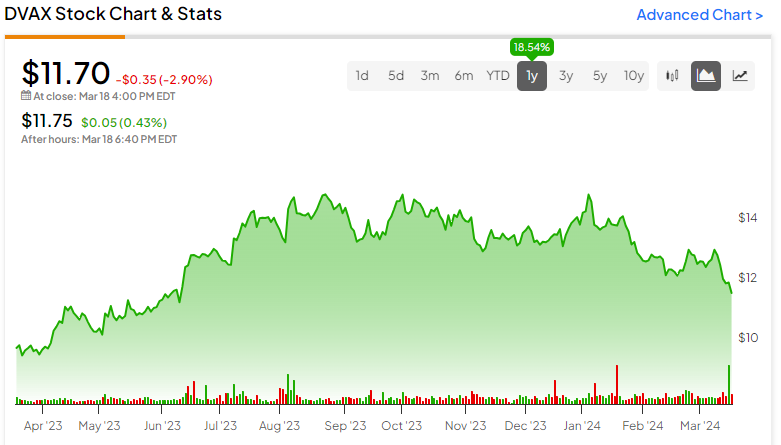

Dynavax (NASDAQ:DVAX) is a biopharmaceutical player focused on developing and commercializing novel vaccines and immuno-oncology therapeutics. The company’s principal product, a vaccine designed to protect adults against hepatitis B virus, has secured a considerable market share. DVAX stock is up over 18% in the past year, though its rich valuation suggests the market is pricing for more robust growth in the years ahead.

Vaccines-R-Us

Dynavax’s primary product is HEPLISAV-B, a vaccine designed to prevent infection by all known subtypes of the hepatitis B virus in adults 18 years of age and older. As of 2023, the vaccine’s market share had risen to roughly 42%, with a healthy tailwind, thanks to the Centers for Disease Control and Prevention’s Advisory Committee of Immunization Practices (ACIP), which has universally recommended vaccination for adult hepatitis B.

The U.S. hepatitis B vaccine market is expanding, with Dynavax believing its potential to reach around $800 million by 2027. Notably, HEPLISAV-B has emerged as the leading vaccine in this market, holding a significant market share in the two growing segments: retail pharmacies and integrated delivery networks (IDNs).

The company is also in the early stages of developing other potential vaccine candidates, including a more effective plague vaccine (notably, this project is receiving partial funding from the Department of Defense) and improved vaccines for Shingles and TDAP.

Impressive Financials

Dynavax recently announced its financials for the fourth quarter (Q4) of 2023. It reported an EPS of $0.00, which beat the estimated consensus of a loss per share of $0.01. Q4 revenue was $55.56 million exceeding the consensus estimate of $52.72 million.

The company saw record revenue growth for its primary product, HEPLISAV-B. The vaccine’s net product revenue for Q4 and 2023 accumulated to about $51.1 million and $213.3 million, respectively, signifying an impressive year-over-year expansion of approximately 46% for Q4 and 69% for 2023.

Looking ahead to 2024, Dynavax expects considerable growth in the HEPLISAV-B brand and advancements in its pipeline programs. The company anticipates that the 2024 HEPLISAV-B net product revenue will be in the range of $265 million to $280 million. Furthermore, the firm’s robust cash position of $742 million allows it to keep building value across its business, develop its R&D efforts, and seek strategic opportunities to hasten growth.

Where the Stock Stands Now

DVAX stock has been on a long upward climb over the past five years, though year-to-date is down nearly 14%. The recent price of $11.70 is trading toward the lower middle of the stock’s 52-week range of $9.42-$15.15. The negative shift in price momentum has the shares trading below the 20-day (12.63) and 50-day (12.98) moving averages.

Despite the recent price drop, Dynavax stock appears relatively richly valued based on comparative metrics. The P/S (price-to-sales) multiple of 7.1x is above the averages of the Healthcare sector (1.97x) and the Drug Manufacturers – Specialty and Generic industry (2.09x).

As the company is early in ramping up sales of its leading treatment, the heightened P/S valuation suggests that most of the present value is more heavily weighted toward future growth. In short, investors are now paying a bit of a premium for the prospect of above-market growth rates over time.

What is the Price Target for DVAX?

Analysts covering DVAX stock have mostly been bullish. However, Goldman Sachs analyst Paul Choi stands out for recently initiating coverage on the stock with a Hold rating and a price target of $20. Choi thinks there is limited upside potential over the near term at the current valuation level.

Based on four analysts’ stock ratings in the past three months, Dynavax is listed as a Strong Buy. The average DVAX stock price target of $25.75 represents an upside potential of 120.09% from current levels.

Final Analysis on DVAX

Dynavax represents an exciting evolution in vaccine development. With a leading product, HEPLISAV-B, demonstrating robust growth and a promising pipeline in development, the company appears poised for future success. Despite recent market fluctuations, Dynavax’s strong financials, including a robust cash position, position it well for the near term.

The stock’s current valuation reflects high growth expectations. Further, the company’s strategic plans, market position, and projected revenue growth suggest it is a compelling prospect for growth investors looking for exposure to the biopharmaceutical market.