Top headlines: RBC CEO says AI not yet ready for prime time in banking sector

Today’s top headlines

Bank of Canada worried government spending could impede inflation fight

Risks are starting to creep into global financial system, IMF warns

Tim Hortons sued by woman who alleges cream in tea stopped her heart

Wage hikes complicating automakers’ quest to create an affordable EV

4:41 p.m.

Market close: Energy losses drag TSX down, U.S. markets mixed

Canada’s main stock index edged lower, led again by losses in energy as the price of oil continued to decline, while U.S. markets wobbled to a mixed close.

The S&P/TSX composite index closed down 45.38 points at 19,530.21.

In New York, the Dow Jones industrial average was down 40.33 points at 34,112.27. The S&P 500 index was up 4.40 points at 4,382.78, while the Nasdaq composite was up 10.56 points at 13,650.41.

The Canadian dollar traded for 72.48 cents U.S. compared with 72.67 cents U.S. on Tuesday.

The December crude contract was down US$2.04 at US$75.33 per barrel and the December natural gas contract was down three cents at US$3.11 per mmBTU.

The December gold contract was down US$15.70 at US$1,957.80 an ounce and the December copper contract was down four cents at US$3.64 a pound.

The Canadian Press

4:26 p.m.

Caisse exploring sale of $2 billion in private equity stakes, sources say

Caisse de dépôt et placement du Québec is exploring the sale of as much as US$2 billion of private equity assets in the secondary market to free up cash for other investments, according to people familiar with the matter.

Canada’s second-largest pension manager is scouting the market and may end up selling a smaller stake or not selling at all, depending on the price, the people said, asking not to be identified discussing confidential matters. Evercore Inc. is advising on the sale, the people said.

Caisse, which had $424 billion of assets at the end of June, declined to comment.

Caisse reported a 4.2 per cent return in the first half of the year, essentially matching its benchmark. Its private equity returns of 1.4 per cent were well below the benchmark of 7.2 per cent, after years of outsize gains.

The pension manager recently sold more than US$1 billion in fund stakes to Partners Group and around US$2 billion of private investments last year, according to a person familiar with the matter.

Bloomberg

2:43 p.m.

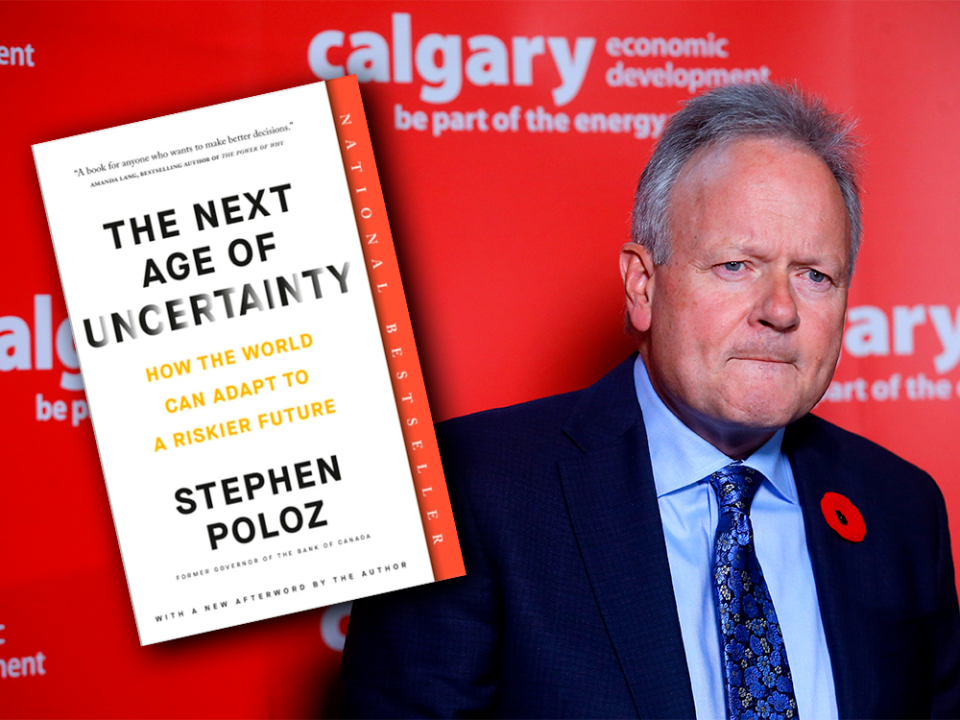

Former Bank of Canada governor Stephen Poloz wins National Business Book Award

Former Bank of Canada governor Stephen Poloz has won the National Business Book Award this year.

