Orion Office REIT Inc. Reports Mixed 2023 Results Amid Market Challenges

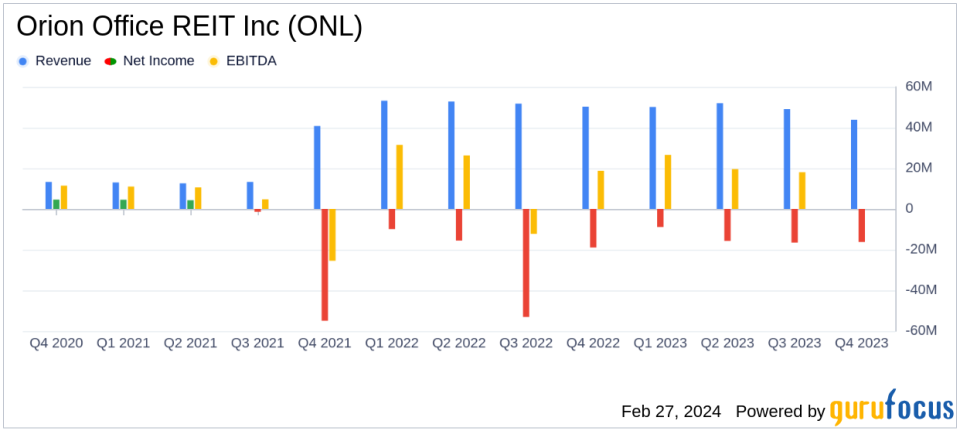

Total Revenues: $195.0 million for the full year 2023, down from $208.1 million in 2022.

Net Loss: $(57.3) million, or $(1.02) per share for the full year 2023, improving from $(97.5) million, or $(1.72) per share in 2022.

Core FFO: $94.8 million, or $1.68 per share for the full year 2023, compared to $108.2 million, or $1.91 per share in 2022.

Leasing Activity: 261,000 square feet of leasing completed in Q4 2023 and an additional 95,000 square feet subsequent to year-end.

Property Dispositions: Sold six properties for $25.4 million in 2023.

Debt Repayment: Repaid $59.0 million in debt obligations during 2023.

Dividend: Declared a dividend of $0.10 per share for the first quarter of 2024.

On February 27, 2024, Orion Office REIT Inc (NYSE:ONL) released its 8-K filing, disclosing its financial results for the fourth quarter and full year ended December 31, 2023. The company, which specializes in the ownership, acquisition, and management of single-tenant net lease office properties across the U.S., faced a challenging economic environment and office market headwinds throughout the year.

Financial Performance and Strategic Moves

Orion Office REIT Inc reported a decrease in total revenues to $195.0 million for the full year 2023, down from $208.1 million in the previous year. The net loss attributable to common stockholders improved to $(57.3) million, or $(1.02) per share, from $(97.5) million, or $(1.72) per share in 2022. Core Funds from Operations (FFO) also saw a decline to $94.8 million, or $1.68 per share, compared to $108.2 million, or $1.91 per share in the prior year.

Despite these challenges, Orion Office REIT Inc made significant strides in its operational strategy. The company completed 261,000 square feet of leasing activity in the fourth quarter and an additional 95,000 square feet subsequent to the year-end. It also successfully sold six properties for a total of $25.4 million and repaid $59.0 million in debt obligations, demonstrating a proactive approach to capital management and portfolio optimization.

Leasing and Disposition Highlights

Leasing activity in the fourth quarter included significant renewals in Memphis, TN, and Minneapolis, MN, as well as a new 10-year lease for retail space in Covington, KY. Post year-end, Orion entered into two long-term lease transactions with the United States Government, further solidifying its tenant base.

Disposition activity for the year included the sale of four properties in the fourth quarter for $11.4 million and six properties throughout the year for $25.4 million. These strategic dispositions are part of the company's efforts to stabilize and reposition its portfolio for long-term growth.

Balance Sheet and Liquidity

At year-end, Orion Office REIT Inc had total debt of $498.3 million and liquidity of $332.1 million, including cash and cash equivalents and available capacity on its credit facility. The company's net debt to adjusted EBITDA ratio stood at 4.01x, indicating a low-levered balance sheet that provides flexibility to navigate market challenges.

Orion's CEO, Paul McDowell, emphasized the company's commitment to enhancing future cash flow through strategic dispositions and capital recycling. He acknowledged the additional earnings pressure expected in the coming year but remained focused on unlocking long-term value for investors.

"2023 marked a year of progress for the Orion team despite the challenging economic environment and office market headwinds. We closed on the sale of six non-core properties for a total of 17 sold since the spin-off, executed 261,000 square feet of leasing activity and repaid $59.0 million in debt. We remain firmly committed to stabilizing and repositioning our existing portfolio through strategic dispositions, while selectively recycling capital as appropriate to enhance future cash flow. Our low-levered balance sheet provides the flexibility to continue to navigate market challenges and execute our plan, which will include additional earnings pressure through the coming year, as we strive to unlock long-term value for our investors," said McDowell.

2024 Outlook

Looking ahead to 2024, Orion Office REIT Inc provided guidance estimates, including a Core FFO per share range of $0.93 to $1.01 and general and administrative expenses between $19.5 million and $20.5 million. The company also anticipates a net debt to adjusted EBITDA ratio of 6.2x to 7.0x.

Orion Office REIT Inc's performance in 2023 reflects a resilient approach to navigating a challenging market. With strategic leasing, dispositions, and debt management, the company is positioning itself to overcome near-term pressures and focus on long-term value creation for its investors.

Explore the complete 8-K earnings release (here) from Orion Office REIT Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance