Whales with a lot of money to spend have taken a noticeably bullish stance on Pfizer.

Looking at options history for Pfizer (NYSE:PFE) we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $165,037 and 5, calls, for a total amount of $321,380.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $20.0 to $30.0 for Pfizer during the past quarter.

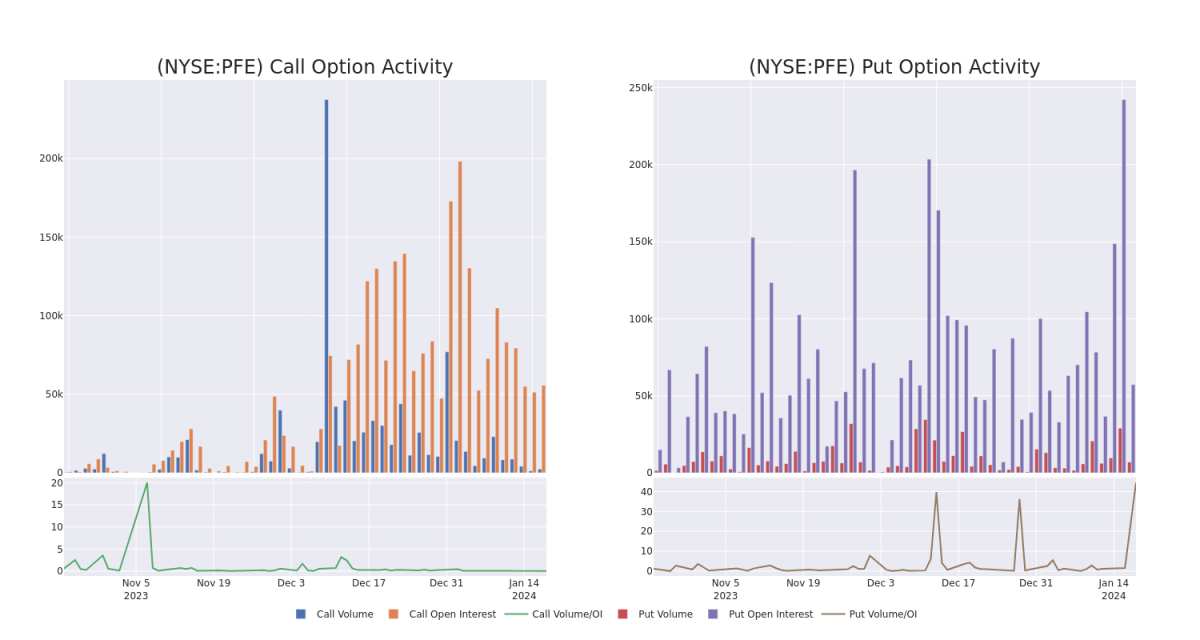

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Pfizer's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Pfizer's substantial trades, within a strike price spectrum from $20.0 to $30.0 over the preceding 30 days.

Pfizer Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| PFE | CALL | SWEEP | BULLISH | 01/16/26 | $30.00 | $146.4K | 16.3K | 521 |

| PFE | PUT | SWEEP | BULLISH | 02/23/24 | $25.00 | $92.1K | 129 | 5.7K |

| PFE | CALL | TRADE | BEARISH | 01/16/26 | $20.00 | $66.4K | 3.2K | 186 |

| PFE | PUT | SWEEP | BEARISH | 01/19/24 | $30.00 | $41.7K | 45.3K | 210 |

| PFE | CALL | TRADE | BEARISH | 01/17/25 | $30.00 | $36.4K | 22.1K | 658 |

About Pfizer

Pfizer is one of the world's largest pharmaceutical firms, with annual sales close to $50 billion (excluding COVID-19 product sales). While it historically sold many types of healthcare products and chemicals, now prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, and cardiovascular treatment Eliquis. Pfizer sells these products globally, with international sales representing close to 50% of total sales. Within international sales, emerging markets are a major contributor.

Following our analysis of the options activities associated with Pfizer, we pivot to a closer look at the company's own performance.

Where Is Pfizer Standing Right Now?

- Currently trading with a volume of 16,271,070, the PFE's price is down by -1.67%, now at $27.68.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 12 days.

What Analysts Are Saying About Pfizer

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $38.5.

- An analyst from TD Cowen has revised its rating downward to Market Perform, adjusting the price target to $32.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $45.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Pfizer, Benzinga Pro gives you real-time options trades alerts.