Cipher Mining Inc (CIFR) Reports Strong Earnings Amidst Expansion Efforts

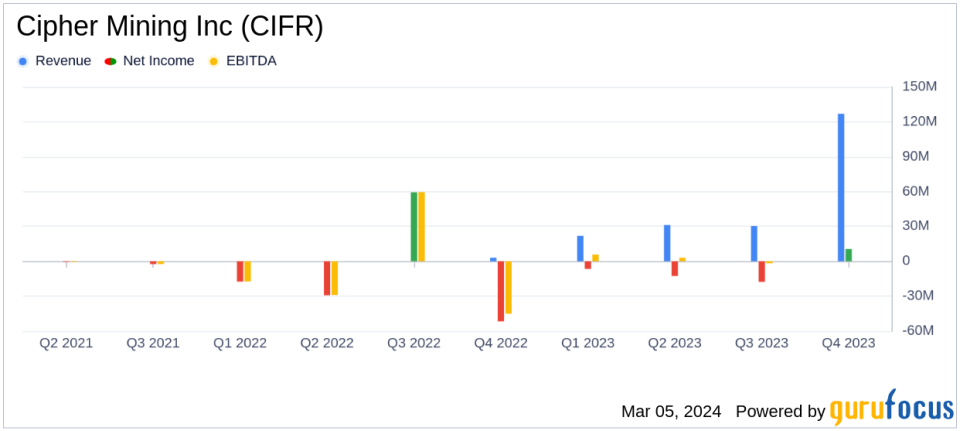

GAAP Earnings: $10.6 million for Q4 and Non-GAAP Earnings of $27.8 million.

Full Year Revenue: $126.8 million, marking significant growth.

Hash Rate Increase: Achieved 7.4 EH/s in Q1 2024, targeting 9.3 EH/s by Q3 2024.

Balance Sheet Strength: Cash and cash equivalents of $86.1 million as of December 31, 2023.

Operational Leverage: Record revenues and net profits on both a GAAP and Non-GAAP basis.

On March 5, 2024, Cipher Mining Inc (NASDAQ:CIFR), an emerging technology company specializing in Bitcoin mining, released its 8-K filing, announcing its fourth quarter and full year results for the period ended December 31, 2023. The company reported a strong quarter with positive net income on both GAAP and Non-GAAP bases, highlighting the first full quarter of operations with all data centers fully deployed.

Cipher Mining Inc (NASDAQ:CIFR) is dedicated to expanding and strengthening the Bitcoin network's infrastructure. With a focus on growth and innovation, the company is well-positioned in the capital markets industry as a leader in Bitcoin mining.

Financial Performance and Expansion Plans

CEO Tyler Page expressed satisfaction with the company's record results, attributing them to Cipher's best-in-class unit economics. The company's expansion plans for 2024 and 2025 are particularly noteworthy, with expectations to reach 9.3 EH/s by the end of Q3 2024 and over 16 EH/s in the first half of 2025. Cipher's potential growth to 25 EH/s by the end of 2025 is underpinned by the completion of the Black Pearl data center.

The company's financial achievements, including record revenues and net profits, are critical for sustaining its competitive edge and capitalizing on the operational leverage provided by its fully funded expansions at Bear and Chief JV data centers. Cipher's strong balance sheet and proven execution track record position it favorably for the upcoming halving and subsequent market cycle.

Key Financial Metrics

Examining the consolidated balance sheets, Cipher Mining Inc (NASDAQ:CIFR) ended the year with $86.1 million in cash and cash equivalents, a substantial increase from $11.9 million the previous year. The company's total assets grew to $566.1 million, up from $418.5 million at the end of 2022. On the liabilities side, total current liabilities decreased slightly to $33.8 million from $40.3 million, while stockholders' equity saw a significant increase to $491.3 million from $342.9 million.

The consolidated statements of operations reveal that revenue from Bitcoin mining surged to $126.8 million in 2023, up from just $3.0 million in 2022. Despite the increase in cost of revenue and general and administrative expenses, the company managed to reduce its net loss to $25.8 million from $39.1 million the previous year.

"These record results are driven by our best-in-class unit economics," said Tyler Page, CEO of Cipher.

Analysis of Performance

The company's strategic investments and operational efficiency have translated into robust financial performance. The increase in hash rate capacity and the acquisition of the Black Pearl facility are indicative of Cipher's commitment to scaling operations and enhancing shareholder value. The company's ability to navigate the complexities of the Bitcoin mining industry and maintain profitability in a dynamic market environment is commendable.

Overall, Cipher Mining Inc (NASDAQ:CIFR)'s earnings report reflects a company on a strong growth trajectory, with a solid financial foundation and strategic plans for expansion. The company's performance is a testament to its operational excellence and strategic foresight in the rapidly evolving cryptocurrency mining landscape.

For a more detailed analysis of Cipher Mining Inc (NASDAQ:CIFR)'s financials and future prospects, investors and interested parties are encouraged to visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Cipher Mining Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance