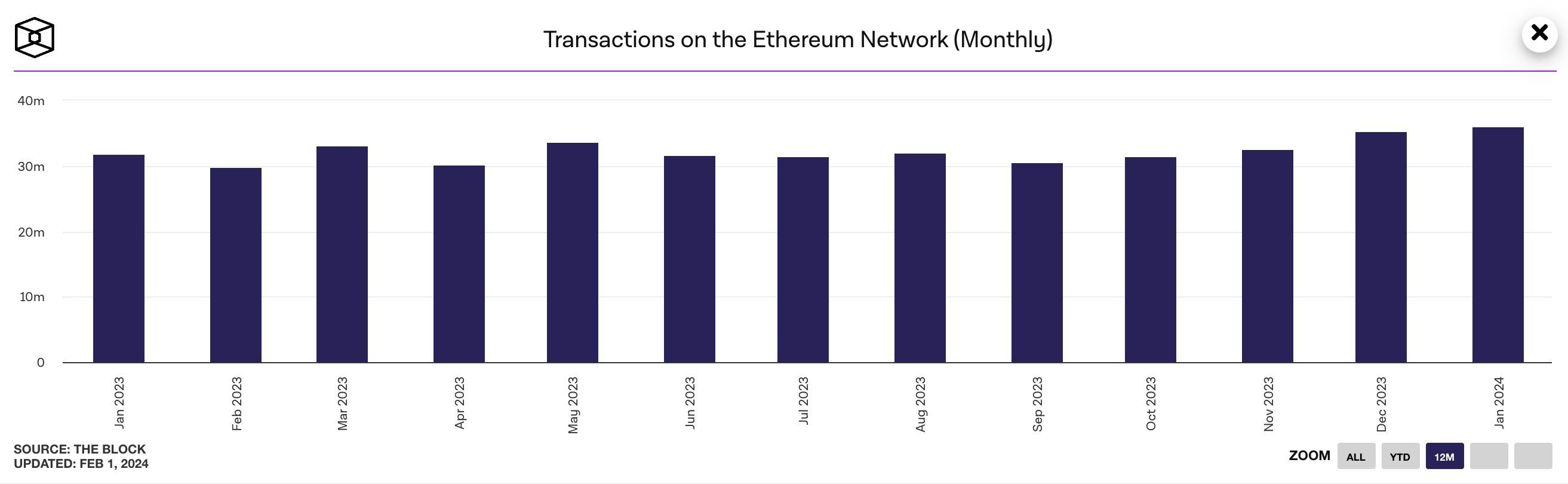

- Ethereum’s monthly transaction count amounted to 36.02 million in January.

- This is its highest monthly count since July 2022.

- Despite the surge in demand for the network, its NFT sales volume and DeFi TVL saw declines.

Ethereum (ETH) recorded a monthly transaction count of 36.02 million, marking its highest in 20 months.

Also read: Ethereum Price Prediction: $2,500 in sight as bullish metrics steer ETH back into the channel

Surge in user activity

Proof-of-Stake network Ethereum (ETH) experienced a significant increase in activity in January, recording its highest monthly transaction count since July 2022, according to The Block Data dashboard. Information from the data provider showed that during the 31-day period, transactions on the network totaled 36.02 million.

Ethereum monthly transaction count

A rise in a Network’s Transaction Count is often due to a corresponding uptick in user activity. Data from The Block showed that in January, the daily number of unique addresses that were active on Ethereum, either as a sender or receiver, rose by 4%. The Daily Active Addresses on Ethereum was 14.1 million, the highest recorded since October 2022.

Ethereum’s NFT and DeFi verticals lose steam

While the network saw an increase in user activity, the growth markers of Ethereum’s non-fungible tokens (NFTs) and Decentralized Finance (DeFi) ecosystems showed a decline in both verticals in January.

To assess the performance of a network’s NFT ecosystem, its sales volume is considered. Data from CryptoSlam showed that in January, NFT sales volume on Ethereum plummeted by 2%. According to the data provider, 138,465 NFT transactions were completed on the chain with a sales volume of $356 million.

Interestingly, the fall in Ethereum’s sales volume did not mirror the general market’s performance. According to data from NFTGo, the total volume of NFT sales across all collections in January climbed by 41%.

