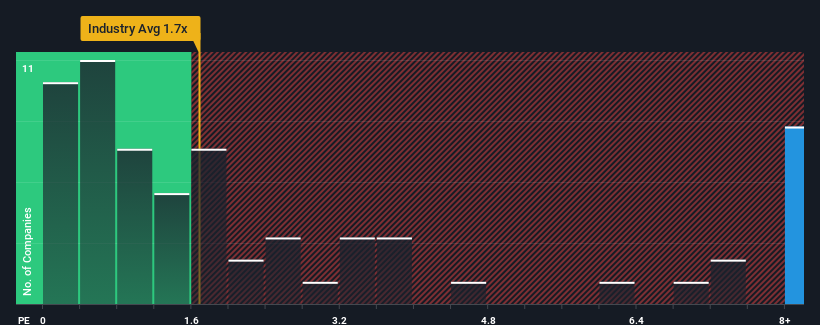

When close to half the companies in the Entertainment industry in Hong Kong have price-to-sales ratios (or "P/S") below 1.7x, you may consider China Ruyi Holdings Limited (HKG:136) as a stock to avoid entirely with its 12x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for China Ruyi Holdings

How China Ruyi Holdings Has Been Performing

China Ruyi Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on China Ruyi Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as China Ruyi Holdings' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 6.5% decrease to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Turning to the outlook, the next year should generate growth of 149% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 45%, which is noticeably less attractive.

With this in mind, it's not hard to understand why China Ruyi Holdings' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that China Ruyi Holdings maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Entertainment industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for China Ruyi Holdings that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.