Poloz was nominated for a book called The Next Age of Uncertainty: How the World Can Adapt to a Riskier Future.

The book talks about how the Bank of Canada works and why it does what it does.

He takes home a $30,000 prize with the award.

Poloz served as governor of the Canadian central bank from 2013 to 2020.

The other finalists for the award were a memoir by Wes Hall, who is the founder of BlackNorth Initiative, and a compilation of first-person essays on leadership during the pandemic that was edited by Globe and Mail columnist Andrew Willis and Greenhill Canada investment banker Steve Mayer.

The Canadian Press

2:36 p.m.

AI showing potential for finance but not ready for prime time: RBC’s McKay

Royal Bank of Canada chief executive Dave McKay says artificial intelligence is already showing its potential in transforming the financial sector even if it’s not quite “ready for prime time.”

Speaking at a University of Waterloo tech conference in Toronto, McKay says AI still has too many errors and “hallucinations” or nonsense answers, to rely on it in banking services.

The bank however does see huge potential in everything from writing code to helping sales staff navigate complex financial products.

He says banks will have to train algorithms in-house to control the data and to make sure the systems are trustworthy and accurate.

McKay says AI is already proving its potential with systems such as Aiden, the bank’s AI-powered trading platform, that has outperformed human traders by 30 per cent.

He said that like climate change, AI is creating fear and anxiety as it begins to transform society and people don’t feel in control, but that it’s a matter of engaging with the change and tackling the challenges step by step.

The Canadian Press

1:57 p.m.

Bank of Canada on standby to raise interest rates further, deliberations reveal

Further interest rate hikes from the Bank of Canada are very much still on the table as its governing council remains split on whether rates may need to rise further.

The central bank today released its summary of deliberations detailing the discussions governing council members had in the lead-up to its Oct. 25 rate decision.

The summary says some members believed it’s more likely than not that interest rates will need to go higher to get inflation back to target levels.

But other members thought its key rate is now high enough to bring inflation down, so long as the central bank maintains it at that level for long enough.

While the Bank of Canada ultimately decided to exert patience by holding its key rate steady at five per cent, members of the governing council agreed to revisit whether rates need to rise further.

The central bank remains concerned that inflation is not falling fast enough, despite the economy responding to higher interest rates.

The Canadian Press

Read more: Bank of Canada worried government spending could impede inflation fight

Noon

Midday markets: TSX falls on tumbling oil prices

Canada’s main stock index was down in early-afternoon trading with base metal and energy stocks helping to lead the way lower as prices for oil and other commodities fell.

The S&P/TSX composite index was down 0.45 per cent at 19,489.36 with the falling price of oil continuing to weigh on the energy-heavy TSX.

Brent crude, the international oil benchmark, fell below US$80 a barrel for the first time in more than three months as a weakening outlook for fuel demand overshadows worries about possible supply disruptions from the Middle East crisis.

In New York, the Dow Jones industrial Average was down 0.22 per cent at 34,076.16. The S&P 500 index was down 0.24 per cent at 4,367.82, while the Nasdaq composite was down 0.28 per cent at 13,600.11.

Wall Street traders are focused on a parade of United States Federal Reserve speakers to see whether the central bank will continue to dampen the market’s dovish narrative that the central bank is done hiking interest rates.

The Canadian dollar traded for 72.42 cents U.S. compared with 72.67 cents U.S. on Tuesday.

The December crude contract was down US$1.63 at US$75.74 per barrel and the December natural gas contract was down three cents at US$3.11 per mmBTU.

The December gold contract was down US$14.50 at US$1,959.00 an ounce and the December copper contract was down three cents at US$3.65 a pound.

The Canadian Press, Bloomberg

11:26 a.m.

Earnings roundup

A slew of companies reported earnings today including Hydro One Ltd. and Indigo Books and Music Inc.

Here is a quick roundup of their results.

Hydro One Ltd.

Hydro One Ltd. reported third-quarter profit of $357 million, up from $307 million a year ago.

The power utility says the profit amounted to 59 cents per diluted share for the quarter ended Sept. 30, up from 51 cents per diluted share a year earlier.

Revenue totalled $1.93 billion, down from $2.03 billion in the same quarter last year, while revenue, net of purchased power, totalled $1.08 billion, up from $1.07 billion a year earlier.

Hydro One says the increase in revenue, net of purchased power, was helped by a hike in transmission rates and higher average monthly peak demand.

Indigo Books and Music Inc.

