XRP price eyes rally to 2024 peak, holders await new developments in SEC v. Ripple lawsuit

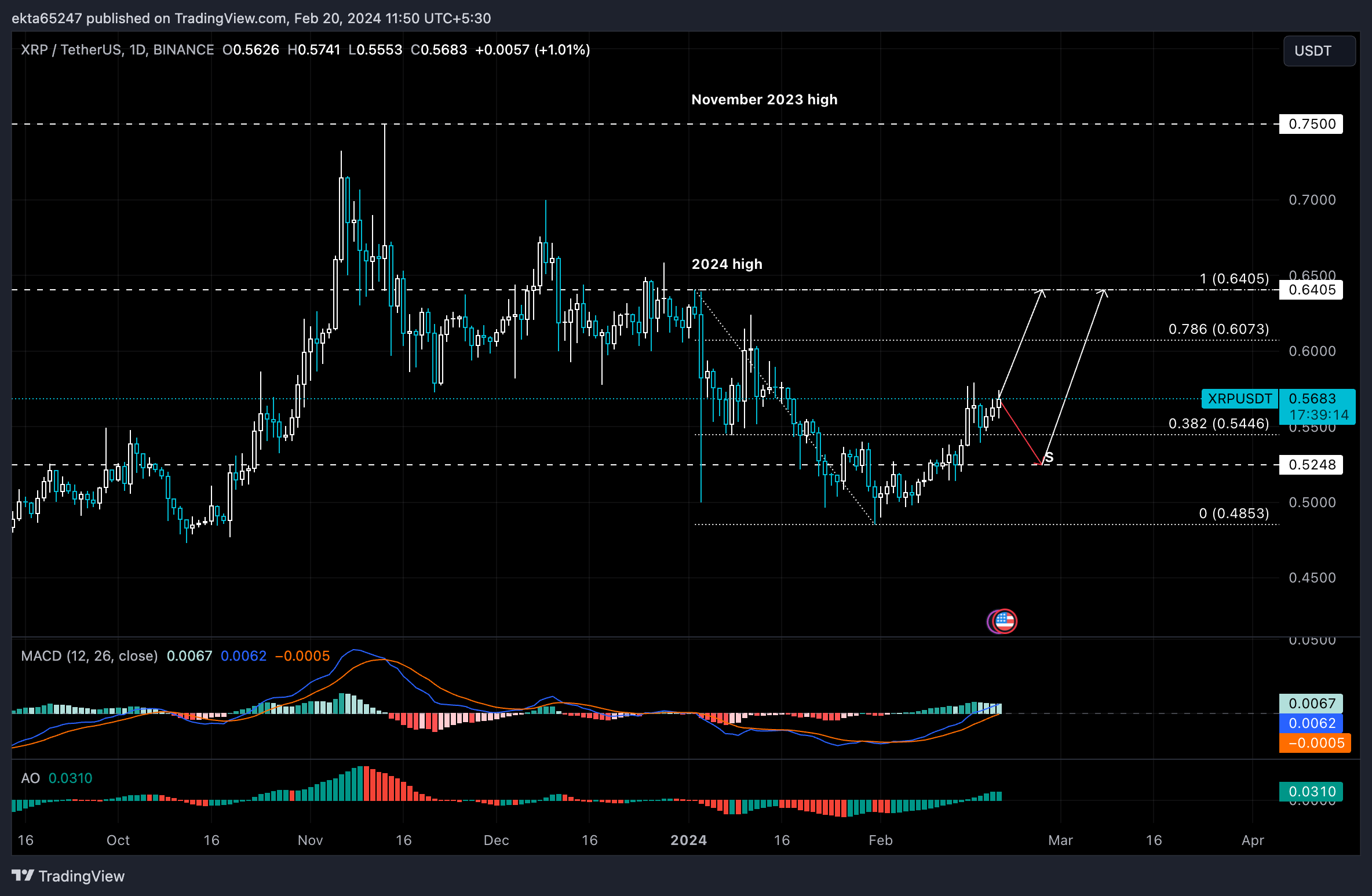

XRP price climbs to a high of $0.5741 on Tuesday, rallying towards its $0.60 target. The altcoin is in an uptrend, as the SEC v. Ripple lawsuit enters a new phase in its legal battle, known as "remedies". The remedies phase could result in a declaratory judgment on the issue before the court, damadges being awarded and or sanctions being imposed.

In Judge Torres' original ruling, Ripple was in violation of securities law only in sales to instiutional clients, not to retail investors, and it is still possible new evidence from the financial statements and institutional sales contracts shared by Ripple, could come to light and influence the outcome of the SEC v. Ripple lawsuit.

Altcoins facing a risk of correction after massive rally: Cardano, Chiliz, Fetch.AI, Lido, The Graph

