The Lake Resources (ASX: LKE) share price is charging ahead today.

Shares in lithium stock closed yesterday trading for 6.6 cents. In morning trade on Tuesday, shares are swapping hands for 6.7 cents apiece, up 1.5%.

For some context, the All Ordinaries Index (ASX: XAO) is down 0.3% at this same time.

This comes after the miner reported on an important sustainability milestone at its Kachi lithium project, located in Argentina.

ASX lithium stock progresses with sustainable production

The Lake Resources share price is shaking off the broader market sell-off today after the company announced it has submitted the required Production Environmental Impact Assessment (EIA) for Kachi to the Catamarca Ministry of Mining.

The miner's sustainable project development plan will result in a small water footprint, which it said will be among the lowest for lithium brine projects per tonne.

As per the EIA, Lake Resources will extract lithium brine via production wells which is then pumped to the Direct Lithium Extraction plant for lithium recovery. The spent brine is then injected back into the subsurface via injection wells.

Management noted that the miner's lilac ion exchange process uses only a fraction of the water required for evaporation ponds and absorption DLE technology.

On the sustainability front, Kachi also requires less land and will cause lower solid waste output compared to traditional evaporation ponds and hard rock projects.

Commenting on the submission of the EIA that looks to be boosting the Lake Resources share price today, CEO David Dickson said:

The timely submission of the EIA underscores Lake's firm commitment to conducting operations in a manner that prioritises care for the environment and fosters collaboration with our neighbouring communities.

Kachi stands as a testament to our adoption of a prudent and groundbreaking approach to lithium brine extraction, aiming for the advancement of sustainable and responsible lithium production.

Lake Resources share price snapshot

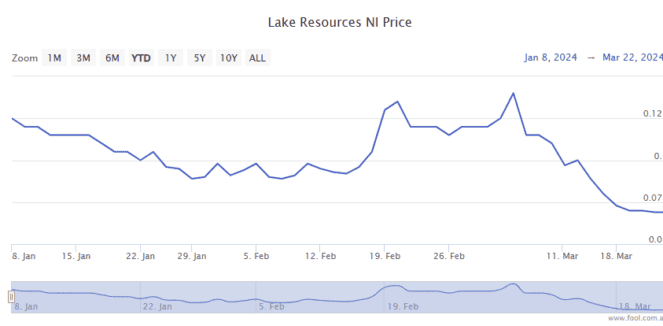

Despite today's welcome lift, the Lake Resources share price remains deep in the red, down 51% in 2024.