Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. For example, the Guangdong Shenglu Telecommunication Tech. Co., Ltd. (SZSE:002446) share price is down 38% in the last year. That contrasts poorly with the market decline of 20%. Longer term investors have fared much better, since the share price is up 9.3% in three years. Furthermore, it's down 35% in about a quarter. That's not much fun for holders.

On a more encouraging note the company has added CN¥420m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Guangdong Shenglu Telecommunication Tech grew its earnings per share, moving from a loss to a profit.

Earnings per share growth rates aren't particularly useful for comparing with the share price, when a company has moved from loss to profit. So it makes sense to check out some other factors.

In contrast, the 4.6% drop in revenue is a real concern. If the market sees the weak revenue as jeopardising EPS, that could explain the lower share price.

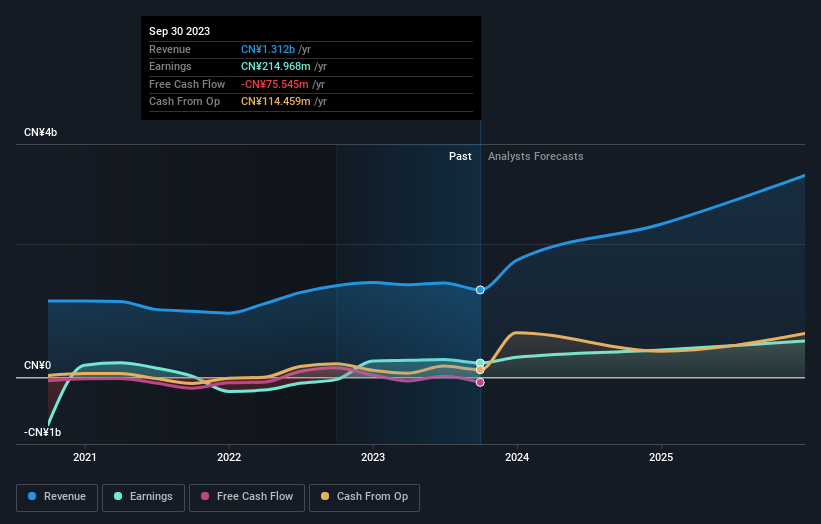

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Guangdong Shenglu Telecommunication Tech has grown profits over the years, but the future is more important for shareholders. This free interactive report on Guangdong Shenglu Telecommunication Tech's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 20% in the twelve months, Guangdong Shenglu Telecommunication Tech shareholders did even worse, losing 38%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before forming an opinion on Guangdong Shenglu Telecommunication Tech you might want to consider these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.