Blade Air Mobility Inc (BLDE) Reports Revenue Growth Amidst Widening Net Loss in Q4 2023

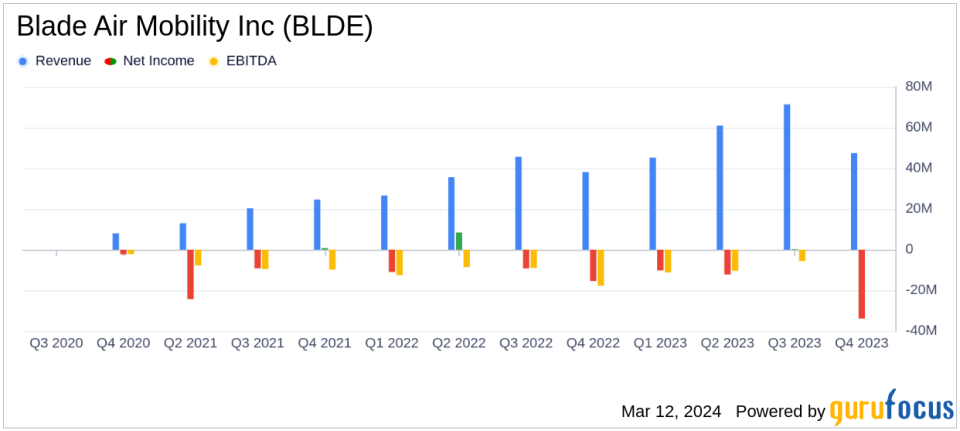

Revenue: Increased by 24.5% to $47.5 million in Q4 2023, and 54.1% to $225.2 million for the full year.

Net Loss: Grew to $(33.9) million in Q4 2023, marking a 120.2% increase from the prior year.

Adjusted EBITDA: Improved to $(5.2) million in Q4 2023, a 34.0% betterment compared to the previous year.

Medical Segment: Showed a 57.8% increase in Adjusted EBITDA to $2.5 million in Q4 2023.

Passenger Segment: Reported a loss of $(25.3) million in Q4 2023, a significant increase from the prior year.

Guidance: Blade introduced guidance for Adjusted EBITDA profitability in full-year 2024 and double-digit millions for 2025.

Liquidity: Ended Q4 2023 with $166.1 million in cash and short-term investments.

On March 12, 2024, Blade Air Mobility Inc (NASDAQ:BLDE) released its 8-K filing, detailing the financial results for the fourth quarter ended December 31, 2023. The company, known for its technology-powered air mobility platform, operates in both Passenger and Medical segments, offering efficient alternatives to traditional ground transportation and logistics for human organ transport.

Despite a notable increase in revenue, Blade's net loss widened significantly in Q4 2023 compared to the prior year. The company attributes this to a $20.8 million impairment charge on intangible assets related to the Blade Europe acquisition. However, the Adjusted EBITDA showed improvement, indicating progress in the company's operational efficiency.

Blade's Medical segment, particularly its MediMobility Organ Transport business, demonstrated strong growth and profitability, contributing positively to the company's Adjusted EBITDA. Conversely, the Passenger segment experienced a substantial loss, although the company remains optimistic about reaching profitability in this segment by 2025.

Blade's financial achievements in the Medical segment and the overall revenue growth are significant for the transportation industry, as they reflect the company's ability to scale its operations and improve unit economics. The company's focus on expanding its dedicated aircraft fleet, including the acquisition of eight jets, underscores its commitment to growth and service enhancement.

Financial Performance Analysis

Blade's financial performance in Q4 2023 was marked by a mix of positive revenue growth and challenges related to net losses. The company's revenue growth is indicative of its successful expansion and operational scaling, particularly in the Medical segment. However, the widened net loss raises concerns about the sustainability of its current cost structure and the impact of non-operational factors such as impairment charges.

The company's liquidity position remains strong, with a substantial cash reserve that provides flexibility for future investments and operational needs. Blade's guidance for future profitability, particularly the expectation of positive Adjusted EBITDA in 2024 and double-digit Adjusted EBITDA in 2025, offers a forward-looking perspective that may appeal to investors seeking long-term growth potential.

Blade's management remains confident in the company's strategic direction, emphasizing the benefits of its asset-light model and the potential for further margin enhancement. The introduction of new services, such as the Trinity Organ Placement Services (TOPS), and the focus on dedicated aircraft for organ transportation, are expected to contribute to improved profitability and competitive positioning.

Overall, Blade's Q4 2023 financial results present a complex picture of growth coupled with short-term challenges. The company's strategic initiatives and market positioning in the air mobility sector, however, provide a basis for cautious optimism about its future performance.

For a more detailed analysis and commentary on Blade Air Mobility Inc's financial results, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Blade Air Mobility Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance