Overstock.com (NASDAQ:OSTK), which is being rebranded as Bed Bath & Beyond, is getting a jolt from hedge fund JAT Capital. The hedge fund, which owns a significant stake, about 9.6% per the Reuters report, is pushing for several strategic changes at Overstock.com, including removing the current CEO, Jonathan Johnson.

JAT Capital’s Recommendations in Detail

In a recent SEC filing, JAT Capital recommends the removal of the current CEO, effective immediately. Further, the hedge fund suggests the name of Marcus Lemonis, the company’s newest independent director, to operate the business. In addition, JAT Capital said Overstock.com is lagging behind its peers in terms of financial performance. This underperformance comes even as the company pursues an aggressive growth strategy.

Additionally, JAT Capital has noted that the company is currently undergoing a brand transition and marketing campaign, which is being led by the current management without prior experience in such endeavors. Furthermore, the firm expects Overstock to use up half of its existing cash during this process.

While JAT Capital has proposed various strategic changes to stimulate growth within the company, it remains uncertain how Overstock’s management will react to these suggestions.

What is the Future of Overstock?

While JAT Capital expresses dissatisfaction with OSTK’s present leadership and disappointing performance, Wedbush analyst Michael Pachter has an optimistic view of the company’s future. In a note to investors dated October 27, Pachter stated that Overstock holds a strong position among home goods retailers, thanks to its diverse range of unbranded products and an “inventory light” business model.

Furthermore, the analyst expects the firm to benefit from the ongoing shift towards e-commerce platforms, allowing Overstock to capture market share from traditional retailers. However, the analyst considerably reduced the company’s price target to $25 from $43, citing significant investment and expected EBITDA losses over the next several quarters.

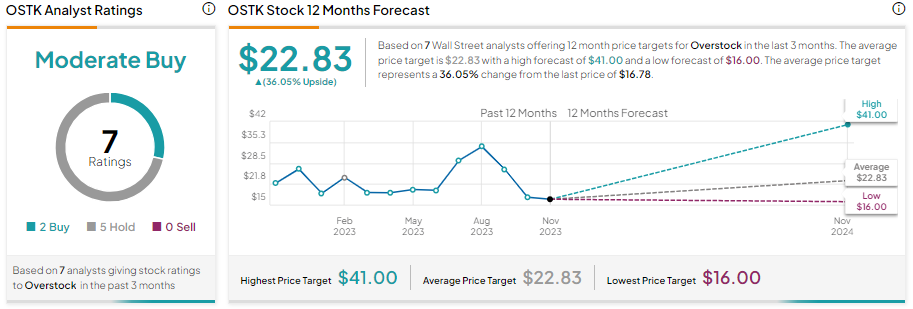

Overall, OSTK stock has two Buy and five Hold recommendations for a Moderate Buy consensus rating. Further, the average OSTK stock price target of $22.83 implies 36.05% upside potential from current levels.