Cyprium Metals Ltd (ASX:CYM, OTC:CYPMF) is making steady progress towards the restart of its brownfield Nifty Copper Project in Western Australia as a long-life large-scale open pit mine, targeting first cashflow within two years.

Nifty, which was discovered by WMC in 1981 and started operation in 1993 as an open-pit oxide copper mine, is on the western edge of the Great Sandy Desert in the northeastern Pilbara region.

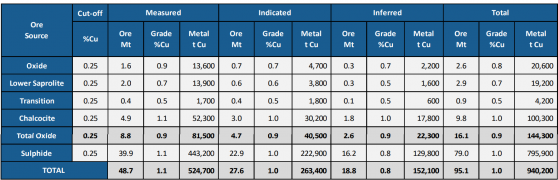

Cyprium’s Nifty development strategy includes the integration of a copper oxide starter open pit operation that will be complemented by the larger scale sulphide open pit, which together is expected to provide a significant +15-year mine life based on +900,000 tonne contained copper mineral resource.

Nifty mineral resource estimate - May 2022.

Nifty’s mineral inventory is relatively shallow, is open along strike in multiple directions and at depth, giving good potential to increase the current resource endowment.

The historical Nifty mine has a substantial operating history and data spanning over 25 years producing both copper metal and concentrate.

Cyprium plans to use the extensive sunk capital infrastructure of ~A$450 million with established infrastructure including power, gas, water, accommodation and an airstrip.

Nifty copper mine – site layout.

Following a capital raise in September 2023 which raised A$31.6 million, the company has sufficient liquidity to complete various studies and test work required for its new integrated mine plan.

Cyprium managing director Clive Donner said in October: “The company is now adequately funded to progress the technical studies necessary to build an integrated mining development plan that encompasses both the oxide and substantial sulphide resources at Nifty.

“The company anticipates being able to release a feasibility study during the first half of calendar 2024.

“Through this additional work we expect to demonstrate a significantly larger scale and longer life project than the previous Oxide Restart Project alone.

“Experienced mining industry professionals are being selectively recruited to the board and management team to ensure the Nifty integrated open pit technical studies deliver the right results for shareholders.”

The following is Cyprium’s planned work program as part of the assessment of the integrated oxide and sulphide restart:

- Pit optimisation and mine scheduling of integrated pit

- Resource definition

- Geotechnical assessment

- Metallurgical sampling and test work of oxides, transition and fresh (sulphide) ores for float amenability and recovery

- Concentrator refurbishment cost

- Mining and processing cost updates

Nifty execution plan – indicative timeline.

Other assets

Cyprium’s other exploration assets at Maroochydore and in the Murchison represent an attractive portfolio of exploration projects that will be assessed and reviewed for additional expenditure along with the start of the development of Nifty.

Together with Nifty, these projects contain more than 1.6 million tonnes of copper.

Copper developer peer comparison - contained copper mineral resources in Australian projects.

Read more on Proactive Investors AU