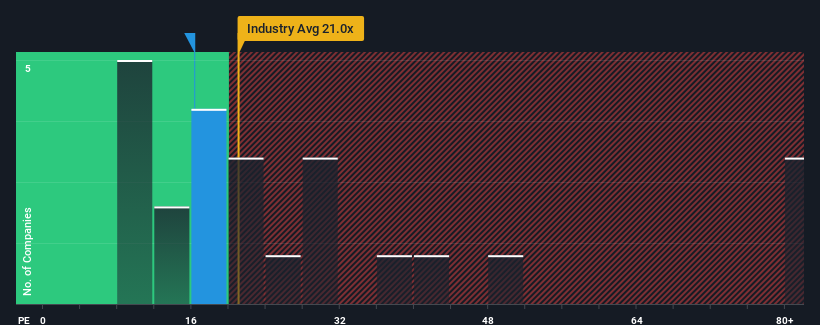

Milkyway Chemical Supply Chain Service Co.,Ltd's (SHSE:603713) price-to-earnings (or "P/E") ratio of 16.3x might make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 35x and even P/E's above 63x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Milkyway Chemical Supply Chain ServiceLtd has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Milkyway Chemical Supply Chain ServiceLtd

How Is Milkyway Chemical Supply Chain ServiceLtd's Growth Trending?

Milkyway Chemical Supply Chain ServiceLtd's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. Still, the latest three year period has seen an excellent 90% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 38% during the coming year according to the seven analysts following the company. Meanwhile, the rest of the market is forecast to expand by 44%, which is noticeably more attractive.

In light of this, it's understandable that Milkyway Chemical Supply Chain ServiceLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Milkyway Chemical Supply Chain ServiceLtd's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Milkyway Chemical Supply Chain ServiceLtd maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 2 warning signs for Milkyway Chemical Supply Chain ServiceLtd (1 is a bit concerning!) that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.