The AUB Group Ltd (ASX: AUB) share price is tracking lower on Tuesday as shareholder eyes trawl through the company's FY24 first-half results.

As the sun charts course for the horizon, shares in the insurance broker and underwriter are likewise heading lower. At the time of writing, AUB shares are down 2.5% to $30.04 per share. Though, it was a far bloodier scene this morning, with the share price falling as much as 5.8% to $29.00.

What did the company report?

The following are underlying figures from AUB Group for the first half of FY24:

- Revenue up 36.4% on prior corresponding period to $635.7 million

- Earnings before interest and tax (EBIT) margin up 1.2% to 32.5%

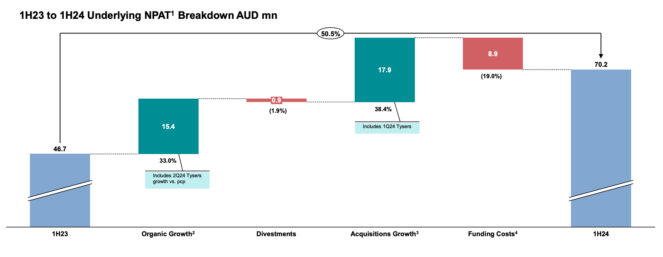

- Net profits after tax (NPAT) up 50.5% to $70.2 million

- Earnings per share (EPS) up 34.4% to 64.76 cents per share

- Interim dividend of 20 cents per share, up 17.6%

AUB experienced revenue growth across all of its divisions during the half. Most notably, the agencies division — encompassing its specialised underwriters — delivered the greatest growth at a 45.4% improvement year on year.

While a large component of AUB's staggering 50% uplift in earnings came from its Tysers acquisition, a majority (65%) of the company's $23.5 million of additional profits were attributable to organic growth, as shown above.

What else happened in the first half?

On 2 November 2023, AUB Group resolved an investigation into its newly added Tysers. The United States Department of Justice (DOJ) investigated people involved with Tysers while conducting business in Ecuador between 2013 and 2017.

The matter was resolved by the company agreeing to pay US$46.589 million to the DOJ.

Oddly enough, the AUB share price was relatively undeterred by the news. Shares moved higher upon the announcement's release. Moreover, the company's share price has rallied from around $27 to approximately $30 since then, as depicted above.

What did AUB management say?

Reflecting on a positive half, AUB Group and managing director Michael Emmett said:

I'm very proud of all that we as a Group have achieved not only over the past year but over several years. Specifically, I'd like to acknowledge the Agency and New Zealand teams who have delivered another very strong set of results.

Emmett continued:

These, along with the strong performance in Australian Broking and BizCover, have ensured that these AUB Group results are some of our strongest ever. I'd also like to acknowledge the Tysers team and some of the recent additions to our International Businesses.

What's next?

Another major positive for AUB shareholders is the accompanying full-year guidance upgrade today.

In FY24, management now anticipates underlying NPAT between $161 million and $171 million. The upgrade represents a 4.4% increase from the midpoint of the company's prior guidance. If achieved, it would see AUB post a 24.7% to 32.5% increase on FY23's underlying profits.

AUB Group share price snapshot

Despite a lacklustre showing today, the AUB share price has surpassed the Aussie benchmark in leaps and bounds over the last year.

The S&P/ASX 200 Index (ASX: XJO) is up 4.1% compared to a year ago. Meanwhile, AUB Group shares are 15.6% greener. However, the company now trades at a rather rich 46 times earnings. Whether it proves expensive depends on whether the growing insurance broker can keep up the above-average growth.