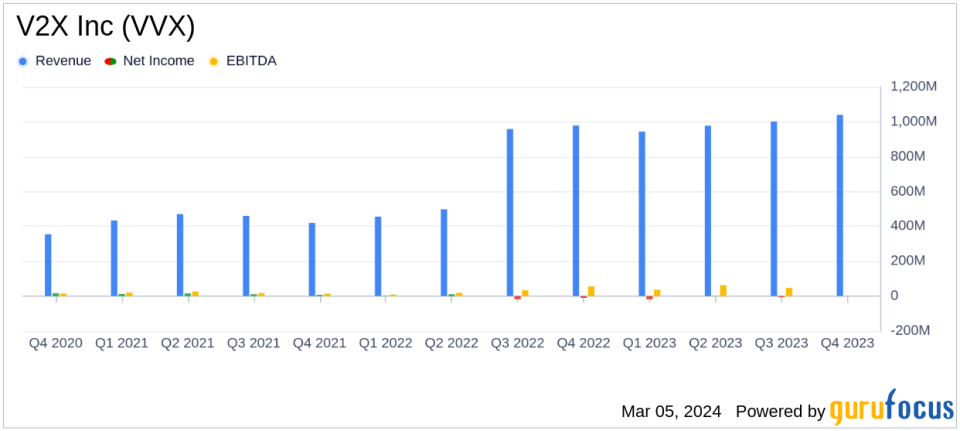

V2X Inc (VVX) Reports Record Revenue and Solid Financial Performance for Q4 and Full-Year 2023

Revenue: Reported a record $1.04 billion in Q4, marking a 6.4% year-over-year increase.

Net Income: Improved to a loss of $0.5 million, up $10.1 million from the previous year.

Adjusted EBITDA: Reached $82.1 million with a margin of 7.9%.

Diluted EPS: Stood at ($0.02), with an adjusted diluted EPS of $1.22.

Cash Flow: Strong year-to-date cash flow from operations at $188.0 million, with a net debt reduction of $137.1 million.

Backlog: Ended the year with a backlog of approximately $13 billion, signaling future revenue potential.

2024 Guidance: Projects revenue and adjusted EBITDA growth of 5% at the mid-point for the coming year.

V2X Inc (NYSE:VVX) released its 8-K filing on March 5, 2024, detailing a strong finish to the fiscal year 2023. The U.S.-based company, which provides a range of services to the U.S. government, including facility and logistics services, information technology mission support, and engineering and digital integration services, has reported record revenue and solid financial performance for both the fourth quarter and the full year.

Company Overview

V2X Inc operates as one segment and is a key player in the Aerospace & Defense industry. The company's information technology and network communications capabilities are extensive, including system-of-systems engineering, software development, and mission support for the Department of Defense. Its facility and logistics services cover a broad spectrum, from airfield management to transportation operations and more.

Financial Performance and Challenges

The company's performance in the fourth quarter was marked by a 6.4% year-over-year increase in revenue, reaching $1.04 billion. This growth was particularly strong in the Pacific and Middle East regions, with increases of 31% and 18%, respectively. Despite a net loss of $0.5 million, this was a significant improvement from the previous year. The adjusted EBITDA of $82.1 million with a margin of 7.9% reflects the company's ability to maintain profitability amidst challenges.

One of the challenges V2X Inc faces is the integration and related costs associated with mergers and acquisitions, which have impacted its GAAP diluted EPS. However, the adjusted diluted EPS of $1.22 indicates the company's underlying profitability when these costs are excluded.

Financial Achievements

The company's financial achievements are critical in the Aerospace & Defense industry, where long-term contracts and stable cash flows are essential. V2X Inc's strong cash flow from operations, which totaled $188.0 million year-to-date, and the significant reduction in net debt by $137.1 million, demonstrate its financial resilience and operational efficiency. The awarded foreign military sales program valued at $400 million over five years highlights the company's growth potential and strategic milestones.

Financial Statements Highlights

Key details from the financial statements include:

Financial Metrics | Q4 2023 | Full-Year 2023 |

|---|---|---|

Revenue | $1.04 billion | $3.963 billion |

Operating Income | $38.5 million | $124.4 million |

Net Income (Loss) | ($0.5 million) | ($22.6 million) |

Adjusted EBITDA | $82.1 million | $293.9 million |

These metrics are important as they provide insights into the company's operational efficiency, profitability, and ability to generate cash to fund operations and reduce debt.

Management Commentary

"Im pleased to report a strong finish to 2023, with record revenue and strong operational performance which drove significant cash generation and net debt reduction," said Chuck Prow, President and Chief Executive Officer of V2X. "The leading indicators for our business remain strong with a backlog of approximately $13 billion, $9 billion of bids submitted currently under evaluation, and a robust pipeline of opportunities valued at $15 billion expected to be submitted over the next twelve months."

Analysis of Performance

V2X Inc's performance in 2023 demonstrates the company's ability to navigate a complex market and deliver value to shareholders. The company's focus on expanding its base, capturing new markets, and delivering with excellence has positioned it well for future growth. The robust backlog and pipeline, along with limited recompetes, suggest a strong outlook for the company.

The company's guidance for 2024, with an expected 5% growth in revenue and adjusted EBITDA at the mid-point, indicates confidence in its continued performance. The emphasis on generating strong cash flow with low capital expenditures underscores the company's commitment to enhancing shareholder value.

For more detailed information and analysis, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from V2X Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance