Altria (MO) Plans to Sell Partial Stake in Anheuser-Busch InBev

Altria Group, Inc. MO unveiled intentions to divest a portion of its stake in Anheuser-Busch InBev SA/NA via a global secondary offering.

This offering includes various components, including a public offering of ABI ordinary shares represented by American depositary shares (ADS) in the United States, a public offering of ABI ordinary shares in the United States, simultaneous private placement of ABI ordinary shares in the European Economic Area and the United Kingdom and an offering of ABI ordinary shares encompassing those represented by ADS in other international markets.

Additionally, ABI has committed to repurchasing $200 million worth of ordinary shares directly from Altria once the offering is concluded.

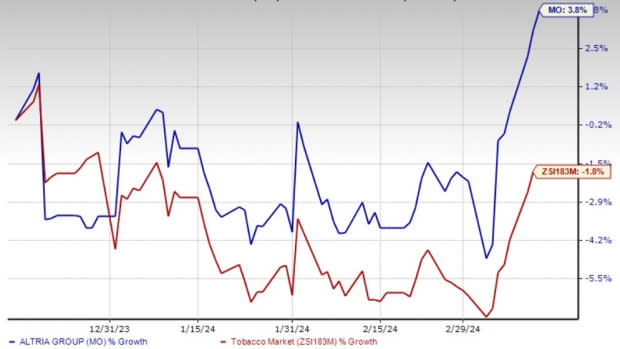

Image Source: Zacks Investment Research

What’s More?

Currently having around 197 million shares of ABI, equivalent to roughly 10% ownership, Altria intends to offer 35 million of ABI’s ordinary shares as the selling shareholder. As part of the offering, Altria anticipates granting underwriters the option to buy up to an additional 5.25 million ABI shares owned by Altria within 30 days following the offering's pricing. Altria expects to use the divestiture proceeds for further repurchases of its common stock.

Altria has been committed to maximizing shareholder value, and the abovementioned transaction appears to be a fitting move to realize gains from the company’s long-term investment in ABI.

Altria on Growth Path

Altria has been navigating market uncertainties with the support of its pricing power and focus on smoke-free products. Additionally, the company’s focus on its journey toward a smoke-free future has been an upside. The company's investment in on! is proving to be fruitful in this regard. The acquisition of NJOY Holdings marks a significant development in the e-vapor category. In the fourth quarter of 2023, reported shipment volumes of on! jumped roughly 33% year over year.

Altria highlighted its 2028 Enterprise Goals at its 2023 Investor Day. These goals take into consideration the NJOY buyout. Altria targets generating mid-single-digit adjusted EPS growth through 2028 (on a compounded annual basis). It targets annual dividend growth in the mid-single digits through 2028. The company plans to maintain a debt-to-consolidated EBITDA ratio of roughly 2.

Further, Altria plans to maintain a total adjusted operating company margin of at least 60% in the next five years. Finally, it intends to maintain its leadership position in the U.S. tobacco space. Moreover, U.S. smoke-free volumes are expected to grow by at least 35% from the 2022 level of 800 million units. Management targets nearly doubling its smoke-free net revenues to $5 billion from the 2022 level.

Shares of this Zacks Rank #3 (Hold) company have risen 3.8% in the past three months against the industry’s decline of 1.8%.

2 Staple Bets Worth Grabbing

Post Holdings POST, a consumer-packaged goods holding company, currently sports a Zacks Rank #1 (Strong Buy). POST has a trailing four-quarter earnings surprise of 52.2%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Post Holdings’ current financial-year sales and earnings indicates growth of 15.2% and 3.4%, respectively, from the year-ago reported numbers.

Celsius Holdings CELH, a functional energy drink and liquid supplement company, currently carries a Zacks Rank #2 (Buy). CELH has a trailing four-quarter earnings surprise of 67.4%, on average.

The Zacks Consensus Estimate for Celsius Holdings’ current fiscal year sales and earnings suggests growth of 41.6% and 37.8%, respectively, from the year-ago period numbers.

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently has a Zacks Rank #2. VITL has a trailing four-quarter earnings surprise of 145%, on average.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales suggests growth of 29% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Altria Group, Inc. (MO) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance