Valaris Ltd (VAL) Posts Robust Q4 Earnings with Significant Net Income Surge

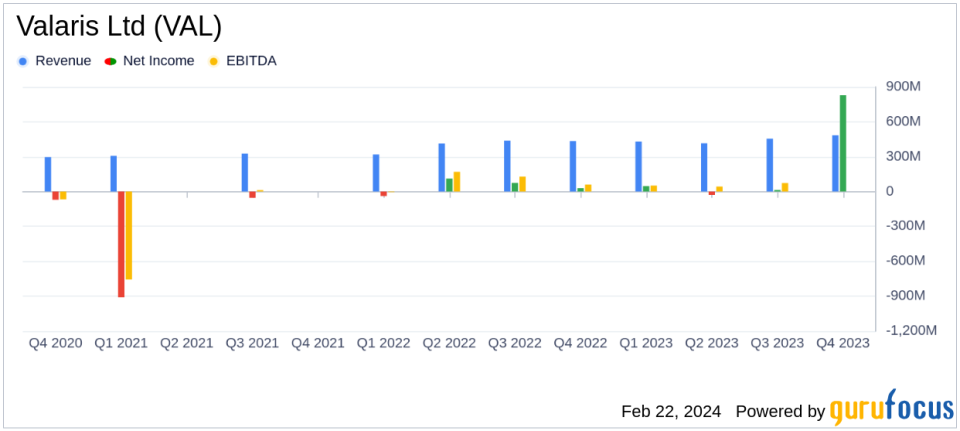

Net Income: Reported a substantial increase to $829 million in Q4, including a tax benefit of $790 million.

Revenue: Grew to $484 million in Q4, up from $455 million in the previous quarter.

Adjusted EBITDA: Increased to $58 million in Q4, compared to $40 million in Q3.

Contract Backlog: Expanded to over $3.9 billion as of February 15, 2024, a nearly 60% increase year-over-year.

Share Repurchase: $50 million of shares repurchased in Q4, with the Board authorizing an increase to $600 million.

Operational Efficiency: Achieved a revenue efficiency of 93% for the quarter and 96% for the year.

On February 21, 2024, Valaris Ltd (NYSE:VAL), a global leader in offshore drilling services, released its fourth quarter 2023 results, showcasing a significant increase in net income and continued growth in its contract backlog. The company reported these results in its 8-K filing on February 22, 2024.

Valaris Ltd operates a high-quality rig fleet, including ultra-deepwater drillships, versatile semisubmersibles, and modern shallow-water jackups, serving clients across all water depths and geographies. The company's focus on safety, operational excellence, and customer satisfaction, coupled with its commitment to technology and innovation, positions it as an industry leader.

Financial and Operational Performance

Valaris' President and CEO, Anton Dibowitz, commented on the company's ability to leverage operating efficiencies and secure contracts at higher market rates. He highlighted the award of new contracts and extensions worth over $1.4 billion, including two multi-year drillship contracts and several jackup contracts. Dibowitz expressed confidence in the strength and duration of the current upcycle in the offshore drilling market.

"We continue to execute on our operating leverage by repricing rigs from legacy day rates to meaningfully higher market rates and successfully delivering reactivated rigs with attractive contracts. We remain confident in the strength and duration of this upcycle and the outlook for Valaris is positive."

The company's net income for the fourth quarter was a remarkable $829 million, which included a significant tax benefit. This represents a substantial increase from the $17 million reported in the third quarter of 2023. Adjusted EBITDA also saw an increase to $58 million, up from $40 million in the previous quarter, primarily due to more operating days across the fleet and lower reactivation expenses.

Strategic Financial Moves

Valaris' strategic financial decisions included repurchasing $50 million of shares during the fourth quarter, totaling $200 million for the year. The Board of Directors further authorized an increase in the share repurchase program to $600 million. These moves reflect the company's commitment to returning value to shareholders and its positive cash flow outlook.

Challenges and Capital Expenditures

Despite the positive results, Valaris faced challenges such as increased depreciation expenses and other income decreases due to foreign currency exchange losses and higher interest expenses associated with a $400 million debt issuance. Capital expenditures rose to $463 million, primarily due to the delivery of newbuild drillships VALARIS DS-13 and DS-14.

Segment Review and Outlook

Valaris' floater and jackup segments both reported revenue increases due to more operating days and the commencement of new contracts. The company's ARO Drilling segment also saw increased revenues and reduced contract drilling expenses. With a total contract backlog exceeding $3.9 billion, Valaris is well-positioned for future earnings and cash flow growth.

Valaris Ltd's strong fourth quarter results, driven by strategic contract management and operational efficiency, underscore the company's robust position in the offshore drilling industry. With a significant backlog and a focus on shareholder returns, Valaris is poised for continued success in the coming years.

For a more detailed analysis of Valaris Ltd's financials and operational performance, investors and interested parties are encouraged to visit the Valaris website and attend the upcoming earnings conference call.

Explore the complete 8-K earnings release (here) from Valaris Ltd for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance