The ASX share market is currently trading at close to its recent all-time high. It could keep climbing in the long term if supportive factors become stronger, such as rising business profits and/or reductions in the interest rate. However, you never know when the next bear market is going to happen.

I'm not forecasting when there's going to be a crash or by how much the fall could be. However, history has shown that crashes do regularly happen – the share market is not rational 100% of the time – sometimes it becomes too exuberant, and occasionally a black swan event happens.

If there is another crash, there are at least three ASX shares that I'd look to buy.

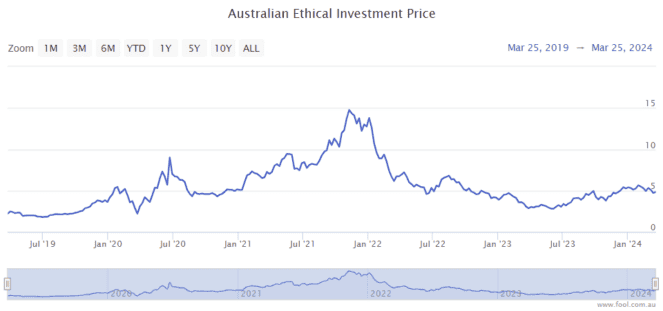

Australian Ethical Investment Ltd (ASX: AEF)

Australian Ethical is a fund manager that aims to provide investors with funds that have a high level of ethics. For example, it avoids investing in sectors like oil and tobacco.

If we look at the Australian Ethical share price over the last five years, we can see there has been enormous volatility.

But, in funds under management (FUM) terms, it has been more stable and the growth has been pleasing.

A fall in the share market naturally hurts the FUM. I think that can prove to be a good time to buy the ASX share, with the future recovery in mind. But, with the company benefiting from sizeable superannuation payments every quarter, it continues to experience good FUM inflows.

I think long-term FUM growth can help the company's operating leverage, boosting its profit margins and ultimately helping the bottom line.

Any short-term pullback would be appealing to me.

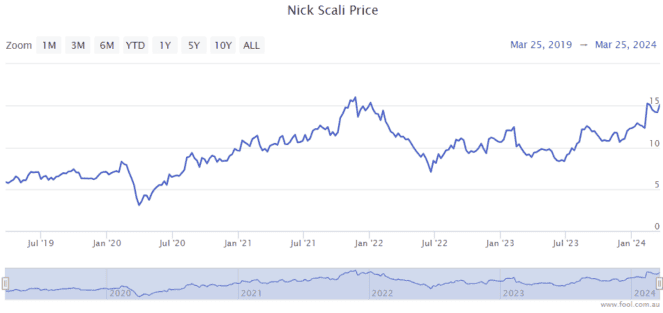

Nick Scali Limited (ASX: NCK)

Nick Scali is one of the largest retailers of furniture in Australia, with its Nick Scali and Plush brands. Unsurprisingly, demand for sofas doesn't seem to be consistent through the economic cycle, and investors can sometimes become worried about the outlook for discretionary spending.

At the moment, investors are excited again about the prospects of the company – its written sales book is performing well, despite weaker economic conditions. In January 2024, written sales orders were up 3.6%.

Nick Scali has proven to be a great business – it earns a high return on equity (ROE) and typically pays an appealing dividend yield.

If the ASX share is able to expand more internationally – in New Zealand and perhaps other countries – then it could have a longer growth runway than some investors are giving it credit.

The potential store rollout in Australia for Nick Scali and Plush is compelling. Possible growth from its online store could also be helpful in the long term.

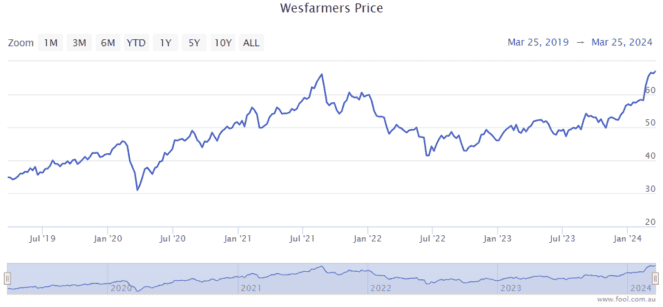

Wesfarmers Ltd (ASX: WES)

Wesfarmers is one of the highest-quality ASX shares Aussies can buy, in my opinion. Bunnings and Kmart have done an exceptional job of growing to their current market-leading positions while achieving large profits and making strong returns on capital for investors.

The last five years have shown how volatile the Wesfarmers share price can be, but it has also demonstrated the strength of the company and its resilient profit.

Its expansion into a sector like healthcare makes a lot of sense because of the ageing tailwinds, and it also brings defensive earnings.

Wesfarmers has been a strong performer for a long time. I'm expecting more volatility in the future, but I'll be there to pounce on any significant declines – I think it's a great ASX share and worth being in almost any investor's portfolio.