US Kitchen Organizers Market Insights Report 2024-2029 Featuring Prominent Vendors - Jones Plastic and Engineering Co, Knape & Vogt, Neighborly, Newell Brands, The Container Store, The Home Depot

US Kitchen Organizers Market

Dublin, March 08, 2024 (GLOBE NEWSWIRE) -- The "US Kitchen Organizers Market - Focused Insights 2024-2029" report has been added to ResearchAndMarkets.com's offering.

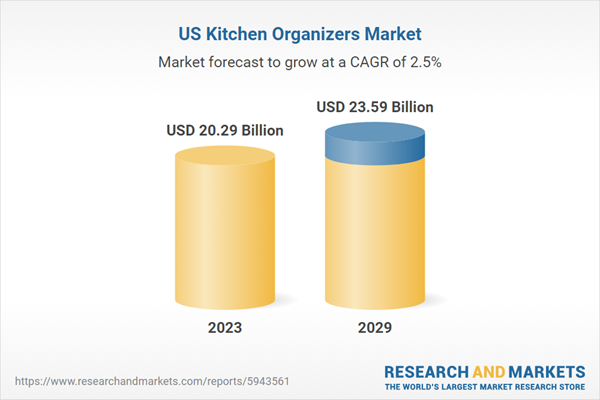

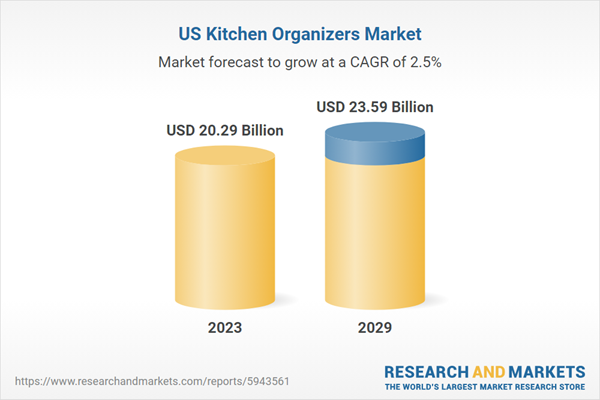

The U.S. kitchen organizer market was valued at USD 20.29 billion in 2023 and is expected to reach a value of $23.59 billion by 2029, growing at a CAGR of 2.54% from 2023 to 2029

Increasing Demand for Hospitality Industry: The demand from the hospitality industry is one of the major drivers in the U.S. kitchen organizer due to various reasons, including rising short-term stays, growth in vacation rentals, focus on amenities & guest experience, emphasis on cleanliness & hygiene, rising differentiation & competition, and demand for sustainable practices.

The rise of platforms like Vrbo and Airbnb led to a surge in vacation rentals. Such properties have smaller kitchens, considering the requirement for space-saving and efficient organization solutions. It creates demand for versatile and compact organizers, which can enhance guest experience by maximizing storage capacity. In hotels & restaurants, there is a significant demand for kitchen organizers in the U.S. In 2022, the hotel occupancy rate increased by 9% in the U.S., per the American Hotel & Lodging Association. This drives the demand for kitchen organizers in the U.S. during the forecast period.

Rising Focus on Home Improvement Activities: The rising focus on home improvement activities is one of the major drivers in the U.S. kitchen organizer market due to various reasons, including increased home value, increased disposable income, enhanced efficiency & functionality, space utilization & optimization, and rising demand for personalization. As people spend more time at home, they spend more on home improvement activities.

As per the Joint Center for Housing Studies of Harvard University, the amount paid by Americans on residential repair and renovation exceeds $500 billion per year. The trend of making organized kitchens is rising in home-improved activities. It increases the value of homes. Many homeowners do the implementation and designing of their kitchens with the help of creative ideas and readily available organizers. This drives the demand for kitchen organizers in the U.S. during the forecast period.

The U.S. kitchen organizer market report contains exclusive data on 32 vendors. Jones Plastic and Engineering Company, LLC, Knape & Vogt, Neighborly, Inc., Newell Brands, The Container Store, and The Home Depot are the leading players with intense market penetration. Established brands in the kitchen organizers market are known for offering durable and affordable organizers with various essential organizers to space optimization solutions. They offer high-quality and innovative solutions to cater to premium and mid-range segments.

THE U.S. KITCHEN ORGANIZER MARKET INSIGHTS

The drawers, upper & lower cabinet organizers segment is growing significantly with the fastest CAGR of 2.75% during the forecast period. The segment is growing significantly due to an increased focus on kitchen organization, the rising popularity of pull-out shelves increased disposable income, and the demand for space optimization solutions.

Wood is a valuable and fastest-growing material segment in the U.S. market. The wood material is seeing incremental growth due to its sustainable qualities, durability, and unique aesthetic appeal. Wood is relatively affordable as compared to metal. Thus, it is an ideal choice for budget-conscious consumers. If a wood-based product is maintained correctly, it will last many years. It can be blended with other materials to add a modern touch.

The residential sector in the end-user segment dominates the U.S. kitchen organizer market with more than 75% market share. The people in the U.S. have more money to spend on home improvement projects. The preference for customization is growing significantly in kitchen organizers such as pull-out shelves, pantry organizers, etc. They are investing in long-lasting kitchen organizers that suit their existing kitchen design. This drives the demand for kitchen organizers in the U.S. market during the forecast period.

By distribution segment, the online stores are seeing prominent growth, with the highest CAGR of 3.54% during the forecast period. The market is seeing major growth because online stores offer kitchen organizers at discounted prices with a wide range of products. Budget-conscious customers get reasonably priced products due to promotional deals and price wars. Thus, the preference for buying kitchen organizers at online stores is growing.

KEY QUESTIONS ANSWERED

How big is the U.S. kitchen organizer market?

What is the growth rate of the U.S. kitchen organizer market?

What are the key drivers in the U.S. kitchen organizer market?

Who are the key players in the U.S. kitchen organizer market?

Key Attributes:

Report Attribute | Details |

No. of Pages | 75 |

Forecast Period | 2023 - 2029 |

Estimated Market Value (USD) in 2023 | $20.29 Billion |

Forecasted Market Value (USD) by 2029 | $23.59 Billion |

Compound Annual Growth Rate | 2.5% |

Regions Covered | United States |

VENDORS LIST

Key Vendors

Jones Plastic and Engineering Company, LLC

Knape & Vogt

Neighborly, Inc.

Newell Brands

The Container Store

The Home Depot

Other Prominent Vendors

Closet Maid

Hafele

Helen of Troy Limited

Honey Can Do International, Inc.

Kitchen Magic

Blum Inc.

mDesign

Simplehuman

Spectrum Diversified Designs

Sterilite

California Closets

Enclume Design Products

Flywell International Corp.

Home Centric

iDesign

IKEA

Kittrich Corporation

Kessebohmer Clever Storage

Kitchen Wise

MUJI

Neat Method

SALICE

SpaceAid

Umbra

Yamazaki Home

YouCopia

SEGMENTATION & FORECAST

Product Market Insights (2023-2029)

Drawers, Upper & Lower Cabinets Organizers

Pantry Organizers

Countertop Organizers

Others

Material Insights (2023-2029)

Plastic

Metal

Wood

Others

End-User Market Insights (2023-2029)

Residential

HoReCa

Others

Distribution Channel Market Insights (2023-2029)

Supermarkets & Hypermarkets

Specialty Stores & Retail Stores

Online Stores

For more information about this report visit https://www.researchandmarkets.com/r/hiqt20

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance