Core Lithium Ltd (ASX: CXO) shares are deep in the red today.

Once more.

Shares in the S&P/ASX 200 Index (ASX: XJO) lithium stock closed yesterday trading for 20 cents. In afternoon trade on Thursday, shares are swapping hands for 19 cents apiece, down 5.0%.

For some context, the ASX 200 is down 0.1% at this same time.

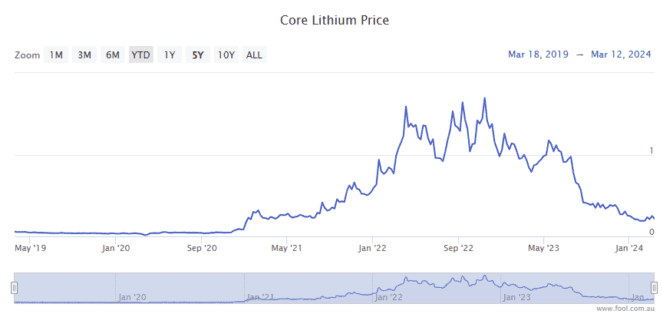

As you can see on the five-year above chart, it's been a very tough year for shareholders, with Core Lithium shares down 78% in 12 months.

And the ASX 200 lithium miner has crashed 89% since 11 November 2022, when shares were trading for $1.67.

With those painful losses already booked, the question now is whether the lithium miner has reached a bottom, or is it time to cut and run.

What now for battered Core Lithium shares?

The biggest headwind battering Core Lithium shares has been a massive fall in lithium prices.

The price of the battery critical metal reached all-time highs in November 2022 amid booming demand and limited supply. As more supply hit the markets in 2023 and demand growth slowed, the lithium price crashed by 80%.

Core isn't the only ASX 200 miner to have come under selling pressure amid that massive price retrace. But the company's share price losses over the past year have far exceeded those of its competitors.

And 2024 has thrown up more obstacles to any kind of rapid recovery.

On 5 January, management reported that the company would suspend all mining activity to preserve cash. And Core Lithium shares closed the day down 11.5%.

At the time, CEO Gareth Manderson said, "The team has moved at pace to ensure Core's value is preserved in these tough market conditions."

He added, "We are working to put the business in the best position possible to recommence mining and proceed with BP33 [underground mine development] when market conditions improve."

Unfortunately for the company and its shareholders, improving market conditions could be some time away as global lithium supply growth continues to outpace demand growth over the medium term.

As for the most recent half-year report, that did little to lift my confidence in the near to medium-term outlook for the ASX 200 miner.

Core reported revenue of $135 million, but earnings before interest, taxes, depreciation and amortisation (EBITDA) came in at a loss of $12 million. And the company posted an after tax loss for the six months of $168 million.

Topping off investor concerns, it was announced that Gareth Manderson was stepping down as CEO.

Goldman rates the ASX 200 lithium stock a 'sell'

All up, I have to agree with the analysts at Goldman Sachs who rate the ASX 200 lithium stock as a 'sell'.

The broker has a 13 cent target price for Core Lithium shares, representing a potential additional 32% downside from current levels.

According to Goldman Sachs (courtesy of CommSec):

Following the suspension of mining in Jan-24, CXO announced mutual termination of the mining services agreement with Lucas in Feb-24.

Subsequently, CXO has also advised Primero that the operation and maintenance agreement for the DMS plant would end once the processing of the remaining ROM [Run of Mine] stocks is completed in mid-2024.

While CXO is restructuring its business in response to the decrease in the spodumene price, we note that with the mining contract terminated and notice given on the processing contract, we expect that a near-term restart of the Finniss operation is increasingly unlikely.

Core Lithium shares may well rebound down the road when the supply and demand dynamics come back into better balance in global lithium markets.

But for now, I'd cut and run.