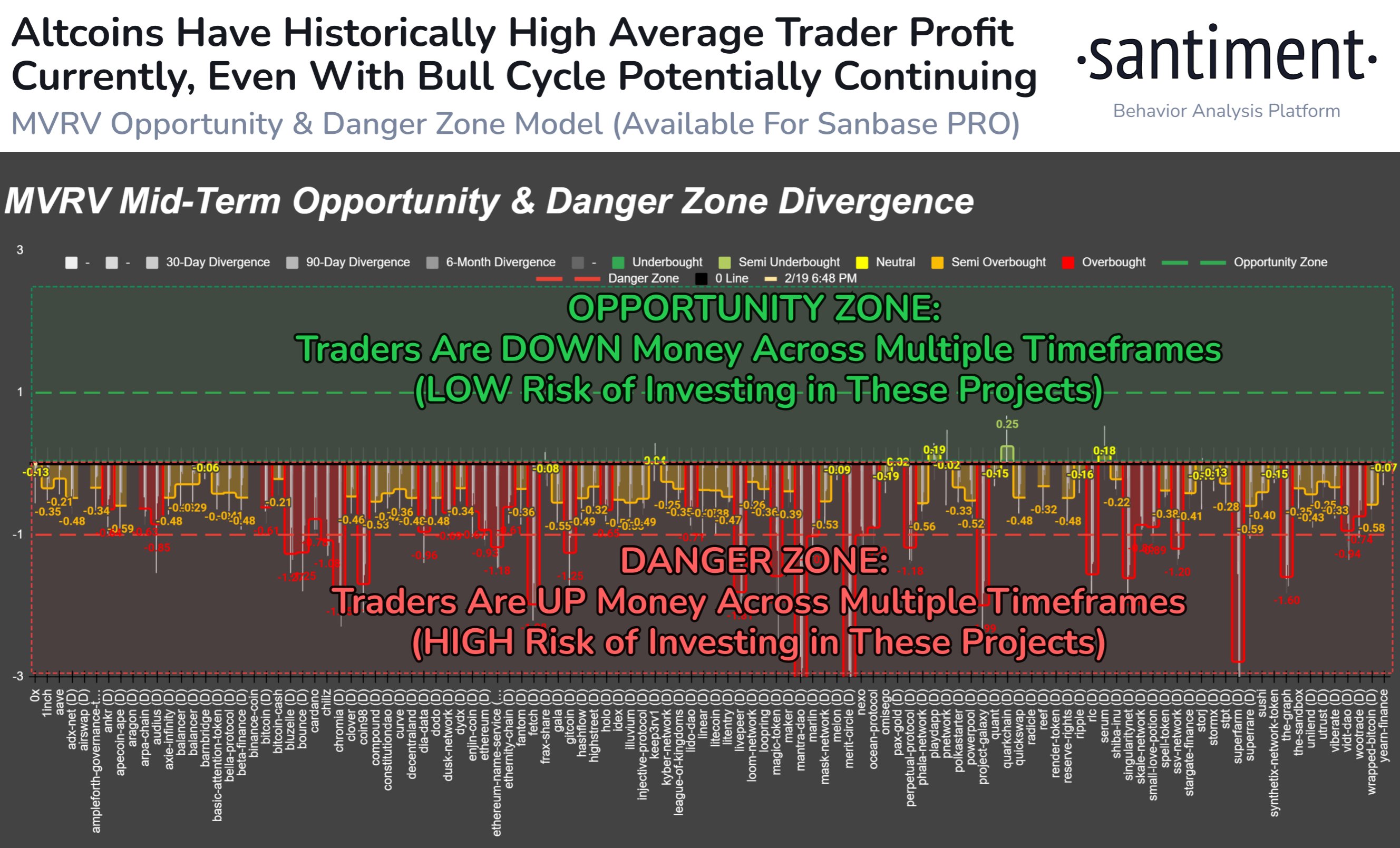

Altcoin prices have climbed in the past four months, offering massive gains to holders beginning October 2023. Except for a few lagging altcoins, a vast majority of assets generated profits for average wallet holders in the mid to long term timescale.

Crypto intelligence tracker Santiment’s predictive model uses Market Value to Realized Value (MVRV) metric to determine whether an altcoin is in an opportunity or danger zone. The model identified several assets in the danger zone, most notable ones including Cardano, Ethereum, Lido and Fetch.AI, among others.

Celestia price could dip before TIA rallies 40%

Celestia (TIA) price shows signs that it is closer to triggering a rally. But there might be a dip before the TIA bulls kickstart an explosive move to the upside. Celestia price action between January 15 and February 20 has resulted in a $13.88 to $20.33 range. Recently, however, TIA has been moving sideways above the daily support level at $18.23. Investors can expect the altcoin to sweep the range’s midpoint at $17.11, which could be a buying opportunity for sidelined buyers.

The Awesome Oscillator (AO) has already flipped negative and is hovering close to the zero level, indicating a struggle between the bulls and the bears. The Relative Strength Index (RSI) also shows a similar, though uncertain, outlook; both indicators support a potential correction if it occurs.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

GameStop, GME, shorts lose over $1 billion in mark-to-market losses on Monday amid meme-stock demand

GameStop short-sellers have lost $1 billion in the first hour of trading on Monday after 2,200% surge. Multiple exchanges reportedly had trouble processing orders following GameStop rally, GME paused due to volatility x3.

JUP price primed for a liftoff as Jupiter Exchange introduces LFG round 3 candidates

After a successful second round in May, the Jupiter Exchange has introduced candidates for its third launchpad (LFG). The Solana-based decentralized exchange (DEX) has been holding LFG votes to identify projects that will debut on its platform.

Top meme coins post gains following increased social activity amid GameStop pump

Meme coins in the crypto market saw impressive gains on Monday following a recent surge in GameStop stock. The increased attention surrounding these tokens signifies a potential resumption of the meme coin frenzy of March.

US Senators raise grave concerns over DOJ's policies towards cryptocurrency asset providers

Senators Ron Wyden and Cynthia Lummis wrote to the Attorney General to express worries over new policies on money transmission. The DOJ has continued to take strict measures against crypto asset software services over the last few months, says Senators.

Bitcoin: Why BTC is close to a bottom

Bitcoin (BTC) price efforts of a recovery this week have been countered by selling pressure during the onset of the American session. However, the downside potential appears to have been capped.