Indigo Books & Music Inc. reported a net loss of $22.4 million in its second quarter, compared with a net loss of $15.9 million a year earlier.

Revenue for the Toronto-based retailer totalled $206.9 million, down from $236.2 million a year earlier.

The company says it lost 80 cents per diluted share for the quarter ended Sept. 30, compared with a loss of 57 cents during the same quarter last year.

Chief executive Heather Reisman, who recently returned to the helm of the company, says her team is committed to returning Indigo to profit and growth.

Read more: Indigo’s Reisman touts transformation plan for returning retailer to profitability

The Canadian Press

10:00 a.m.

Markets open: Wall Street ekes out slight gain, TSX flat

Stocks, bonds and the U.S. dollar saw small moves Wednesday, with traders focused on a parade of United States Federal Reserve speakers to see whether the central bank will continue to dampen the market’s dovish narrative.

The S&P 500 edged slightly higher after a powerful rally that sent the gauge to its longest winning streak in two years. It was up 0.13 per cent at 4,383.12. Treasury 10-year yields are hovering around 4.6 per cent — well below the 16-year high of 5.02 per cent reached in October. The dollar rose. Oil fell as a forecast drop in U.S. gasoline consumption added to a growing array of indicators suggesting the demand outlook is worsening.

The Dow Jones Industrial Average rose 0.15 per cent to 34.204.36. The Nasadaq composite fell 0.07 per cent to 13,631.84.

Fed chair Jerome Powell said Wednesday the central bank must be willing to think beyond the complex mathematical simulations it traditionally uses to forecast the economy. He didn’t comment on the outlook for interest rates or the economy. Powell will likely have more time to express his views on Thursday as he participates in panel on monetary policy challenges.

In Toronto, the S&P/TSX composite index was flat at 19,574.93.

Bloomberg

9:33 a.m.

TC Energy reports Q3 loss as it takes Coastal GasLink charge

TC Energy Corp. reported a loss in its latest quarter compared with a profit a year ago as it took an impairment charge related to its Coastal GasLink pipeline project.

The result came as the company says it has achieved mechanical completion of Coastal GasLink ahead of its year-end target and plans to complete commissioning activities to be ready to deliver gas to the LNG Canada facility by the end of the year.

The pipeline company reported a net loss attributable to common shares of $197 million or 19 cents per share for the quarter ended Sept. 30 compared with net income of $841 million or 84 cents per share in third quarter 2022.

The latest results included a $1.18-billion after-tax impairment charge related to its equity investment in the Coastal GasLink Pipeline Limited Partnership.

TC Energy says its comparable earnings for the quarter amounted to $1 per share, down from $1.07 per share in the same quarter last year.

Revenue for the quarter totalled $3.94 billion, up from $3.80 billion a year earlier. Read more.

The Canadian Press

7:30 a.m.

Loblaw warns grocery code of conduct could raise food prices for Canadians by more than $1 billion

Canada’s biggest grocer is warning that the upcoming grocery code of conduct could raise food costs for Canadians.

Loblaw Cos. Ltd in a letter to the committee developing the code said it was concerned that it could “raise food prices for Canadians by more than $1 billion.”

Chief financial officer Richard Dufresne wrote in the letter obtained by The Canadian Press, that the grocer cannot endorse the code in its current form, and requested a special meeting of the industry sub-committee to address Loblaw’s concerns.

Stock markets before the opening bell

Stocks are slipping lower this morning as investors wait for clues from Federal Reserve chair Jerome Powell on where interest rates are heading next. Powell speaks at a conference in Washington D.C. this morning.

Oil was trading at US$76.78 after shedding more than $3 yesterday. WTI crude is now back where it was before the Israel-Hamas war raised concerns about supply.

Losses in the energy sector dragged down the S&P/TSX composite index which closed yesterday off 168.35 points at 19,575.59. For the TSX’s top three performers, check here.

What to watch today

Markets will be watching Federal Reserve chair Jerome Powell when he addresses a conference in Washington, D.C., this morning for clues on whether the world’s most powerful central bank has done hiking interest rates.

Later today the Bank of Canada releases its summary of deliberations on its Oct. 25 decision to hold rates at 5 per cent.

Earnings season is in full swing with a host of Canadian companies reporting today, including Suncor Energy Inc, TC Energy Corp, Kinross Gold Corp and CCL Industries Inc.

Also today the Financial Accountability Office of Ontario will release a report that provides details on long-term trends of international immigrants in Ontario’s labour market.

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Yahoo Finance

Yahoo Finance