Regarding Ethereum’s DeFi sector, it witnessed a 7% dip in its Total Value Locked (TVL) in the last month, per data from DefiLlama. At press time, Ethereum’s DeFi TVL was $31.85B

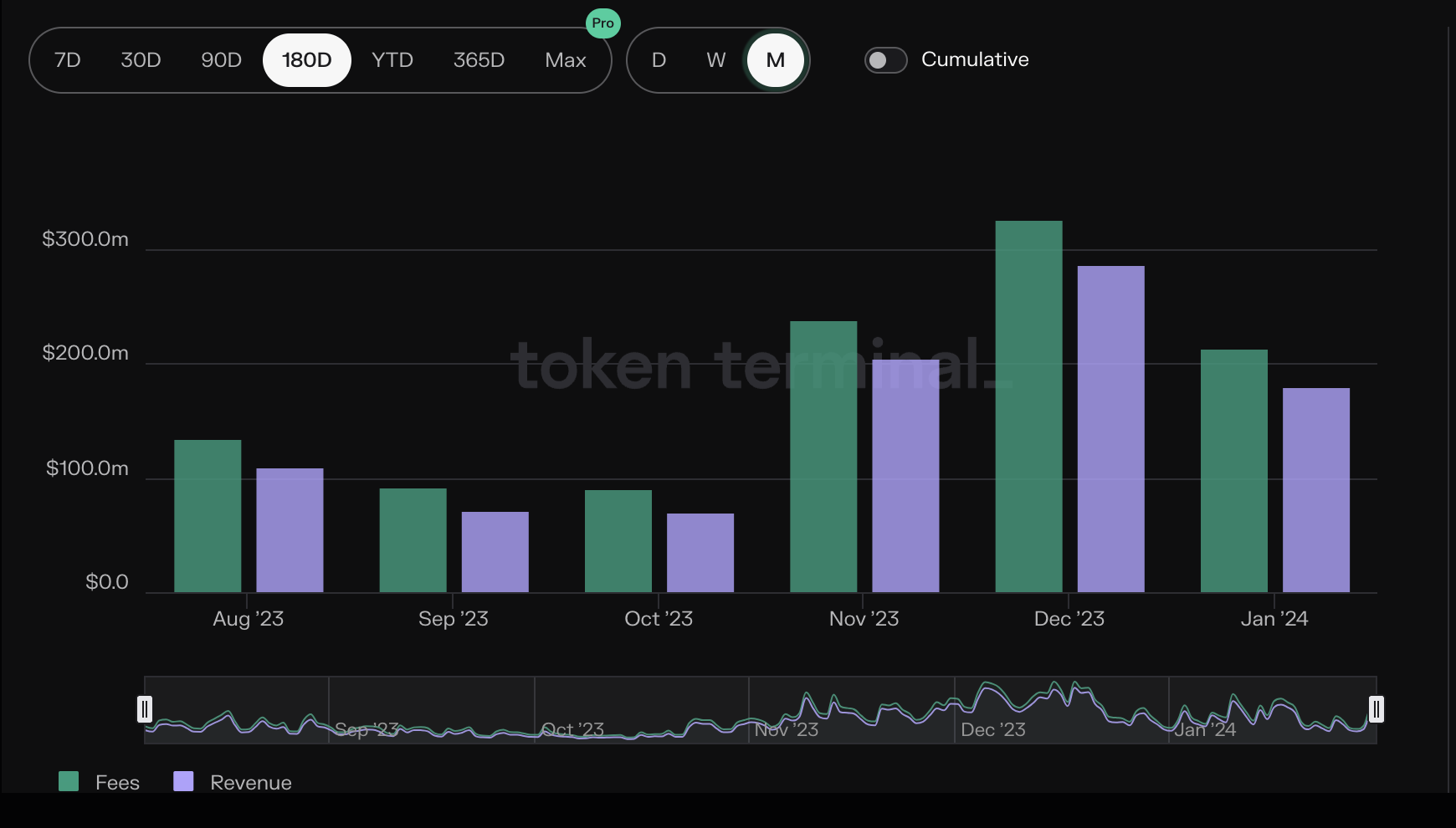

Double-digit decline in network fees and revenue

Despite the surge in user activity and demand for Ethereum in January, it took a significant hit to its transaction fees and revenue.

Ethereum Monthly Fee and Revenue

Data from Token Terminal showed that during the period under review, users paid a total of $213 million in fees to use Ethereum. This marked a 34% decline from the $325 million the network received as user fees in December.

Likewise, the revenue it derived from last month’s fees plunged by 37%. In January, Ethereum’s monthly revenue totaled $179 million. In December, it was almost $290 million.

With the consistent sideways movement in ETH’s price, the network may witness a decline in demand in February unless market sentiment improves. Should this happen, network fees and revenue may plunge further.

Recommended Content

Editors’ Picks

Crypto traders brace for short-term volatility with $2.4 billion options expiry on Friday

Bitcoin and Ethereum options market looks bullish on Friday, according to data from intelligence tracker Greeks.live. The firm said it has identified two Bitcoin calls that show an underlying bullish sentiment among market participants.

XRP recovers from week-long decline following Ripple’s response to SEC motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

Lido adds 4% gains as protocol rolls out first step towards decentralization

Lido takes the first batch of simple DVT validators to live, a step taken to decentralize the protocol. Lido leveraged technology to expand the protocol to multiple node operators, inviting both solo and community stakers.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Bitcoin: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.