Vivid Seats Inc (SEAT) Posts Strong Earnings Growth and Expands Market Presence

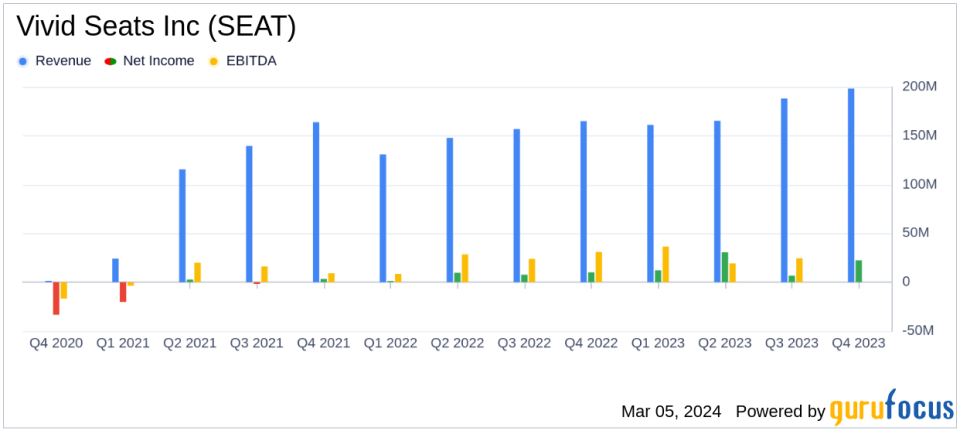

Marketplace GOV: Increased by 23% year-over-year to $3.92 billion.

Revenue: Grew by 19% year-over-year to $712.9 million.

Net Income: Rose by 51% year-over-year to $107.0 million.

Adjusted EBITDA: Improved by 25% year-over-year to $142.0 million.

Share Repurchase Program: Newly authorized $100 million share repurchase program.

On March 5, 2024, Vivid Seats Inc (NASDAQ:SEAT) released its 8-K filing, detailing a year of significant growth and strategic expansion. The online ticket marketplace, which serves as a hub for fans to access live events, reported substantial increases in key financial metrics for the full year and fourth quarter ended December 31, 2023.

Vivid Seats Inc operates as a technology platform that connects buyers with ticket sellers for a variety of events, including sports, concerts, theater, and comedy. The company operates in two segments: marketplace and resale, and has established itself as the marketplace of choice for both sellers and buyers.

For the full year of 2023, Vivid Seats Inc reported a Marketplace Gross Order Value (GOV) of $3.92 billion, marking a 23% increase from the previous year. Revenues climbed to $712.9 million, a 19% rise from 2022, while net income surged by 51% to $107.0 million. Adjusted EBITDA also saw a healthy increase, up 25% to $142.0 million.

Despite a strong annual performance, the fourth quarter of 2023 presented some challenges, with net income declining by 10% to $22.4 million. However, the company maintained growth in other areas, with Marketplace GOV and revenues increasing by 31% and 20%, respectively, and Adjusted EBITDA growing by 4%.

CEO Stan Chia emphasized the company's growth and strategic acquisitions, which expanded their Total Addressable Market (TAM) and reinforced their position in the industry. CFO Lawrence Fey highlighted the company's ability to convert top-line growth into cash flow, enabling strategic investments and share repurchases.

The company's balance sheet remains robust, with a healthy cash and cash equivalents position of $125.4 million as of December 31, 2023. The company's strategic acquisitions have been accretive, contributing to an expanded goodwill of $947.4 million, up from $715.3 million the previous year.

Vivid Seats Inc's financial achievements are particularly important in the interactive media industry, where the ability to scale and adapt to changing market dynamics is crucial. The company's growth in Marketplace GOV and revenues indicates a strong demand for its platform, while the increase in net income and Adjusted EBITDA reflects operational efficiency and profitability.

"In 2023 we grew top and bottom line by nearly 25%, significantly expanded our TAM through strategic acquisitions, and executed against our objective of being the marketplace of choice for both sellers and buyers," said Stan Chia, Vivid Seats CEO.

Looking ahead, Vivid Seats Inc anticipates continued growth with Marketplace GOV expected to be in the range of $4.2 billion to $4.5 billion, revenues between $810.0 million and $840.0 million, and Adjusted EBITDA projected to be between $160.0 million and $170.0 million for the year ending December 31, 2024.

The company's performance is a testament to its strategic initiatives and operational excellence. With a clear focus on expanding its market presence and enhancing shareholder value, Vivid Seats Inc is well-positioned for sustained growth in the dynamic live event ticketing industry.

For more detailed information and analysis on Vivid Seats Inc's financial performance, investors and interested parties are encouraged to access the full earnings report and webcast details on the company's investor relations website.

Explore the complete 8-K earnings release (here) from Vivid Seats Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance