Despite an already strong run, Rhythm Pharmaceuticals, Inc. (NASDAQ:RYTM) shares have been powering on, with a gain of 39% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 66% in the last year.

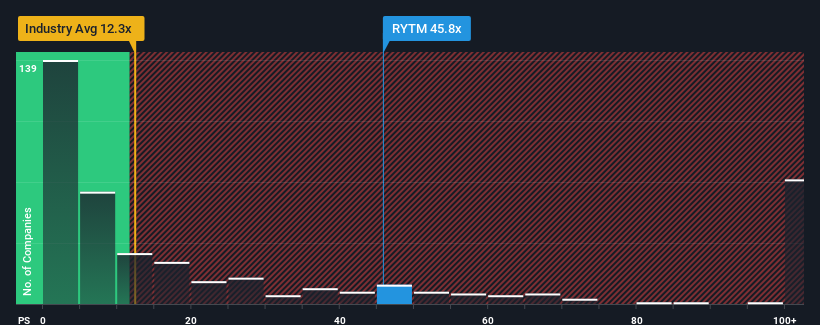

Following the firm bounce in price, Rhythm Pharmaceuticals may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 45.8x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios under 12.3x and even P/S lower than 3x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Rhythm Pharmaceuticals

What Does Rhythm Pharmaceuticals' P/S Mean For Shareholders?

Recent times have been advantageous for Rhythm Pharmaceuticals as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Rhythm Pharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Rhythm Pharmaceuticals?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Rhythm Pharmaceuticals' to be considered reasonable.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. In spite of this unbelievable short-term growth, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 90% per year over the next three years. With the industry predicted to deliver 240% growth per annum, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Rhythm Pharmaceuticals' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Rhythm Pharmaceuticals' P/S Mean For Investors?

The strong share price surge has lead to Rhythm Pharmaceuticals' P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It comes as a surprise to see Rhythm Pharmaceuticals trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

You always need to take note of risks, for example - Rhythm Pharmaceuticals has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Rhythm Pharmaceuticals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.