Liberty Live Group (LLYVA) Reports Full Year and Q4 2023 Financial Results

Revenue: Liberty Live Group reports a slight decrease in full-year revenue to $8.95 billion.

Net Income: Full-year net income stands at $1.26 billion with diluted EPS of $0.32.

Adjusted EBITDA: The company achieved $2.79 billion in full-year adjusted EBITDA.

Free Cash Flow: Liberty Live Group generated $1.20 billion in free cash flow for the year.

Debt Reduction: Reduced Liberty SiriusXM Group debt by $782 million over the full year.

Strategic Moves: Liberty Media plans to complete the combination of Liberty SiriusXM Group and SiriusXM in Q3 2024.

Stock Repurchase: No repurchases of Liberty Medias common stock from November 1, 2023, through January 31, 2024; remaining authorization at $1.1 billion.

On February 28, 2024, Liberty Live Group (NASDAQ:LLYVA) released its 8-K filing, detailing its financial performance for the fourth quarter and the full year of 2023. Liberty Live Group, which is engaged in the operations of Live Nation and aims to maximize the value of its investment in the company, faced a slight revenue decline but maintained strong net income and free cash flow figures.

Performance and Challenges

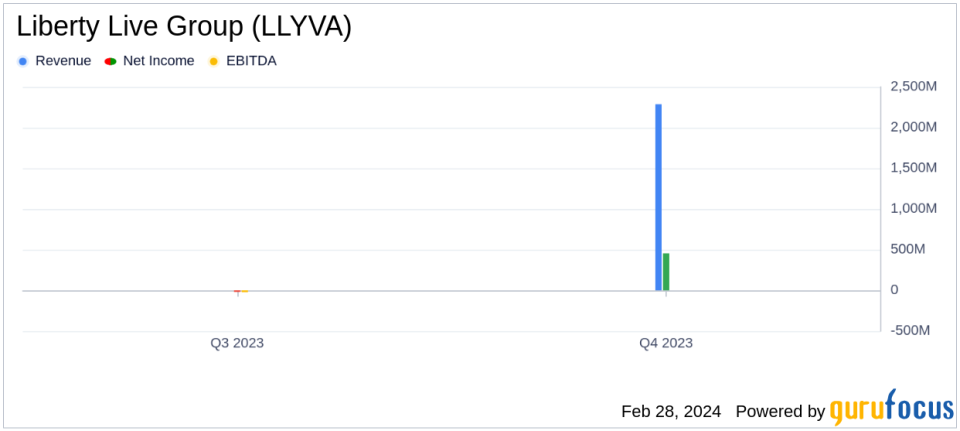

Liberty Live Group's full-year revenue dipped slightly to $8.95 billion, a 1% decrease from the previous year. However, the company's net income remained robust at $1.26 billion, and it reported a diluted EPS of $0.32. The adjusted EBITDA for the year was $2.79 billion, and the company generated a healthy free cash flow of $1.20 billion. The reduction of Liberty SiriusXM Group's debt by $782 million signifies a strong balance sheet and financial prudence.

The performance of Liberty Live Group is critical as it reflects the health of the Media - Diversified industry, which is increasingly competitive and subject to rapid changes in consumer preferences. The slight revenue decline may signal challenges in maintaining growth momentum, while the strong net income and free cash flow highlight the company's ability to manage costs and generate profits effectively.

Financial Achievements and Industry Significance

Liberty Live Group's financial achievements, particularly in reducing debt and maintaining a strong net income, are significant in an industry where content creation and distribution costs are soaring. The company's ability to generate substantial free cash flow provides it with the flexibility to invest in new projects, pay dividends, or repurchase shares, which is vital for sustaining growth and shareholder value in the Media - Diversified sector.

Key Financial Metrics

Important metrics for Liberty Live Group include its operating income, which for the Liberty SiriusXM Group segment saw a 6% decrease to $1.808 billion for the full year. The adjusted OIBDA for the same segment also experienced a 3% decrease to $2.732 billion. These metrics are important as they reflect the company's profitability from its core operations, excluding non-operational items like depreciation and amortization.

Formula One Group, another segment of Liberty Media, reported a 25% increase in total revenue to $3.222 billion for the full year, with operating income jumping 64% to $392 million. The success of the Formula One Group is particularly noteworthy given the global popularity of the sport and the potential for further monetization.

Liberty had a productive 2023. We split-off the Atlanta Braves, created the Liberty Live Group tracking stock and announced the combination of Liberty SiriusXM Group with SiriusXM, said Greg Maffei, Liberty Media President and CEO. Formula 1 had another fantastic year with double digit growth across all revenue streams. The Las Vegas Grand Prix generated massive global buzz, and we look forward to delivering great racing, fan experiences and economic benefit to F1 and the local community for years to come.

Analysis of Company Performance

Liberty Live Group's strategic initiatives, such as the planned combination with SiriusXM, are set to streamline operations and potentially unlock synergies. The company's investment in Formula 1 has paid off with significant revenue growth, and the focus on live events through Live Nation positions it well to capitalize on the global music industry's expansion.

While the slight decrease in revenue may raise concerns, the company's overall financial health appears solid, with a strong net income and a commitment to reducing debt. The performance of Liberty Live Group in 2023 demonstrates resilience and strategic planning in a challenging industry landscape.

For a detailed analysis of Liberty Live Group's financials and strategic outlook, investors and interested parties can access the full earnings report and supplemental materials on the company's investor relations website.

Explore the complete 8-K earnings release (here) from Liberty Live Group for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance