The Jiangsu Fengshan Group Co.,Ltd (SHSE:603810) share price has done very well over the last month, posting an excellent gain of 29%. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 6.5% in the last twelve months.

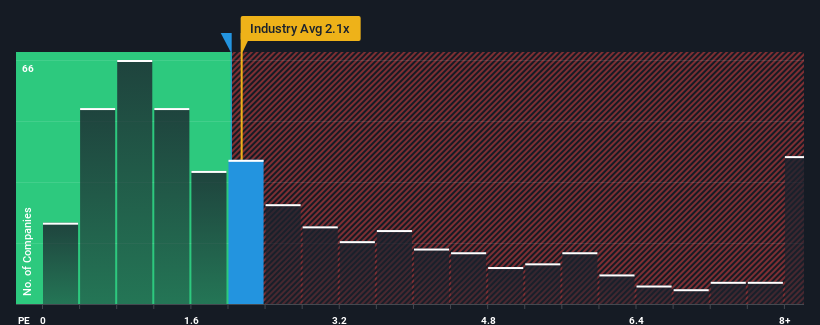

Even after such a large jump in price, it's still not a stretch to say that Jiangsu Fengshan GroupLtd's price-to-sales (or "P/S") ratio of 2x right now seems quite "middle-of-the-road" compared to the Chemicals industry in China, where the median P/S ratio is around 2.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Jiangsu Fengshan GroupLtd

How Has Jiangsu Fengshan GroupLtd Performed Recently?

As an illustration, revenue has deteriorated at Jiangsu Fengshan GroupLtd over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Jiangsu Fengshan GroupLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Jiangsu Fengshan GroupLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Jiangsu Fengshan GroupLtd would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 7.7% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 27% shows it's noticeably less attractive.

With this in mind, we find it intriguing that Jiangsu Fengshan GroupLtd's P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Jiangsu Fengshan GroupLtd's P/S?

Jiangsu Fengshan GroupLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Jiangsu Fengshan GroupLtd revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Jiangsu Fengshan GroupLtd (of which 1 is significant!) you should know about.

If you're unsure about the strength of Jiangsu Fengshan GroupLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.