Ginkgo Bioworks Holdings Inc (DNA) Reports Decline in 2023 Revenue Amid Transition and ...

Total Revenue: $251 million in 2023, a 47% decrease from the previous year.

Cell Engineering Revenue: $139 million, up 31% from 2022, with 78 new programs added.

Biosecurity Revenue: $108 million, transitioning to a more recurring business model.

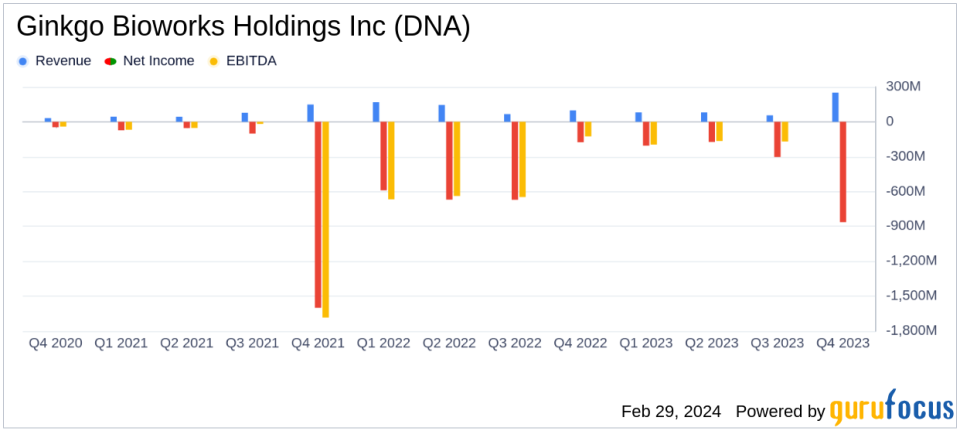

Net Loss: $892.9 million for the year, an improvement from a $2.1 billion loss in 2022.

Cash Position: Year-end cash balance of nearly $950 million, providing a multi-year runway.

2024 Guidance: Anticipates adding 100-120 new Cell Programs and expects total revenue of $215-$235 million.

On February 29, 2024, Ginkgo Bioworks Holdings Inc (NYSE:DNA) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The company, a leader in cell programming and biosecurity, reported a total revenue of $251 million for the year, marking a 47% decrease from the previous year's revenue. Despite this, the Cell Engineering segment saw a 31% growth in services revenue, totaling $139 million, and added 78 new Cell Programs. The Biosecurity segment generated $108 million in revenue as it shifted towards a more sustainable, recurring model.

Financial Performance and Strategic Developments

Ginkgo Bioworks' CEO, Jason Kelly, highlighted 2023 as a "breakout year" for the company, with significant growth in biopharma and the establishment of an ecosystem around Ginkgo's platform. The company's strategic acquisitions and the launch of its Technology Network are expected to bolster its capabilities in AI and biopharma. Ginkgo's Biosecurity segment is expanding its global bioradar network and partnering with entities like the Qatar Free Zones Authority to build a Center for Unified Biosecurity Excellence.

The company's net loss for the year improved to $892.9 million from a $2.1 billion loss in the previous year. The year-end cash balance of nearly $950 million provides Ginkgo with a solid financial foundation to drive towards profitability and capitalize on improved platform efficiency. For 2024, Ginkgo expects to add between 100-120 new Cell Programs and forecasts total revenue in the range of $215-$235 million, with Cell Engineering services revenue projected to be between $165-185 million.

Challenges and Industry Context

Despite the growth in Cell Engineering, the company faced a significant decrease in total revenue, primarily due to the expected ramp down of K-12 testing in the Biosecurity segment and the non-recurrence of certain equity milestones in Cell Engineering. The fourth quarter of 2023 saw a 65% decrease in total revenue compared to the same period in the previous year, with a loss from operations of $(178) million. The adjusted EBITDA for the quarter was $(96) million, a decline from the previous year's $(76) million.

The challenges faced by Ginkgo Bioworks reflect the broader volatility and transition within the biotechnology industry. As the company navigates these changes, its strong cash position and strategic initiatives position it to potentially overcome these hurdles and capitalize on long-term growth opportunities.

Conclusion and Outlook

Ginkgo Bioworks Holdings Inc (NYSE:DNA) is at a pivotal point, balancing the need for strategic growth with the challenges of a transitioning revenue model. The company's focus on expanding its Cell Engineering programs and building a global biosecurity infrastructure suggests a forward-looking approach aimed at long-term success. Investors and industry watchers will be closely monitoring Ginkgo's progress as it aims to translate its technological advancements and strategic partnerships into financial growth and market leadership in the years ahead.

For a detailed analysis of Ginkgo Bioworks Holdings Inc's financials and strategic positioning, as well as the full earnings report, please visit the Ginkgo Investor Relations website.

Explore the complete 8-K earnings release (here) from Ginkgo Bioworks Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance