The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Boyaa Interactive International (HKG:434). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Fast Is Boyaa Interactive International Growing Its Earnings Per Share?

In the last three years Boyaa Interactive International's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Impressively, Boyaa Interactive International's EPS catapulted from CN¥0.098 to CN¥0.18, over the last year. It's a rarity to see 84% year-on-year growth like that.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Boyaa Interactive International shareholders can take confidence from the fact that EBIT margins are up from 28% to 32%, and revenue is growing. Both of which are great metrics to check off for potential growth.

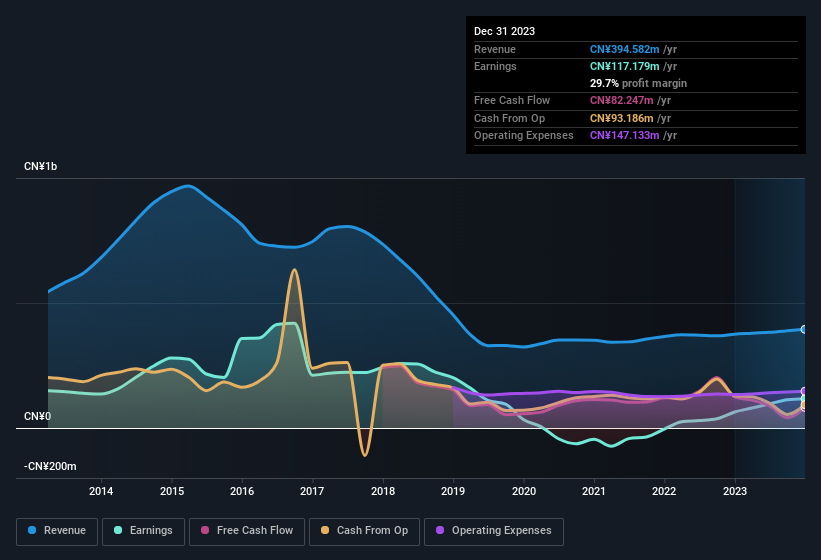

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Boyaa Interactive International isn't a huge company, given its market capitalisation of HK$1.6b. That makes it extra important to check on its balance sheet strength.

Are Boyaa Interactive International Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So those who are interested in Boyaa Interactive International will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Owning 43% of the company, insiders have plenty riding on the performance of the the share price. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. In terms of absolute value, insiders have CN¥681m invested in the business, at the current share price. That's nothing to sneeze at!

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Our quick analysis into CEO remuneration would seem to indicate they are. The median total compensation for CEOs of companies similar in size to Boyaa Interactive International, with market caps between CN¥719m and CN¥2.9b, is around CN¥2.4m.

Boyaa Interactive International's CEO took home a total compensation package of CN¥620k in the year prior to December 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is Boyaa Interactive International Worth Keeping An Eye On?

Boyaa Interactive International's earnings have taken off in quite an impressive fashion. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. Boyaa Interactive International certainly ticks a few boxes, so we think it's probably well worth further consideration. Still, you should learn about the 3 warning signs we've spotted with Boyaa Interactive International (including 2 which are potentially serious).

Although Boyaa Interactive International certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Hong Kong companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.