Markets Dip but it's Time to Buy These Low-Risk High-Income Stocks

Broader markets dipped this morning as the Producer Price Index (PPI) showed a 0.6% increase in the production cost for domestic producers from January. This came in much hotter than expectations of a 0.3% uptick.

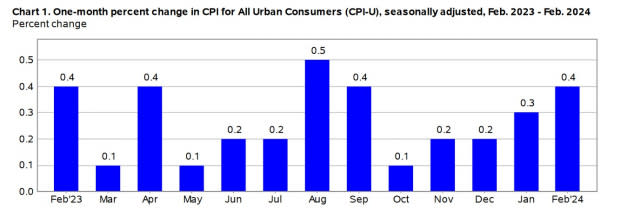

We may not be out of the woods in terms of inflationary pressures with the Consumer Price Index (CPI) starting to tick higher over the last few months as well but several low-beta stocks are standing out which suggests they should be less volatile.

Belonging to the Zacks Rank #1 (Strong Buy) list, these stocks also have dividend yields of over 5% making them more appealing if further volatility is on the horizon.

Image Source: U.S. Department of Labor

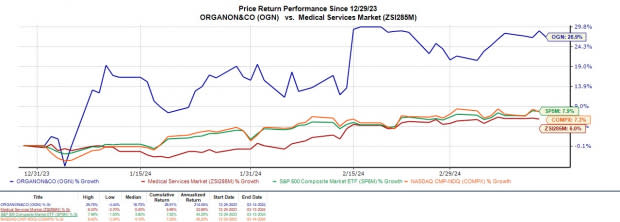

Organon & CO OGN: Checking in with a beta of 0.81 is Organon & Co, a medical services company focused on healthcare for women which looks vastly undervalued at the moment. Although Organon’s stock has soared +27% year to date it still trades at $18 and just 4.3X forward earnings with annual EPS forecasted to be up 3% in fiscal 2024 and projected to rise another 3% in FY25 to $4.45 per share.

While many medical services stocks don’t offer a payout, Organon has a 6.04% annual dividend yield that towers over the S&P 500’s 1.31% average.

Image Source: Zacks Investment Research

OverseaChinese Banking OVCHY: Headquartered in Singapore, Oversea-Chinese Banking has a beta of 0.71 and a reassuringly low volatile 52-week range of $17.46-$20.49 a share.

The commercial bank stock also offers a 5.42% annual dividend which it has increased eight times in the last five years. Furthermore, Oversea is expecting 9% EPS growth this year with annual earnings projected to rise another 4% in FY25 to $2.62 per share.

Image Source: Zacks Investment Research

Southside Bancshares SBSI: We’ll round out this list with a domestic commercial bank in Southside Bancshares which has a very low beta ratio of 0.53 and a 5.1% annual dividend yield that impressively tops the Zacks Banks-Southwest Industry average of 0.88%.

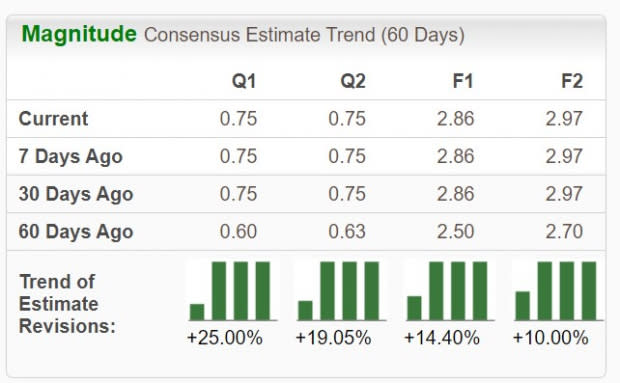

Southside Bancshares stock has dipped -11% YTD to around $27 and is starting to look like a strong buy-the-dip candidate with earnings estimate revisions noticeably higher over the last 60 days for both FY24 and FY25. The low-risk beta reading comes as SBSI shares trade at an attractive 9.8X forward earnings multiple with EPS expected to increase 1% in FY24 and edge up another 4% next year to $2.97 per share.

Image Source: Zacks Investment Research

Bottom Line

Like Southside Bancshares stock, earnings estimate revisions have remained higher for Organon & Co and Oversea-Chinese Banking. This makes now an ideal time to buy these lower-risk, high-income stocks especially as markets start to digest hot inflationary data.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southside Bancshares, Inc. (SBSI) : Free Stock Analysis Report

Oversea-Chinese Banking Corporation Limited (OVCHY) : Free Stock Analysis Report

Organon & Co. (OGN) : Free Stock Analysis Report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report