Semrush (NYSE:SEMR) has established itself as a leading company in the SEO (search engine optimization) industry. Many businesses use Semrush to find keywords, analyze the competition, and discover additional ways to rank high for their desired search phrases. The growing demand for SEO, Semrush’s leading position, and its revenue recurring model make me bullish on the stock.

Popular search engines like Alphabet’s (NASDAQ:GOOG, NASDAQ:GOOGL) Google redefined how businesses get in front of customers. Content creation and optimization suddenly became important for every small business instead of only being exclusively for media organizations and large corporations.

Semrush Is a Leader in the SEO Industry

Semrush is a premier tool for businesses that want to rank higher on search engines and optimize their ad campaigns. Many of the world’s leading brands use Semrush to grow their online audiences.

The SEO firm recently announced that it has more than one million active customers. 108,000 of those active users are paying customers. The user base is large enough to garner attention from investors, but it also demonstrates that Semrush has an opportunity to expand. The SEO industry is expected to achieve a CAGR of 8.7% from now until 2032, and Semrush stands to gain from this growth.

Recurring Revenue Is Growing

Semrush’s business model revolves around recurring revenue, as customers pay a monthly subscription to use Semrush’s features. The firm reported a 23% year-over-year improvement in annual recurring revenue. Further, the company stands to make $337.1 million each year from its customer pool, which it has been expanding.

CEO and co-founder Oleg Shchegolev offered some insights into the company’s plans to increase its recurring revenue, saying, “Looking ahead, we remain focused on our three main growth pillars: increasing new user growth, driving expansion by delivering higher value to our customers, and adding new products and monetization to our portfolio to address client needs and market trends.”

Semrush has delivered on those core objectives. A higher customer base, better product selection, and customer upgrades are helping the company deliver solid returns for its investors. The company’s pool of customers who pay more than $10,000 per year for its software increased by more than 30% year-over-year. Acquiring new customers and having existing customers pay more can support meaningful growth for several years.

The Recent Shift to Profitability Is Promising

A common weakness of many growth stocks is that they do not generate profits. Stocks in this category have high revenue growth and require investors to consider a company’s potential rather than what it can do right now.

However, Semrush made an important step in strengthening the bullish thesis by becoming profitable. The company closed out 2023 with about $1 million in full-year net income. That’s not much, but it is a starting point. Thanks to its scalability, Semrush stands to expand its profit margins in the future.

Q4-2023 results highlight this trend. Although the firm only reported $1 million in GAAP net income in full-year 2023, the company’s Q4 GAAP net income came to $6.9 million. Semrush’s net profit margin exceeded 8% in the quarter. The sequential growth in net profit margins suggests we may see at least one quarter where Semrush posts a double-digit net profit margin.

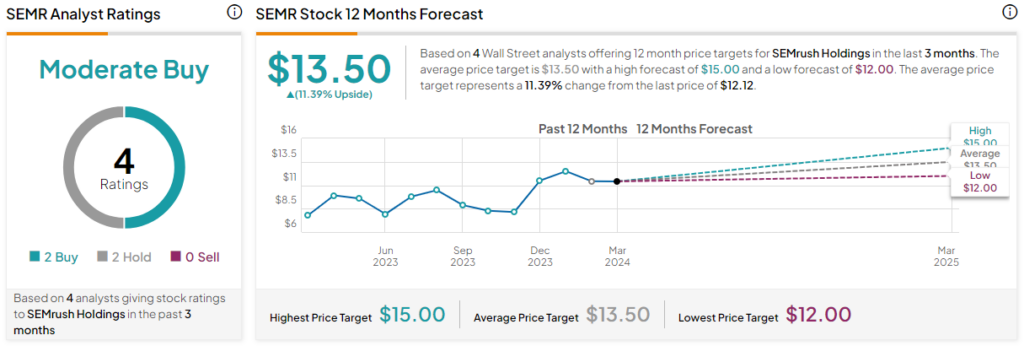

Is Semrush Stock a Buy, According to Analysts?

Semrush doesn’t have as much coverage as other stocks, thanks to its market cap being below $2 billion. The stock has two Buy ratings and two Hold ratings, making it a Moderate Buy, according to TipRanks. The average SEMR stock price target of $13.50 suggests 11.4% upside potential.

The Bottom Line on Semrush Stock

Semrush is a leader in a promising industry that will remain relevant for a long time. Businesses recognize that investing in SEO can put them in front of their target audiences more often. The corporation operates in a good industry, and its financial growth makes it more enticing. High growth for its annual recurring revenue and meaningful profit margin expansion can make the valuation look better for long-term investors.

Semrush isn’t getting as much attention from Wall Street or the media. It’s a smaller stock that has gained 29% over the past year. Shares are down by 60% from their all-time high which was set in September 2021. Nevertheless, good leadership, an effective product, and rising profits can help Semrush reclaim its all-time high within a few years.