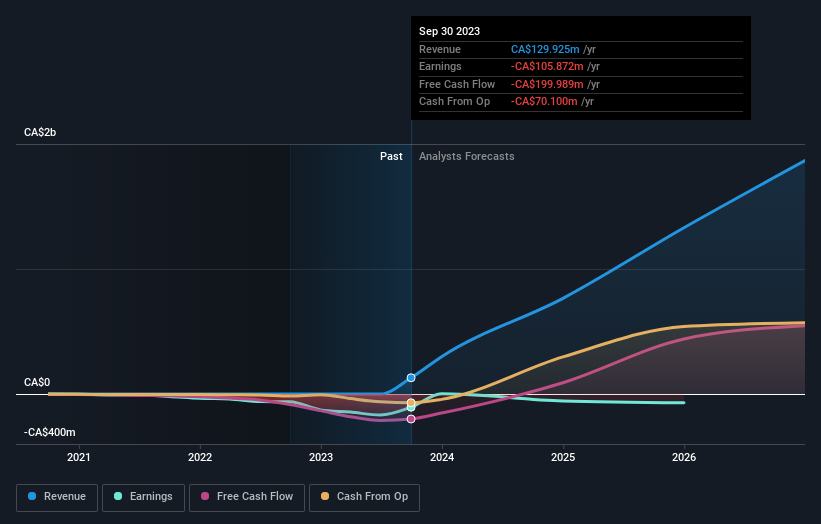

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market gained around 32% in the last year, Sigma Lithium shareholders lost 65%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 56%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Sigma Lithium (of which 1 is significant!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.